S&P Global Inc. (SPGI)

$

527.79

-0.84 (-0.16%)

Key metrics

Financial statements

Free cash flow per share

17.9461

Market cap

159.8 Billion

Price to sales ratio

10.6458

Debt to equity

0.3570

Current ratio

0.9743

Income quality

1.2869

Average inventory

0

ROE

0.1239

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

S&P Global Inc., along with its subsidiaries, specializes in providing credit ratings, benchmarks, analytics, and workflow solutions across various markets, including capital, commodities, and automotive sectors. The cost of revenue for the company is $4,391,000,000.00 showcasing its production and operational expenses. Additionally, the operating expenses amount to $4,237,000,000.00 encompassing various operational costs incurred. The earnings per share (EPS) is reported at $12.36 indicating the company's profitability on a per-share basis, while the weighted average number of shares outstanding is 311,600,000.00 highlighting the company's shareholder base. This financial data pertains to the fiscal year 2024. The company operates through six divisions: S&P Global Ratings focuses on credit ratings, research, and analytics to support market participants; S&P Dow Jones Indices provides valuation and index benchmarks; S&P Global Commodity Insights delivers data for global energy and commodity markets; S&P Global Market Intelligence offers data and technology solutions for decision-making; S&P Global Mobility draws insights from automotive data; and S&P Global Engineering Solutions provides expertise in various engineering fields, transforming workflows for their clients. The stock is priced at $507.16 positioning it in the higher-end market. Furthermore, the stock has a high average trading volume of 1,518,593.00 indicating strong liquidity and investor interest. With a large market capitalization of $159,814,812,000.00 the company is a dominant player in the financial services landscape. It is a key player in the Financial - Data & Stock Exchanges industry, contributing significantly to the overall market landscape. Additionally, it belongs to the Financial Services sector, driving innovation and growth across its operations. The comprehensive suite of services offered positions S&P Global Inc. as a significant contributor to the complexities of global markets, allowing it to meet the diverse needs of its clients effectively.

Is S&P Global Inc. (SPGI) a good investment?

Investing in S&P Global Inc. (SPGI) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B, with a Bearish outlook. Always conduct your own research before investing.

What is S&P Global Inc. (SPGI)'s stock forecast?

Analysts predict S&P Global Inc. stock to fluctuate between $427.14 (low) and $579.05 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is S&P Global Inc.'s market capitalization?

As of 2026-01-30, S&P Global Inc.'s market cap is $159,814,812,000, based on 302,800,000 outstanding shares.

How does S&P Global Inc. compare to competitors like JPMorgan Chase & Co.?

Compared to JPMorgan Chase & Co., S&P Global Inc. has a Lower Market-Cap, indicating a difference in performance.

Does S&P Global Inc. pay dividends?

S&P Global Inc. pays dividends. The current dividend yield is 0.73%, with a payout of $0.97 per share.

How can I buy S&P Global Inc. (SPGI) stock?

To buy S&P Global Inc. (SPGI) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for SPGI. Place an order (Market, Limit, etc.).

What is the best time to invest in S&P Global Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has S&P Global Inc. stock ever split?

S&P Global Inc.'s last stock split was 2:1 on 2005-05-18.

How did S&P Global Inc. perform in the last earnings report?

Revenue: $14,208,000,000 | EPS: $12.36 | Growth: 49.82%.

Where can I find S&P Global Inc.'s investor relations reports?

Visit https://www.spglobal.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for S&P Global Inc.?

You can explore historical data from here

What is the all-time high and low for S&P Global Inc. stock?

All-time high: $579.05 (2025-08-14) | All-time low: $279.32 (2022-10-13).

