Sensata Technologies Holding plc (ST)

$

35.58

+0.99 (2.78%)

Key metrics

Financial statements

Free cash flow per share

3.1964

Market cap

5 Billion

Price to sales ratio

1.3533

Debt to equity

1.1783

Current ratio

2.9057

Income quality

-22.1445

Average inventory

638.7 Million

ROE

-0.0092

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

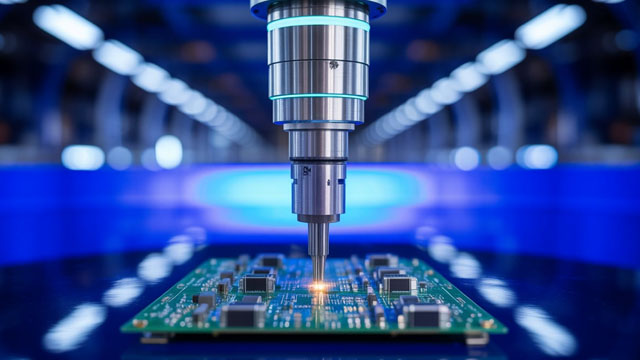

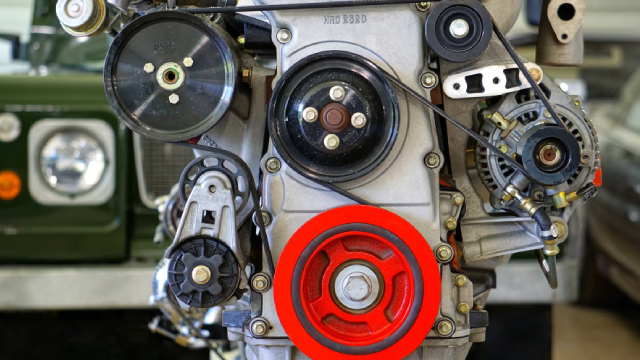

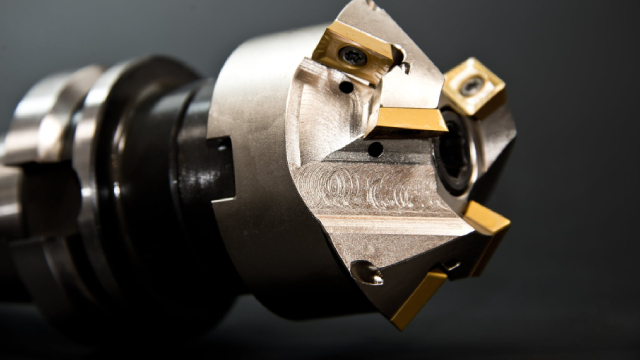

The company reported a net loss of $128,477,000.00 indicating challenges in its operations during the fiscal year 2024. The operating expenses amount to $561,472,000.00 encompassing various operational costs incurred. To account for the wear and tear of its assets, the company reported depreciation and amortization expenses of $312,879,000.00. Additionally, the net total of other income and expenses is -$439,370,000.00 reflecting non-core financial activities, which may further impact its financial stability. Sensata Technologies Holding plc develops, manufactures, and sells sensors and sensor-based solutions across the Americas, Europe, Asia, and internationally, and operates in two segments: Performance Sensing and Sensing Solutions. The Performance Sensing segment focuses on critical applications, serving customers primarily in the automotive and heavy vehicle industries, while the Sensing Solutions segment caters mainly to industrial and aerospace markets with specialized sensor products. The stock is affordable at $31.27 suitable for budget-conscious investors seeking potential opportunities. Notably, the stock has a high average trading volume of 1,338,986.00 indicating strong liquidity, which is crucial for investor confidence. With a mid-range market capitalization of $5,183,249,391.00 the company is a steady performer within its sector. It is a key player in the Hardware, Equipment & Parts industry, contributing significantly to the overall market landscape and driving innovation and growth. The company’s diverse product offerings, including pressure sensors, high-voltage contactors, and electrical protection devices, further solidify its position in the Technology sector, showcasing its commitment to delivering advanced solutions.

