Twin Disc, Incorporated (TWIN)

$

16.37

+0.23 (1.41%)

Key metrics

Financial statements

Free cash flow per share

0.3276

Market cap

235.5 Million

Price to sales ratio

0.6771

Debt to equity

0.4152

Current ratio

2.0830

Income quality

51.6104

Average inventory

155.1 Million

ROE

0.0023

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

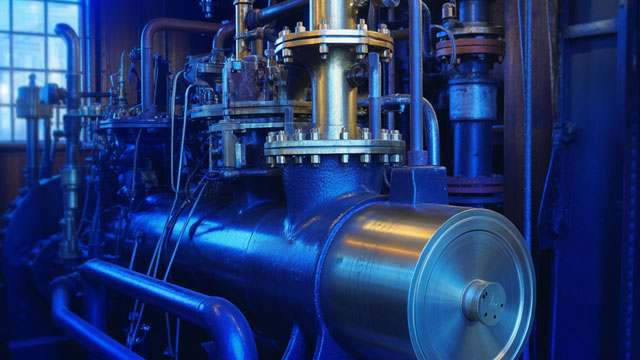

Twin Disc, Incorporated designs, manufactures, and sells marine and heavy-duty off-highway power transmission equipment globally, operating through two key segments: Manufacturing and Distribution. The cost of revenue for the company is $248,012,000.00 showcasing its production and operational expenses. The gross profit stands at $92,726,000.00 highlighting the company's profitability from core operations. Additionally, the company recorded an operating income of $9,887,000.00 reflecting its earnings from core operations. This financial data pertains to the fiscal year 2025 and the diluted EPS is -$0.14 accounting for potential share dilution. Twin Disc's product line includes marine transmissions, azimuth drives, surface drives, propellers, and boat management systems, as well as power-shift transmissions, hydraulic torque converters, power take-offs, industrial clutches, and control systems. Moreover, the company offers non-Twin Disc manufactured products. With a direct sales force and a distributor network, Twin Disc serves various customers primarily in the pleasure craft, commercial, and military marine markets, while also catering to the energy, natural resources, government, and industrial markets. Founded in 1918, Twin Disc is headquartered in Racine, Wisconsin. The stock is affordable at $13.33 suitable for budget-conscious investors. However, it has a low average trading volume of 34,025.00 indicating lower market activity. With a market capitalization of $235,532,067.00 the company is classified as a small-cap player. It holds a significant position in the Industrial - Machinery industry, contributing notably to the overall market landscape. Furthermore, it belongs to the Industrials sector, driving innovation and growth within its field. Through its diverse offerings and strategic market positioning, Twin Disc, Incorporated continues to play a vital role in shaping the dynamics of the industries it operates in.

Is Twin Disc, Incorporated (TWIN) a good investment?

Investing in Twin Disc, Incorporated (TWIN) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as C+, with a Bearish outlook. Always conduct your own research before investing.

What is Twin Disc, Incorporated (TWIN)'s stock forecast?

Analysts predict Twin Disc, Incorporated stock to fluctuate between $6.16 (low) and $19.63 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Twin Disc, Incorporated's market capitalization?

As of 2026-02-05, Twin Disc, Incorporated's market cap is $235,532,067, based on 14,388,031 outstanding shares.

How does Twin Disc, Incorporated compare to competitors like GE Aerospace?

Compared to GE Aerospace, Twin Disc, Incorporated has a Lower Market-Cap, indicating a difference in performance.

Does Twin Disc, Incorporated pay dividends?

Twin Disc, Incorporated pays dividends. The current dividend yield is 0.98%, with a payout of $0.04 per share.

How can I buy Twin Disc, Incorporated (TWIN) stock?

To buy Twin Disc, Incorporated (TWIN) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for TWIN. Place an order (Market, Limit, etc.).

What is the best time to invest in Twin Disc, Incorporated?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has Twin Disc, Incorporated stock ever split?

Twin Disc, Incorporated's last stock split was 2:1 on 2008-01-02.

How did Twin Disc, Incorporated perform in the last earnings report?

Revenue: $340,738,000 | EPS: -$0.14 | Growth: -117.50%.

Where can I find Twin Disc, Incorporated's investor relations reports?

Visit https://www.twindisc.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Twin Disc, Incorporated?

You can explore historical data from here

What is the all-time high and low for Twin Disc, Incorporated stock?

All-time high: $19.63 (2026-02-03) | All-time low: $6.16 (2025-04-22).

What are the key trends affecting Twin Disc, Incorporated stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

seekingalpha.com

Twin Disc, Incorporated (TWIN) Q2 2026 Earnings Call Transcript

globenewswire.com

MILWAUKEE, Jan. 29, 2026 (GLOBE NEWSWIRE) -- Twin Disc, Inc. (NASDAQ: TWIN), today announced that the Board of Directors (the "Board") approved a regular quarterly cash dividend of $0.04 per share payable on March 2, 2026, to shareholders of record at the close of business on February 18, 2026.

seekingalpha.com

Twin Disc should benefit from growing momentum in luxury marine, autonomous vehicles, and frac rebuilds. I see organic revenue growth accelerating above 6% in coming years, supported by those healthy marine, defense, and e-frac markets, as well as strong ARFF demand. Margin leverage is critical—sustained 30%+ gross and 10%+ EBITDA margins would unlock meaningful valuation upside.

globenewswire.com

MILWAUKEE, Nov. 26, 2025 (GLOBE NEWSWIRE) -- Twin Disc, Inc. (NASDAQ: TWIN), today announced that Chief Financial Officer Jeff Knutson is presenting at the Noble Capital Markets Emerging Growth Equity Conference in Boca Raton, Florida on Wednesday, December 3 at 1:30 pm Central. In conjunction with the event, Twin Disc executives will be available to participate in one-on-one meetings with investors registered to attend the conference.

zacks.com

TWIN's Q1 FY26 results show narrower year-over-year loss per share and rising sales, margin expansion and defense demand strength, supported by the Kobelt acquisition and a robust backlog.

seekingalpha.com

Twin Disc, Incorporated ( TWIN ) Q1 2026 Earnings Call November 5, 2025 9:00 AM EST Company Participants Jeffrey Knutson - VP of Finance, CFO, Treasurer & Secretary John Batten - President, CEO & Director Conference Call Participants David S. MacGregor - Longbow Research LLC Presentation Operator Hello, and welcome to the Twin Disc, Inc. Fiscal First Quarter 2026 Conference Call.

globenewswire.com

MILWAUKEE, Oct. 30, 2025 (GLOBE NEWSWIRE) -- Twin Disc, Inc. (NASDAQ: TWIN), today announced that the Board of Directors (the "Board") approved a regular quarterly cash dividend of $0.04 per share payable on December 1, 2025, to shareholders of record at the close of business on November 17, 2025.

seekingalpha.com

Twin Disc offers reasonable value and moderate upside potential, supported by management's ambitious growth plans and recent strategic acquisitions. TWIN's top-line growth is driven primarily by acquisitions, with organic expansion seen mainly in its Veth Propulsion business and international markets. Profitability has been mixed due to acquisition-related costs and inflation, but current valuation multiples remain fair to slightly undervalued versus peers.

zacks.com

TWIN gains from rising defense spending, growing demand for hybrid systems, strategic acquisitions and strong financials, driving growth, innovation and long-term resilience.

zacks.com

TWIN's Q4 earnings decline year over year on higher costs, but sales rose 15%. Backlog strength, acquisitions and electrification initiatives support its long-term growth outlook.

See all news