Two Harbors Investment Corp. (TWO)

$

13.29

-0.42 (-3.16%)

Key metrics

Financial statements

Free cash flow per share

-0.4666

Market cap

1.4 Billion

Price to sales ratio

2.5176

Debt to equity

4.7585

Current ratio

0.9417

Income quality

-0.0761

Average inventory

0

ROE

-0.0955

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

Two Harbors Investment Corp. operates as a real estate investment trust (REIT) that focuses on investing in, financing, and managing residential mortgage-backed securities (RMBS), non-agency securities, mortgage servicing rights, and other financial assets in the United States. The financial data pertains to the fiscal year 2024. The weighted average number of diluted shares outstanding is 113,090,000.00 reflecting potential dilution effects. The income before tax ratio is 0.67 reflecting the pre-tax margin. The company reported depreciation and amortization expenses of $0.00 reflecting the wear and tear of its assets. Furthermore, the net total of other income and expenses is $0.00 reflecting non-core financial activities. Its target assets encompass agency RMBS collateralized by fixed rate mortgage loans, adjustable rate mortgage loans, and hybrid adjustable-rate mortgage (ARMs), in addition to other financial and mortgage-related assets, including non-agency securities and non-hedging transactions. The company qualifies as a REIT for federal income tax purposes and is required to distribute at least 90% of annual taxable income to its stockholders. Founded in 2009, Two Harbors Investment Corp. is headquartered in Minnetonka, Minnesota. With a market capitalization of $1,384,312,847.00 the company is classified as a small-cap player. The stock is affordable at $9.90 making it suitable for budget-conscious investors. Furthermore, the stock has a high average trading volume of 2,824,016.00 indicating strong liquidity. Two Harbors is a key player in the REIT - Mortgage industry, contributing significantly to the overall market landscape. It belongs to the Real Estate sector, driving innovation and growth. As a REIT, the company's focus on a variety of financial assets plays an essential role in its operations, influencing the dynamics of the markets in which it participates.

Is Two Harbors Investment Corp. (TWO) a good investment?

Investing in Two Harbors Investment Corp. (TWO) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as C-, with a Bearish outlook. Always conduct your own research before investing.

What is Two Harbors Investment Corp. (TWO)'s stock forecast?

Analysts predict Two Harbors Investment Corp. stock to fluctuate between $9.30 (low) and $14.28 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Two Harbors Investment Corp.'s market capitalization?

As of 2026-01-30, Two Harbors Investment Corp.'s market cap is $1,384,312,847, based on 104,161,990 outstanding shares.

How does Two Harbors Investment Corp. compare to competitors like PROLOGIS, INC.?

Compared to PROLOGIS, INC., Two Harbors Investment Corp. has a Lower Market-Cap, indicating a difference in performance.

Does Two Harbors Investment Corp. pay dividends?

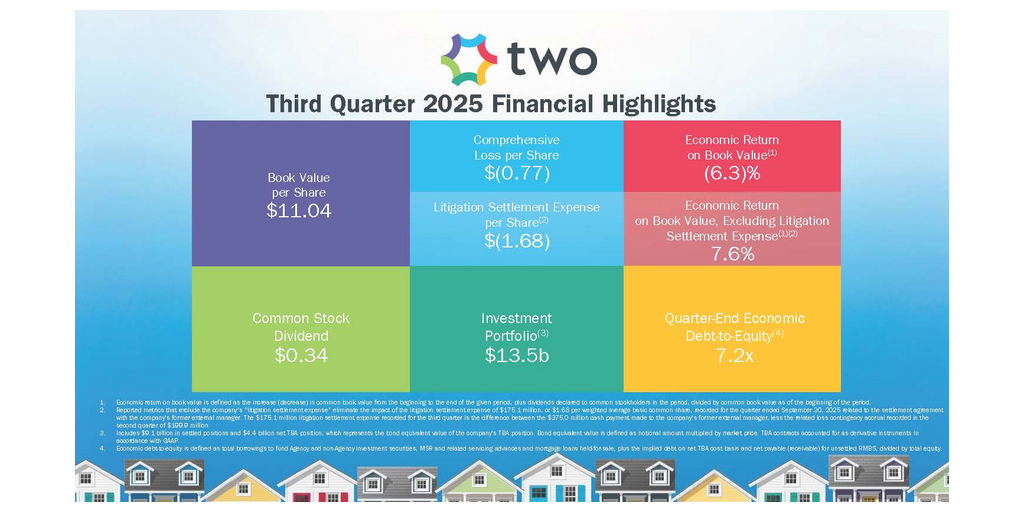

Two Harbors Investment Corp. pays dividends. The current dividend yield is 14.63%, with a payout of $0.34 per share.