Is Sensata Technologies Holding plc (ST) a good investment?

Investing in Sensata Technologies Holding plc (ST) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as C+, with a Bearish outlook. Always conduct your own research before investing.

What is Sensata Technologies Holding plc (ST)'s stock forecast?

Analysts predict Sensata Technologies Holding plc stock to fluctuate between $17.32 (low) and $36.25 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Sensata Technologies Holding plc's market capitalization?

As of 2026-02-02, Sensata Technologies Holding plc's market cap is $5,183,249,391, based on 145,678,735 outstanding shares.

How does Sensata Technologies Holding plc compare to competitors like Nvidia Corp?

Compared to Nvidia Corp, Sensata Technologies Holding plc has a Lower Market-Cap, indicating a difference in performance.

Does Sensata Technologies Holding plc pay dividends?

Sensata Technologies Holding plc pays dividends. The current dividend yield is 1.35%, with a payout of $0.12 per share.

How can I buy Sensata Technologies Holding plc (ST) stock?

To buy Sensata Technologies Holding plc (ST) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for ST. Place an order (Market, Limit, etc.).

What is the best time to invest in Sensata Technologies Holding plc?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

How did Sensata Technologies Holding plc perform in the last earnings report?

Revenue: $3,935,060,000 | EPS: $0.85 | Growth: -3,407.39%.

Where can I find Sensata Technologies Holding plc's investor relations reports?

Visit https://www.sensata.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Sensata Technologies Holding plc?

You can explore historical data from here

What is the all-time high and low for Sensata Technologies Holding plc stock?

All-time high: $65.58 (2022-01-05) | All-time low: $17.32 (2025-04-09).

What are the key trends affecting Sensata Technologies Holding plc stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

businesswire.com

SWINDON, United Kingdom--(BUSINESS WIRE)--Sensata Technologies Board Approves Q1 2026 Dividend of $0.12 per share.

zacks.com

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

zacks.com

The increasing adoption of industrial automation, focus on higher energy efficiency and optimum resource utilization should drive the Zacks Instruments - Control industry. ST and THR are well-positioned to gain from the evolving market dynamics.

zacks.com

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

seekingalpha.com

Sensata Technologies shows modest organic growth and gradual deleveraging but remains hampered by flattish sales and highly adjusted earnings. Recent SKU rationalization is hurting top-line sales but could improve margins, though tangible benefits remain to be seen. Leverage is trending down, with net debt reduced to $2.43 billion and a 2.9x EBITDA ratio, yet it remains elevated.

zacks.com

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

seekingalpha.com

Sensata Technologies Holding plc (NYSE:ST ) Q3 2025 Earnings Call October 28, 2025 5:00 PM EDT Company Participants James Entwistle - Senior Director of Investor Relations Stephan Von Schuckmann - CEO & Director Andrew Lynch - CFO & Executive VP Conference Call Participants Ashley Wallace - BofA Securities, Research Division Mark Delaney - Goldman Sachs Group, Inc., Research Division Guy Drummond Hardwick - Barclays Bank PLC, Research Division Joseph Spak - UBS Investment Bank, Research Division Joseph Giordano - TD Cowen, Research Division Luke Junk - Robert W. Baird & Co. Incorporated, Research Division Shreyas Patil - Wolfe Research, LLC Konstandinos Tasoulis - Wells Fargo Securities, LLC, Research Division William Stein - Truist Securities, Inc., Research Division Robert Jamieson - Vertical Research Partners, LLC Manmohanpreet Singh - JPMorgan Chase & Co, Research Division Presentation Operator Good day, and welcome to the Sensata Technologies Third Quarter 2025 Earnings Call.

zacks.com

Although the revenue and EPS for Sensata (ST) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

businesswire.com

SWINDON, United Kingdom--(BUSINESS WIRE)--Sensata Technologies Board Approves Q4 2025 Dividend of $0.12 per share.

businesswire.com

SWINDON, United Kingdom--(BUSINESS WIRE)--Sensata Technologies to Release Third Quarter 2025 Financial Results on October 28, 2025.

See all news