TTM Technologies, Inc. (TTMI)

$

92.58

-3.64 (-3.93%)

Key metrics

Financial statements

Free cash flow per share

0.3464

Market cap

9.6 Billion

Price to sales ratio

3.2915

Debt to equity

0.0022

Current ratio

1.9283

Income quality

2.3876

Average inventory

251.9 Million

ROE

0.1061

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

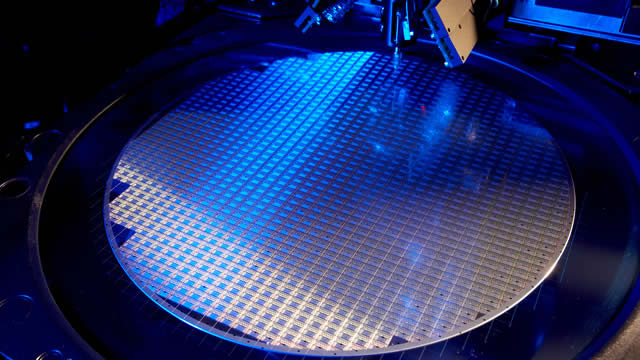

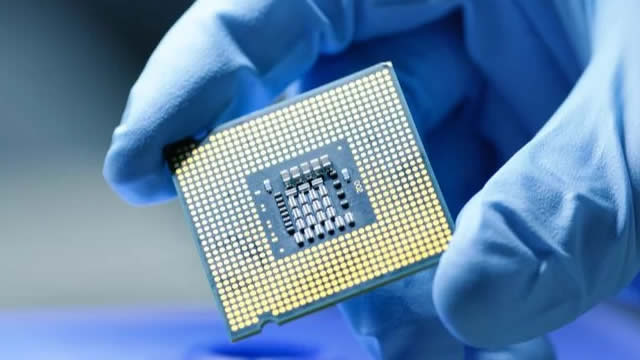

TTM Technologies, Inc., along with its subsidiaries, is engaged in the global manufacture and sale of printed circuit boards (PCBs), effectively operating within two key segments: PCB and RF&S Components. The company recorded an operating income of $261,652,000.00 reflecting its earnings from core operations. The total costs and expenses for the company are $2,644,693,000.00 highlighting its overall spending in the industry. Furthermore, TTM Technologies reported selling, general, and administrative expenses of $277,609,000.00 which indicate its operational overhead costs. The cost of revenue for the company stands at $2,338,092,000.00 serving to showcase its production and operational expenses. The EBITDA is $402,842,000.00 which acts as a vital indicator of the company's operational profitability, underlining its capacity to generate earnings before interest, taxes, depreciation, and amortization. TTM Technologies offers an extensive range of PCB products and related services, catering primarily to original equipment manufacturers and electronic manufacturing services firms across various sectors, including aerospace and defense, data center computing, automotive components, medical devices, and industrial instrumentation products. Established in 1978, the company is headquartered in Santa Ana, California. The stock is affordable at $52.12 making it an attractive option for budget-conscious investors. With an average trading volume of 2,597,816.00 the stock indicates moderate liquidity, allowing for reasonable trading opportunities. TTM Technologies boasts a mid-range market capitalization of $9,566,358,521.00 positioning it as a steady performer within its field. As a key player in the Hardware, Equipment & Parts industry, the company significantly contributes to the overall market landscape, enhancing its reputation as a reliable entity. Furthermore, it belongs to the Technology sector, where it drives innovation and growth, underscoring its commitment to delivering quality and advancing technology within its domain.

Is TTM Technologies, Inc. (TTMI) a good investment?

Investing in TTM Technologies, Inc. (TTMI) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B-, with a Bearish outlook. Always conduct your own research before investing.

What is TTM Technologies, Inc. (TTMI)'s stock forecast?

Analysts predict TTM Technologies, Inc. stock to fluctuate between $15.77 (low) and $111 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is TTM Technologies, Inc.'s market capitalization?