What are the key trends affecting S&P Global Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

prnewswire.com

The S&P Cotality Case-Shiller U.S. National Home Price NSA Index posted a 1.4% annual gain for November, in line with the previous month. Real home values declined as consumer inflation (2.7%) outpaced the National Index gain (1.4%) by 1.3 percentage points.

zacks.com

S&P Global (SPGI) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

zacks.com

S&P Global (SPGI) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

prnewswire.com

Alarming Spike In Odometer Fraud Since Last Year Costing Unsuspecting Buyers Thousands CENTREVILLE, Va. , Dec. 16, 2025 /PRNewswire/ -- Odometer fraud is a serious and growing concern for used car buyers across the country.

defenseworld.net

Ameriprise Financial Inc. increased its stake in S&P Global Inc. (NYSE: SPGI) by 8.0% in the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 1,596,875 shares of the business services provider's stock after purchasing an additional 118,034 shares during the period.

prnewswire.com

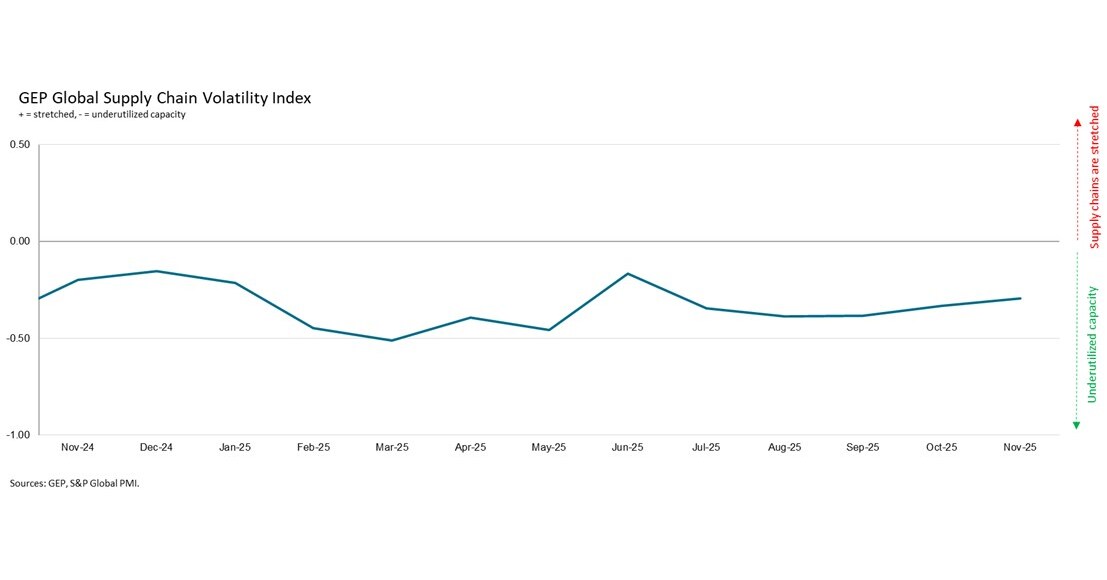

North America posts the steepest decline in input demand by region, signaling softening activity heading into 2026 Europe and the UK remain subdued amid weak manufacturing pipelines Asia sees another month of low demand as Chinese factory purchasing continues to slow With ample spare capacity worldwide, companies face little price pressure outside of tariffs CLARK, N.J. , Dec. 10, 2025 /PRNewswire/ -- GEP Global Supply Chain Volatility Index, a leading economic indicator based on a monthly survey of 27,000 businesses, shows that global supply chains remained underutilized in November, with manufacturers continuing to limit purchasing, signaling a weakening outlook for the start of 2026.

seekingalpha.com

S&P Global Inc. (SPGI) Presents at Goldman Sachs 2025 U.S. Financial Services Conference Transcript

zacks.com

S&P Global (SPGI) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

defenseworld.net

Aspire Growth Partners LLC decreased its position in S&P Global Inc. (NYSE: SPGI) by 20.2% during the undefined quarter, according to its most recent disclosure with the SEC. The fund owned 411 shares of the business services provider's stock after selling 104 shares during the period. Aspire Growth Partners LLC's holdings in S&P

prnewswire.com

The S&P Cotality Case-Shiller U.S. National Home Price NSA Index posted a 1.3% annual gain for September, down from a 1.4% rise in the previous month. Inflation outpaced home prices for a fourth straight month, with September's CPI running 1.7 percentage points above housing appreciation—the widest gap since the measures began diverging in June.

See all news