CVR Partners, LP (UAN)

$

103.57

-1.75 (-1.69%)

Key metrics

Financial statements

Free cash flow per share

13.0982

Market cap

1.1 Billion

Price to sales ratio

1.8115

Debt to equity

1.8365

Current ratio

2.6786

Income quality

2.0805

Average inventory

77.9 Million

ROE

0.4138

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

CVR Partners, LP, together with its subsidiaries, operates in the nitrogen fertilizer market within the United States, focusing on the production and sale of various fertilizer products. The company reported an income before tax of $60,977,000.00 showcasing its pre-tax profitability. Additionally, it incurred an income tax expense of $77,000.00 indicating its tax obligations to the government. The company's financial performance is underscored by a gross profit standing at $118,865,000.00 highlighting the profitability derived from its core operations. With a notable revenue of $525,324,000.00 CVR Partners, LP demonstrates steady growth in its business segment. Furthermore, the weighted average number of diluted shares outstanding is 10,570,000.00 reflecting potential dilution effects for shareholders. CVR GP, LLC serves as the general partner of the company, which was incorporated in 2007 and is headquartered in Sugar Land, Texas. As a small-cap player with a market capitalization of $1,094,697,304.00 CVR Partners, LP is classified within the nitrogen fertilizer industry, significantly contributing to the overall market landscape. The stock is reasonably priced at $91.02 appealing to a broad range of investors. However, it also exhibits a low average trading volume of 47,981.00 indicating lower market activity compared to larger firms. Belonging to the Basic Materials sector, the company plays a vital role in driving innovation and growth. As a key player in the Agricultural Inputs industry, CVR Partners, LP's operations not only fulfill customer needs but also influence the dynamics of the nitrogen fertilizer market, further establishing its reputation in the sector.

Is CVR Partners, LP (UAN) a good investment?

Investing in CVR Partners, LP (UAN) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as A-, with a Bearish outlook. Always conduct your own research before investing.

What is CVR Partners, LP (UAN)'s stock forecast?

Analysts predict CVR Partners, LP stock to fluctuate between $63.45 (low) and $119.90 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is CVR Partners, LP's market capitalization?

As of 2026-01-30, CVR Partners, LP's market cap is $1,094,697,304, based on 10,569,637 outstanding shares.

How does CVR Partners, LP compare to competitors like Southern Copper Corporation?

Compared to Southern Copper Corporation, CVR Partners, LP has a Lower Market-Cap, indicating a difference in performance.

Does CVR Partners, LP pay dividends?

CVR Partners, LP pays dividends. The current dividend yield is 12.26%, with a payout of $4.02 per share.

How can I buy CVR Partners, LP (UAN) stock?

To buy CVR Partners, LP (UAN) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for UAN. Place an order (Market, Limit, etc.).

What is the best time to invest in CVR Partners, LP?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has CVR Partners, LP stock ever split?

CVR Partners, LP's last stock split was 1:10 on 2020-11-24.

How did CVR Partners, LP perform in the last earnings report?

Revenue: $525,324,000 | EPS: $5.76 | Growth: -64.68%.

Where can I find CVR Partners, LP's investor relations reports?

Visit https://www.cvrpartners.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for CVR Partners, LP?

You can explore historical data from here

What is the all-time high and low for CVR Partners, LP stock?

All-time high: $179.74 (2022-04-20) | All-time low: $51.00 (2021-08-09).

What are the key trends affecting CVR Partners, LP stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

businesswire.com

5 days ago

SUGAR LAND, Texas--(BUSINESS WIRE)--CVR Partners, LP (“CVR Partners” or the “Partnership”) (NYSE: UAN) today announced preliminary estimated financial results for the fourth quarter and full-year 2025. “The planned turnaround at our Coffeyville facility was completed as scheduled in early November; however, the subsequent startup was delayed by several weeks due to downtime at the third-party owned air separation unit,” said Mark Pytosh, Chief Executive Officer. “Despite this delay, we saw stro.

seekingalpha.com

14 days ago

The Dividend Power strategy highlights 35 high-yield, low-valuation stocks, with 6 identified as 'safer' due to strong free cash flow coverage. The top ten DiviPower stocks are projected to deliver an average net gain of 40.62% by January 2027, with risk/volatility 14% below the market. Seventeen of thirty-five Dividend Power Dogs show negative free cash flow margins, signaling unsustainable dividends and elevated risk.

seekingalpha.com

18 days ago

CVR Partners is rated a strong buy, driven by robust fertilizer demand, secure feedstock, and compelling long-term yield prospects. UAN benefits from declining pet coke costs and rising UAN/ammonia prices, supporting a sustainable 9–11% yield with a 7.98% floor. Distribution coverage remains solid near 2x on OCF and FCF, with potential for special distributions as cash reserves grow.

businesswire.com

a month ago

SUGAR LAND, Texas--(BUSINESS WIRE)--CVR Partners, LP (NYSE: UAN) today announced its preliminary capital spending estimates for 2026 of $60 million to $75 million. Estimated capital expenditures for 2026 by category are as follows: Maintenance capital $35 million to $45 million Growth capital $25 million to $30 million Total capital expenditures $60 million to $75 million “For our growth capital projects, we look forward to progressing or completing certain margin-improvement and debottleneckin.

