TriMas Corporation (TRS)

$

34.78

-0.26 (-0.75%)

Key metrics

Financial statements

Free cash flow per share

1.0922

Market cap

1.4 Billion

Price to sales ratio

1.3941

Debt to equity

0.6275

Current ratio

2.6829

Income quality

2.3369

Average inventory

222.1 Million

ROE

0.0631

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

The total costs and expenses for the company are $872,190,000.00 reflecting its overall spending and operational commitments. In evaluating its financial health, the company recorded an operating income of $52,820,000.00 demonstrating its earnings from core operations. Additionally, the net total of other income and expenses is -$22,780,000.00 which encompasses results from non-core financial activities. The company also incurred an interest expense of $19,560,000.00 highlighting its debt servicing obligations. Lastly, the weighted average number of shares outstanding is $40,725,714.00 underlining the company's shareholder base and equity distribution. On a market perspective, the stock is affordable at $39.92 making it an appealing option for budget-conscious investors. Despite the attractiveness of the stock, it has a low average trading volume of 599,123.00 indicating lower market activity, which may affect liquidity for potential buyers. With a market capitalization of $1,413,656,437.00 the company is classified as a small-cap player, representing a niche within the broader investment landscape. It is a key player in the Packaging & Containers industry, contributing significantly to the overall market landscape with its diverse product offerings. Furthermore, it belongs to the Consumer Cyclical sector, where it drives innovation and growth, establishing a strong market presence amidst competitive pressures.

Is TriMas Corporation (TRS) a good investment?

Investing in TriMas Corporation (TRS) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B, with a Bullish outlook. Always conduct your own research before investing.

What is TriMas Corporation (TRS)'s stock forecast?

Analysts predict TriMas Corporation stock to fluctuate between $19.33 (low) and $40.34 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is TriMas Corporation's market capitalization?

As of 2026-02-05, TriMas Corporation's market cap is $1,413,656,437, based on 40,645,671 outstanding shares.

How does TriMas Corporation compare to competitors like GE Aerospace?

Compared to GE Aerospace, TriMas Corporation has a Lower Market-Cap, indicating a difference in performance.

Does TriMas Corporation pay dividends?

TriMas Corporation pays dividends. The current dividend yield is 0.50%, with a payout of $0.04 per share.

How can I buy TriMas Corporation (TRS) stock?

To buy TriMas Corporation (TRS) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for TRS. Place an order (Market, Limit, etc.).

What is the best time to invest in TriMas Corporation?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has TriMas Corporation stock ever split?

TriMas Corporation's last stock split was 251:200 on 2015-07-01.

How did TriMas Corporation perform in the last earnings report?

Revenue: $925,010,000 | EPS: $0.60 | Growth: -38.14%.

Where can I find TriMas Corporation's investor relations reports?

Visit https://www.trimascorp.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for TriMas Corporation?

You can explore historical data from here

What is the all-time high and low for TriMas Corporation stock?

All-time high: $40.34 (2025-09-24) | All-time low: $19.33 (2025-02-27).

What are the key trends affecting TriMas Corporation stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

zacks.com

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

zacks.com

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

zacks.com

TriMas (TRS) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

zacks.com

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

businesswire.com

BLOOMFIELD HILLS, Mich.--(BUSINESS WIRE)--TriMas (NASDAQ: TRS) today announced that its Board of Directors has increased the Company's common stock share repurchase authorization to a total of up to $150 million, adding to the $65.4 million remaining under the previous authorization. “Increasing our share repurchase authorization reinforces our long-term commitment to returning capital to shareholders and the Board's confidence in TriMas' future,” said Thomas Snyder, TriMas President and Chief.

zacks.com

The heavy selling pressure might have exhausted for TriMas (TRS) as it is technically in oversold territory now. In addition to this technical measure, strong agreement among Wall Street analysts in revising earnings estimates higher indicates that the stock is ripe for a trend reversal.

businesswire.com

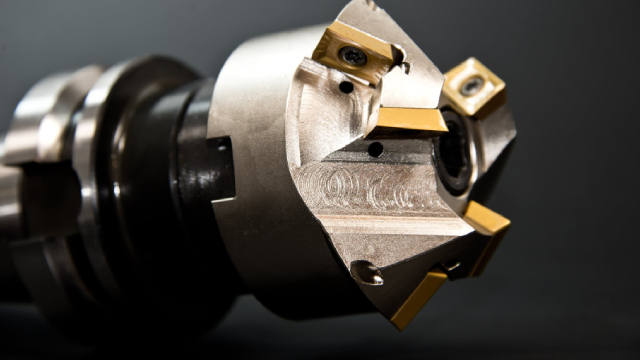

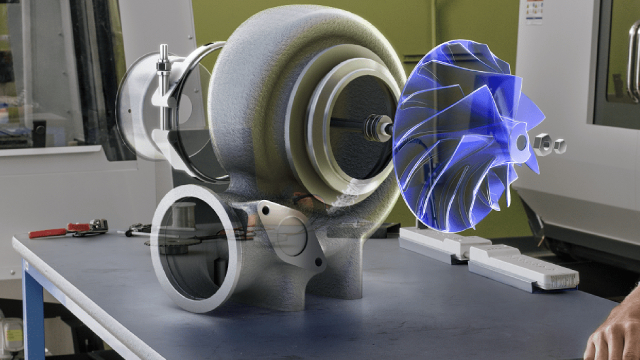

NEW YORK--(BUSINESS WIRE)--Tinicum, L.P. (“Tinicum”) today announced that one of its affiliates has signed an agreement to acquire the aerospace assets of TriMas Corporation (“TriMas Aerospace”), through which TriMas Aerospace will be merged with PennAero, a Tinicum portfolio company (“the Transaction”). Funds managed by Blackstone will be a minority investor in the Transaction. This investment reinforces PennAero's strategy of partnering with its customers to provide best-in-class engineering,.

wsj.com

TriMas agreed to sell its aerospace business for $1.45 billion to an affiliate of private investment firm Tinicum. Funds managed by Blackstone will be a minority investor in the transaction.

businesswire.com

BLOOMFIELD HILLS, Mich.--(BUSINESS WIRE)--TriMas (NASDAQ: TRS) announced today that it has entered into a definitive agreement to sell its Aerospace segment for an all-cash purchase price of approximately $1.45 billion to an affiliate of Tinicum L.P. (the “Transaction”). Funds managed by Blackstone will be a minority investor in the Transaction. The purchase price represents an enterprise value multiple of approximately 18x last twelve months (LTM) third quarter 2025 adjusted EBITDA(1). “As pre.

zacks.com

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

See all news