How can I buy Two Harbors Investment Corp. (TWO) stock?

To buy Two Harbors Investment Corp. (TWO) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for TWO. Place an order (Market, Limit, etc.).

What is the best time to invest in Two Harbors Investment Corp.?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has Two Harbors Investment Corp. stock ever split?

Two Harbors Investment Corp.'s last stock split was 1:4 on 2022-11-02.

How did Two Harbors Investment Corp. perform in the last earnings report?

Revenue: $510,748,000 | EPS: $2.41 | Growth: -250.63%.

Where can I find Two Harbors Investment Corp.'s investor relations reports?

Visit https://www.twoharborsinvestment.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Two Harbors Investment Corp.?

You can explore historical data from here

What is the all-time high and low for Two Harbors Investment Corp. stock?

All-time high: $27.24 (2021-10-20) | All-time low: $9.30 (2025-10-30).

What are the key trends affecting Two Harbors Investment Corp. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

prnewswire.com

NEW YORK and NEW ORLEANS, Jan. 23, 2026 /PRNewswire/ -- Former Attorney General of Louisiana Charles C. Foti, Jr., Esq.

defenseworld.net

Two Harbors Investments Corp (NYSE: TWO - Get Free Report) insider Rebecca Sandberg sold 27,370 shares of the business's stock in a transaction that occurred on Friday, December 19th. The shares were sold at an average price of $11.43, for a total transaction of $312,839.10. Following the completion of the sale, the insider directly owned 156,718

globenewswire.com

NEW YORK, Dec. 20, 2025 (GLOBE NEWSWIRE) -- Halper Sadeh LLC, an investor rights law firm, is investigating the following companies for potential violations of the federal securities laws and/or breaches of fiduciary duties to shareholders relating to: Two Harbors Investment Corp.

seekingalpha.com

Two Harbors is now set to be acquired by UWM Holdings. The article explores the terms of the transaction and the timing. The article goes through the TWOD debenture from Two Harbors and its terms and conditions.

prnewswire.com

NEW YORK , Dec. 18, 2025 /PRNewswire/ -- Class Action Attorney Juan Monteverde with Monteverde & Associates PC (the "M&A Class Action Firm"), has recovered millions of dollars for shareholders and is recognized as a Top 50 Firm in the 2024 ISS Securities Class Action Services Report. The firm is headquartered at the Empire State Building in New York City and is investigating Two Harbors Investment Corp. (NYSE: TWO) related to its sale to UWM Holdings Corporation.

businesswire.com

NEW YORK--(BUSINESS WIRE)--TWO Announces Fourth Quarter 2025 Common and Preferred Stock Dividends.

businesswire.com

NEW YORK--(BUSINESS WIRE)--Halper Sadeh LLC, an investor rights law firm, is investigating whether the sale of Two Harbors Investment Corp. (NYSE: TWO) to UWM Holdings Corporation for 2.3328 shares of UWM Class A Common Stock for each share of Two Harbors common stock is fair to Two Harbors shareholders. Halper Sadeh encourages Two Harbors shareholders to click here to learn more about their legal rights and options or contact Daniel Sadeh or Zachary Halper at (212) 763-0060 or sadeh@halpersade.

seekingalpha.com

Two Harbors Investment Corp. (NYSE:TWO ) Q3 2025 Earnings Call October 28, 2025 9:00 AM EDT Company Participants Margaret Field - Head of Investor Relations William Greenberg - President & CEO William Dellal - VP & Chief Financial Officer Nicholas Letica - VP & Chief Investment Officer Conference Call Participants Bose George - Keefe, Bruyette, & Woods, Inc., Research Division Douglas Harter - UBS Investment Bank, Research Division Richard Shane - JPMorgan Chase & Co, Research Division Trevor Cranston - Citizens JMP Securities, LLC, Research Division Merrill Ross - Compass Point Research & Trading, LLC, Research Division Eric Hagen - BTIG, LLC, Research Division Presentation Operator Good morning. My name is Taryn, and I will be your conference facilitator.

businesswire.com

NEW YORK--(BUSINESS WIRE)---- $TWO #Earnings--TWO Reports Third Quarter 2025 Financial Results.

seekingalpha.com

Two Harbors Investment baby bond offers an attractive yield of 8.88% with lower risk than common and preferred shares. TWO's strong capital buffer, high cash flow coverage, and 64% Agency MBS portfolio provide robust protection for TWOD investors. TWOD stands out in the mortgage REIT sector with one of the best equity-to-debt ratios and a stable dividend history.

See all news