gurufocus.com

a month ago

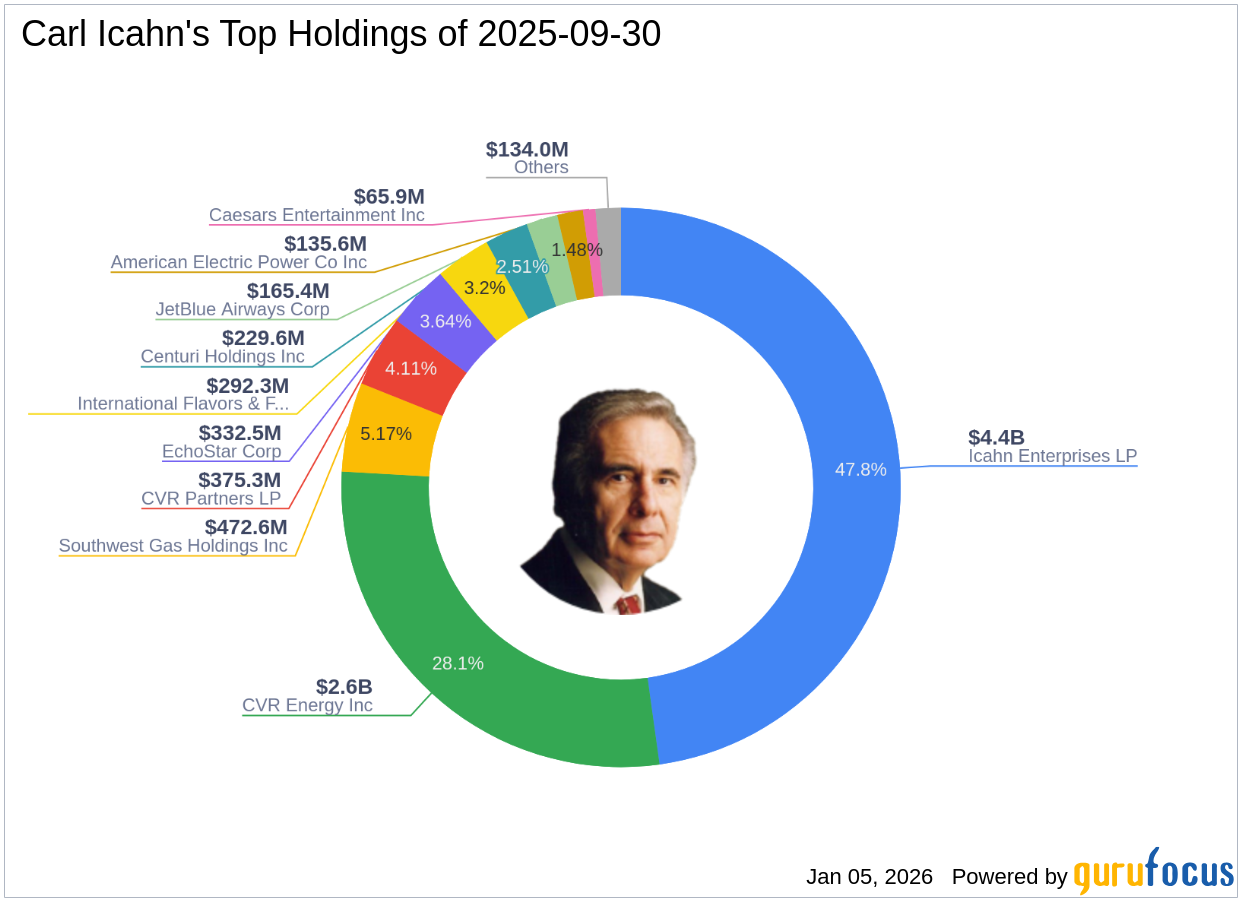

Significant Transaction on December 24, 2025 On December 24, 2025, Carl Icahn (Trades, Portfolio) executed a noteworthy transaction involving Icahn Enterprises

defenseworld.net

a month ago

Shares of CVR Partners, LP (NYSE: UAN - Get Free Report) hit a new 52-week high during trading on Wednesday. The company traded as high as $101.12 and last traded at $101.03, with a volume of 16626 shares changing hands. The stock had previously closed at $98.27. Analyst Ratings Changes Separately, Weiss Ratings reiterated a

seekingalpha.com

2 months ago

The December Dividend Power list identifies 35 high-yield stocks, with 14 offering 'safer' dividends backed by free cash flow yields exceeding dividend yields. Top actionable picks include Annaly Capital, Barings BDC, Noah Holdings, Blue Owl Capital, and SLR Investment, all meeting the dogcatcher ideal for safety and value. Analyst projections estimate average net gains of 38.75% for the top ten Dividend Power stocks by December 2026, with risk profiles generally below market average.

seekingalpha.com

2 months ago

CVR Partners, LP is a buy, offering undervalued exposure to nitrogen fertilizer with strategic Midwest facilities and unique feedstock flexibility. UAN's dual-input Coffeyville facility and capacity expansion initiatives provide a durable competitive advantage, supporting long-term utilization targets around 95%. The partnership structure delivers high, albeit volatile, distributions tied to commodity cycles, with tax-advantaged potential for certain investors.

seekingalpha.com

3 months ago

Of 35 November Dividend Power Dogs, 12 are recommended for "safer" dividends, with free-cash-flow-yields exceeding dividend-yields, and returns from $1,000 invested equaling-or-exceeding share-price, making them ideal buys. Analyst forecasts project average net gains of 36.78% for the top ten DiviPower stocks by November 2026, with strong upside potential in select financials. Caution is advised for stocks with negative free cash flow margins, as 18 of 35 are considered cash-poor and riskier for dividend sustainability.

seekingalpha.com

3 months ago

The Undercovered Dozen series spotlights 12 lesser-known stocks highlighted in recent Seeking Alpha articles. This week's edition covers articles published between Oct. 31 and Nov. 7, offering fresh investment ideas. The series aims to inspire discussion and help investors discover overlooked opportunities in the market.

See all news