Wolfspeed, Inc. (WOLF)

$

17.33

-0.13 (-0.75%)

Key metrics

Financial statements

Free cash flow per share

-9.7096

Market cap

448.7 Million

Price to sales ratio

0.5906

Debt to equity

-6.7709

Current ratio

7.7266

Income quality

0.2913

Average inventory

418.4 Million

ROE

8.3660

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

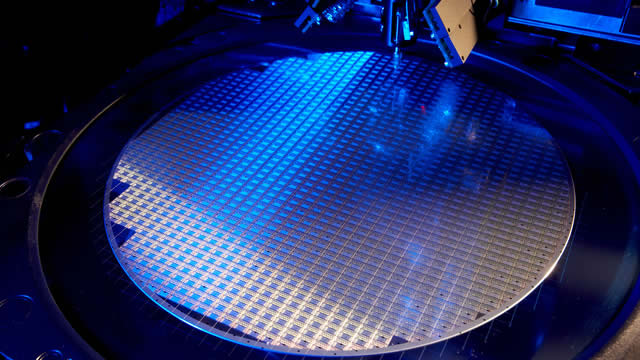

Wolfspeed, Inc. offers a diverse range of silicon carbide and gallium nitride (GaN) materials, which include silicon carbide bare wafers, epitaxial wafers, and GaN epitaxial layers on silicon carbide wafers, supporting various applications in RF, power, and beyond. The company provides customers with essential components such as silicon carbide Schottky diodes, metal oxide semiconductor field effect transistors (MOSFETs), power modules, and gate driver boards, which are vital for electric vehicles, charging infrastructure, server power supplies, solar inverters, uninterruptible power supplies, and industrial power supplies. In addition, its RF devices encompass GaN-based die, high-electron mobility transistors, monolithic microwave integrated circuits, and laterally diffused MOSFET power transistors tailored for telecommunications infrastructure, military needs, and other commercial uses. The company’s products find applications in various sectors including transportation, fast charging, wireless systems, 5G, motor drives, renewable energy and storage, as well as aerospace and defense, with its materials and RF devices being utilized in military communications, radar, satellite, and telecommunication sectors. The income before tax ratio is -2.14 reflecting the pre-tax margin. The company recorded a notable revenue of $757,600,000.00 showcasing its steady growth. Moreover, it earned interest income of $67,600,000.00 highlighting its financial investments, while selling, general, and administrative expenses were reported at $190,500,000.00 indicating its operational overhead costs. The earnings per share (EPS) stands at -$11.39 indicating the company’s profitability on a per-share basis. In the current market context, the stock is considered affordable at $2.23 making it suitable for budget-conscious investors. It boasts a high average trading volume of 1,372,275.00 reflecting strong liquidity. With a market capitalization of $448,716,089.00 the company is classified as a small-cap player, which positions it uniquely within the landscape. As a key player in the Semiconductors industry, Wolfspeed significantly contributes to the overall market landscape and is recognized for its impact. Additionally, it belongs to the Technology sector, driving both innovation and growth within its operational domain.

Is Wolfspeed, Inc. (WOLF) a good investment?

Investing in Wolfspeed, Inc. (WOLF) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as C, with a Bearish outlook. Always conduct your own research before investing.

What is Wolfspeed, Inc. (WOLF)'s stock forecast?

Analysts predict Wolfspeed, Inc. stock to fluctuate between $8.05 (low) and $36.60 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Wolfspeed, Inc.'s market capitalization?

As of 2026-01-29, Wolfspeed, Inc.'s market cap is $448,716,089, based on 25,892,446 outstanding shares.

How does Wolfspeed, Inc. compare to competitors like Meta Platforms, Inc. Class A Common Stock?

Compared to Meta Platforms, Inc. Class A Common Stock, Wolfspeed, Inc. has a Lower Market-Cap, indicating a difference in performance.

Does Wolfspeed, Inc. pay dividends?

Wolfspeed, Inc. pays dividends. The current dividend yield is 0.00%, with a payout of $0.00 per share.

How can I buy Wolfspeed, Inc. (WOLF) stock?

To buy Wolfspeed, Inc. (WOLF) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for WOLF. Place an order (Market, Limit, etc.).

What is the best time to invest in Wolfspeed, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has Wolfspeed, Inc. stock ever split?

Wolfspeed, Inc.'s last stock split was 2:1 on 2000-12-11.

How did Wolfspeed, Inc. perform in the last earnings report?

Revenue: $757,600,000 | EPS: -$11.39 | Growth: -0%.

Where can I find Wolfspeed, Inc.'s investor relations reports?

Visit https://www.wolfspeed.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Wolfspeed, Inc.?

You can explore historical data from here

What is the all-time high and low for Wolfspeed, Inc. stock?

All-time high: $142.33 (2021-11-15) | All-time low: $0.39 (2025-06-30).

What are the key trends affecting Wolfspeed, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

fool.com

Wolfspeed has emerged from its corporate restructuring and bankruptcy. The restructured company has far less debt, but still faces some big challenges.

seekingalpha.com

Wolfspeed is well-positioned to capitalize on the EV boom, leveraging its 200mm silicon carbide ramp and strong Toyota partnership. With $1.5 billion in liquidity, including a $698.6 million IRS tax refund, WOLF can accelerate Mohawk Valley Fab production and support future growth. Despite recent revenue declines and deep net losses, WOLF is projected to rebound, with FY2026 revenue estimates at $800.44 million and an improving EPS outlook.

fool.com

Both Wolfspeed and Plug Power have struggled with negative gross margins. Wolfspeed emerged from bankruptcy with a better balance sheet and the goal of fixing its manufacturing yield issues.

fool.com

A $10,000 investment in Wolfspeed made at the end of November 2022 would be worth just $2,071 today. Cash burn remained a major issue even as Wolfspeed moved closer to breakeven earnings.

fool.com

Wolfspeed has finally received nearly $700 million in tax refunds set aside for the company through the CHIPS Act. The new funding improves Wolfspeed's financial position and makes it more likely that additional governmental help could arrive at some point.

fool.com

The IRS just cut Wolfspeed a check for $698.6 million. Wolfspeed expects to eventually reap $1 billion-worth of Advanced Manufacturing Investment Credits.

fool.com

Wolfspeed emerged from Chapter 11 bankruptcy this September. Its carrying less debt and better positioned to expand its 200mm fabs.

fool.com

In an interview released on Friday, Wolfspeed's CEO said his company will work to diversify its customer base, looking beyond electric vehicles. Wolfspeed is still in a precarious position, and its stock could continue to see dilution.

seekingalpha.com

Silicon carbide semiconductor solutions provider Wolfspeed, Inc., emerged from bankruptcy in late September with a substantially improved balance sheet and decent liquidity. Last week, WOLF reported Q1/FY2026 results largely in line with muted expectations. However, management now expects market weakness to persist for the entire fiscal year. In addition, the recent bankruptcy appears to have resulted in some market share losses.

seekingalpha.com

Wolfspeed, Inc. ( WOLF ) Q1 2026 Earnings Call October 29, 2025 5:00 PM EDT Company Participants Tyler Gronbach - Vice President of Investor Relations Robert Feurle - CEO & Director Gregor Issum - Executive VP & CFO Presentation Tyler Gronbach Vice President of Investor Relations Good afternoon, everyone. Welcome to Wolfspeed's Fiscal First Quarter 2026 Earnings Conference Call.

See all news