As of 2026-02-05, TTM Technologies, Inc.'s market cap is $9,566,358,521, based on 103,330,725 outstanding shares.

How does TTM Technologies, Inc. compare to competitors like Nvidia Corp?

Compared to Nvidia Corp, TTM Technologies, Inc. has a Lower Market-Cap, indicating a difference in performance.

How can I buy TTM Technologies, Inc. (TTMI) stock?

To buy TTM Technologies, Inc. (TTMI) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for TTMI. Place an order (Market, Limit, etc.).

What is the best time to invest in TTM Technologies, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

How did TTM Technologies, Inc. perform in the last earnings report?

Revenue: $2,906,345,000 | EPS: $1.73 | Growth: 214.55%.

Where can I find TTM Technologies, Inc.'s investor relations reports?

Visit https://www.ttm.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for TTM Technologies, Inc.?

You can explore historical data from here

What is the all-time high and low for TTM Technologies, Inc. stock?

All-time high: $111 (2026-02-03) | All-time low: $9.76 (2022-02-10).

What are the key trends affecting TTM Technologies, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

247wallst.com

Alphabet (NASDAQ:GOOGL) announced $175 to $185 billion in capital expenditures for 2026, nearly doubling previous spending.

zacks.com

TTM Technologies (TTMI) came out with quarterly earnings of $0.7 per share, beating the Zacks Consensus Estimate of $0.68 per share. This compares to earnings of $0.6 per share a year ago.

zacks.com

TTMI's Q4 2025 outlook looks supported by AI-driven data center and defense demand, partly offset by a persistent slowdown in automotive markets.

prnewswire.com

NEW YORK, Jan. 27, 2026 /PRNewswire/ -- S&P Dow Jones Indices will make the following changes to the S&P MidCap 400, S&P SmallCap 600: S&P SmallCap 600 constituent TTM Technologies Inc. (NASD: TTMI) will replace Civitas Resources Inc. (NYSE: CIVI) in the S&P MidCap 400, and Amneal Pharmaceuticals Inc. (NASD: AMRX) will replace TTM Technologies in the S&P SmallCap 600 effective prior to the opening of trading on Friday, January 30. S&P SmallCap 600 constituent SM Energy Co. (NYSE: SM) is acquiring Civitas Resources in a deal expected to be completed soon, pending final closing conditions.

zacks.com

TTM (TTMI) is well positioned to outperform the market, as it exhibits above-average growth in financials.

globenewswire.com

SANTA ANA, Calif., Jan. 22, 2026 (GLOBE NEWSWIRE) -- TTM Technologies, Inc. (NASDAQ:TTMI) will hold a conference call on Wednesday, February 4, 2026, at 4:30 p.m.

zacks.com

TTM (TTMI) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

forbes.com

On January 13, 2026, TTM Technologies experienced a remarkable increase of nearly 20% after the firm anticipated considerable long-term revenue and earnings growth during an investor conference. This bold movement occurred on substantial trading volume, propelling the stock to new 52-week highs.

globenewswire.com

SANTA ANA, Calif., Jan. 12, 2026 (GLOBE NEWSWIRE) -- TTM Technologies, Inc. (NASDAQ: TTMI) (“TTM”), a leading global manufacturer of technology products, including mission systems, radio frequency (“RF”) components, RF microwave/microelectronic assemblies, and technologically advanced printed circuit boards (“PCB”s), is proud to announce that its Syracuse Campus has been named the winner of the fifth annual TTM Chair for Community Service Award.

seekingalpha.com

Expand Energy Corporation looks good ending the year, growing net income by $613 million TTM vs prior TTM and increasing merger synergies by $200 million. Oil and gas seems promising for 2026 due to more supportive policies and increases in demand due to AI and data centers. Expand has been consolidating aggressively, acquiring ~82,500 net acres of value-accretive leasehold across Western Haynesville and Southwest Appalachia in Q3.

See all news