Snap-on Incorporated (SNA)

$

371.52

+5.41 (1.46%)

Key metrics

Financial statements

Free cash flow per share

19.6648

Market cap

19.1 Billion

Price to sales ratio

3.7333

Debt to equity

0.2186

Current ratio

4.3994

Income quality

1.0650

Average inventory

1 Billion

ROE

0.1807

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

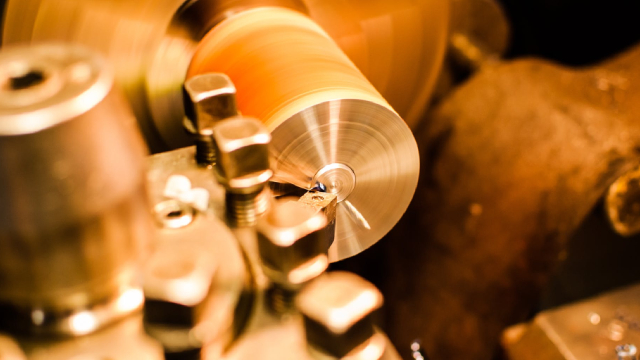

Snap-on Incorporated manufactures and markets a comprehensive range of tools, equipment, diagnostics, and repair information systems for professional users globally. The company's operational profitability is reflected in its EBITDA of $1,520,700,000.00 a key indicator of its financial performance. The reported depreciation and amortization expenses of $98,000,000.00 highlight the wear and tear associated with the company's assets. Furthermore, Snap-on reported an income before tax of $1,373,100,000.00 showcasing its pre-tax profitability and financial robustness. The gross profit stands at $2,654,800,000.00 underscoring the company's profitability from its core operations, while the gross profit ratio of 0.52 reflects the efficiency of its production and sales efforts. Through its diverse segments, including the Commercial & Industrial Group and Snap-on Tools Group, the company offers a vast array of hand tools, power tools, and diagnostic solutions tailored for various professional sectors. The stock is priced at $337.24 positioning it in the higher-end market, which may attract a specific investor demographic. Additionally, the stock has a low average trading volume of 280,925.00 indicating lower market activity and possibly reflecting investor sentiment toward the company. With a mid-range market capitalization of $19,379,734,108.00 Snap-on is recognized as a steady performer within the industry. It is a key player in the Manufacturing - Tools & Accessories industry, contributing significantly to the overall market landscape and showcasing its integral role. Furthermore, it belongs to the Industrials sector, where it drives innovation and growth, solidifying its position as a leader in the professional tools and equipment market.

Is Snap-on Incorporated (SNA) a good investment?

Investing in Snap-on Incorporated (SNA) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as A-, with a Bullish outlook. Always conduct your own research before investing.

What is Snap-on Incorporated (SNA)'s stock forecast?

Analysts predict Snap-on Incorporated stock to fluctuate between $289.81 (low) and $375.28 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Snap-on Incorporated's market capitalization?

As of 2026-02-03, Snap-on Incorporated's market cap is $19,379,734,108, based on 52,163,367 outstanding shares.

How does Snap-on Incorporated compare to competitors like GE Aerospace?

Compared to GE Aerospace, Snap-on Incorporated has a Lower Market-Cap, indicating a difference in performance.

Does Snap-on Incorporated pay dividends?

Snap-on Incorporated pays dividends. The current dividend yield is 2.64%, with a payout of $2.44 per share.

How can I buy Snap-on Incorporated (SNA) stock?

To buy Snap-on Incorporated (SNA) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for SNA. Place an order (Market, Limit, etc.).

What is the best time to invest in Snap-on Incorporated?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Snap-on Incorporated stock ever split?

Snap-on Incorporated's last stock split was 3:2 on 1996-09-11.

How did Snap-on Incorporated perform in the last earnings report?

Revenue: $5,108,400,000 | EPS: $19.85 | Growth: 3.87%.

Where can I find Snap-on Incorporated's investor relations reports?

Visit https://www.snapon.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Snap-on Incorporated?

You can explore historical data from here

What is the all-time high and low for Snap-on Incorporated stock?

All-time high: $380.20 (2026-02-03) | All-time low: $190.08 (2022-06-17).

What are the key trends affecting Snap-on Incorporated stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

zacks.com

SNA's Q4 results are likely to show modest revenue and EPS growth as strong auto repair demand and innovation offset macro pressures.

businesswire.com

KENOSHA, Wis.--(BUSINESS WIRE)--Snap-on will release 2025 fourth quarter and full year results prior to the market open on February 5, 2026, with a call to follow at 10:00 a.m. ET.

defenseworld.net

Generali Asset Management SPA SGR bought a new stake in shares of Snap-On Incorporated (NYSE: SNA) during the third quarter, according to its most recent 13F filing with the SEC. The institutional investor bought 5,968 shares of the company's stock, valued at approximately $2,068,000. Several other institutional investors also recently modified their holdings

defenseworld.net

Ariel Investments LLC trimmed its stake in Snap-On Incorporated (NYSE: SNA) by 5.7% in the second quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 33,005 shares of the company's stock after selling 1,981 shares during the quarter. Ariel Investments LLC owned 0.06% of

defenseworld.net

CW Advisors LLC grew its holdings in shares of Snap-On Incorporated (NYSE: SNA) by 141.1% in the undefined quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 16,223 shares of the company's stock after purchasing an additional 9,493 shares during the period.

zacks.com

Snap-on's growth strategy, innovation push and expanding product lineup signal resilient operations and potential progress ahead.

feeds.newsfilecorp.com

Brampton, Ontario--(Newsfile Corp. - November 27, 2025) - Star Navigation Systems Group Ltd. (CSE: SNA) (CSE: SNA.CN) ("Star" or the

seekingalpha.com

Snap-on Incorporated ( SNA ) Baird 55th Annual Global Industrial Conference November 12, 2025 10:40 AM EST Company Participants Nicholas Pinchuk - Chairman, CEO & President Conference Call Participants Luke Junk - Robert W. Baird & Co. Incorporated, Research Division Presentation Luke Junk Robert W.

seekingalpha.com

Snap-On has delivered strong long-term returns, with a 5-year CAGR of around 18%, outpacing the S&P 500. SNA demonstrates consistent financial performance, including stable gross margins above 50% and a rising return on invested capital, now over 15%. The company boasts a robust dividend growth track record, with a 15-year streak and annual growth rates near 14%, supporting shareholder value.

marketbeat.com

Snap-on Incorporated NYSE: SNA stock trades near the high end of its historical range in 2025, but it can go higher because this premium is well deserved. The high-quality industrial business is well-supported by global demand, generates ample cash flow, and pays a healthy capital return, including dividends, distribution growth, a market-beating yield, and share-reducing buybacks.

See all news