Stanley Black & Decker, Inc. (SWK)

$

67.23

+1.71 (2.54%)

Key metrics

Financial statements

Free cash flow per share

5.0633

Market cap

11.1 Billion

Price to sales ratio

0.7254

Debt to equity

0.7623

Current ratio

1.1040

Income quality

3.1296

Average inventory

4.6 Billion

ROE

0.0407

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

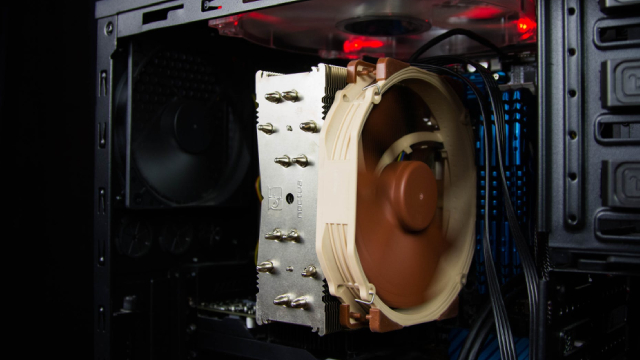

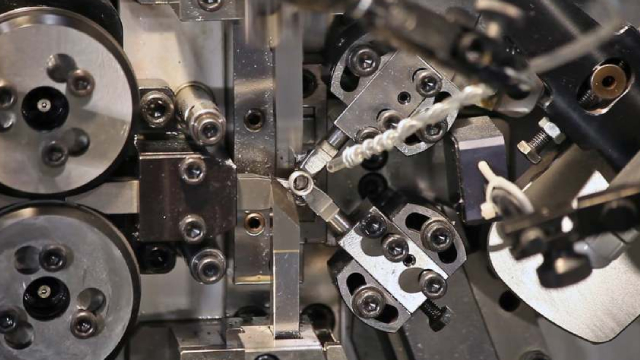

Stanley Black & Decker, Inc. operates within the tools and storage and industrial sectors across various geographic regions, including the United States, Canada, and several countries in Europe and Asia. The Tools & Storage segment provides a wide array of professional products, featuring high-grade corded and cordless electric power tools, equipment, and pneumatic tools tailored for professional use. Additionally, it offers consumer-oriented products under the BLACK+DECKER brand, which encompasses corded and cordless power tools, lawn and garden equipment, hand tools, and accessories. These products are distributed through numerous channels, including retailers, dealers, and a direct sales force, serving a diverse clientele from professional end-users to retail consumers. The Industrial segment focuses on delivering engineered fastening systems to industries such as automotive, manufacturing, and aerospace, while also providing pipe handling and joint welding equipment necessary for pipeline construction. Additionally, the company offers hydraulic tools and attachments for heavy machinery, catering to the oil and natural gas pipeline sectors, along with selling automatic doors for commercial use. The EBITDA is $1,323,100,000.00 a key indicator of the company's operational profitability. The operating income ratio is 0.08 indicating the company's operational profitability margin. The company reported depreciation and amortization expenses of $589,500,000.00 reflecting the wear and tear of its assets. The gross profit stands at $4,514,400,000.00 highlighting the company's profitability from core operations. Lastly, the operating expenses amount to $3,310,500,000.00 encompassing various operational costs incurred. The stock is reasonably priced at $67.23 appealing to a broad range of investors. The stock has a high average trading volume of 2,944,208.00 indicating strong liquidity. With a mid-range market capitalization of $10,401,354,990.00 the company is a steady performer. It is a key player in the Manufacturing - Tools & Accessories industry, contributing significantly to the overall market landscape. Moreover, it belongs to the Industrials sector, driving innovation and growth.

Is Stanley Black & Decker, Inc. (SWK) a good investment?

Investing in Stanley Black & Decker, Inc. (SWK) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B-, with a Bullish outlook. Always conduct your own research before investing.

What is Stanley Black & Decker, Inc. (SWK)'s stock forecast?

Analysts predict Stanley Black & Decker, Inc. stock to fluctuate between $53.91 (low) and $110.88 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Stanley Black & Decker, Inc.'s market capitalization?

As of 2025-05-27, Stanley Black & Decker, Inc.'s market cap is $10,401,354,990, based on 154,713,000 outstanding shares.

How does Stanley Black & Decker, Inc. compare to competitors like GE Aerospace?

Compared to GE Aerospace, Stanley Black & Decker, Inc. has a Lower Market-Cap, indicating a difference in performance.

Does Stanley Black & Decker, Inc. pay dividends?

Stanley Black & Decker, Inc. pays dividends. The current dividend yield is 4.88%, with a payout of $0.82 per share.

How can I buy Stanley Black & Decker, Inc. (SWK) stock?

To buy Stanley Black & Decker, Inc. (SWK) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for SWK. Place an order (Market, Limit, etc.).

What is the best time to invest in Stanley Black & Decker, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Stanley Black & Decker, Inc. stock ever split?

Stanley Black & Decker, Inc.'s last stock split was 2:1 on 1996-06-04.

How did Stanley Black & Decker, Inc. perform in the last earnings report?

Revenue: $15,365,700,000 | EPS: $1.95 | Growth: -194.20%.

Where can I find Stanley Black & Decker, Inc.'s investor relations reports?

Visit https://www.stanleyblackanddecker.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Stanley Black & Decker, Inc.?

You can explore historical data from here

What is the all-time high and low for Stanley Black & Decker, Inc. stock?

All-time high: $225 (2021-05-10) | All-time low: $53.91 (2025-04-09).

What are the key trends affecting Stanley Black & Decker, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

fool.com

Stanley Black & Decker (SWK 0.42%) stock rose by 12.8% in the week to Friday morning. The move comes as a thawing in the U.S./China trading relationship encouraged investors to price in a better outcome for the toolmaker's earnings in 2025 and beyond.

fool.com

Shares in toolmaker and engineered fastener company Stanley Black & Decker (SWK 4.20%) slumped by 21.9% in April, according to data from S&P Global Market Intelligence. There's no debating the reason.

fool.com

Toolmaker Stanley Black & Decker (SWK -2.74%) beat earnings expectations for the first quarter, but revenue was light and the company sees rising cost pressures due to tariffs, according to its quarterly report from this morning. Investors viewed the glass as half-empty, sending shares of Stanley down as much as 5% for the day and down 3% heading into market close.

zacks.com

Weakness in both segments weighs on SWK's top line in the first quarter of 2025.

investopedia.com

Stanley Black & Decker (SWK) shares fell Wednesday as the power tool maker anticipates the Trump administration's tariffs negatively affecting its profits this year as it alters its supply chain and raises prices.

prnewswire.com

DEWALT Posts 8th Consecutive Quarter of Revenue Growth First Quarter Gross Margin Improves Versus Prior Year as Global Cost Reduction Program Drives Margin Expansion Accelerates Supply Chain Adjustments & Price Actions in Response to U.S. Tariffs NEW BRITAIN, Conn. , April 30, 2025 /PRNewswire/ -- Stanley Black & Decker (NYSE: SWK), a worldwide leader in tools and outdoor, today announced first quarter 2025 financial results.

prnewswire.com

DEWALT congratulates all high school seniors committing to a career in the trades DEWALT is encouraging seniors to post their trade school decision on social media utilizing a variety of free downloadable digital banners provided by the brand and tagging DEWALT Majority of students (and their parents) enrolled in skilled trades education feel optimistic about their career choice, according to a recent DEWALT survey TOWSON, Md. , April 29, 2025 /PRNewswire/ -- To honor and support the next generation of skilled tradespeople, DEWALT, a Stanley Black & Decker brand and leader in jobsite solutions, is recognizing high school seniors entering the trades starting on National Decision Day, traditionally held on May 1.

zacks.com

SWK's Q1 2025 results are likely to benefit from strength in the Engineered Fastening business. However, weakness in the Industrial and Tools & Outdoor segments is likely to have weighed on its performance.

prnewswire.com

NEW BRITAIN, Conn. , April 25, 2025 /PRNewswire/ -- Stanley Black & Decker (NYSE: SWK), a worldwide leader in Tools and Outdoor, announced today that its Board of Directors approved a regular second quarter cash dividend of $0.82 per common share.

zacks.com

SWK benefits from strength in the Tools & Outdoor unit, cost-saving measures and shareholder-friendly policies. Softness in its Industrial unit and high debt are concerning.

See all news