Super Micro Computer, Inc. (SMCI)

$

29.11

-1.01 (-3.47%)

Key metrics

Financial statements

Free cash flow per share

0.3318

Market cap

18.4 Billion

Price to sales ratio

0.8734

Debt to equity

0.7321

Current ratio

5.3941

Income quality

0.4202

Average inventory

5.2 Billion

ROE

0.1246

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

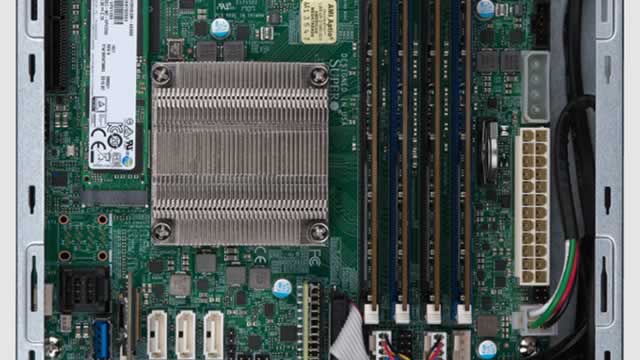

Super Micro Computer, Inc., together with its subsidiaries, develops and manufactures high-performance server and storage solutions based on modular and open architecture, serving various markets, including enterprise data centers, cloud computing, artificial intelligence, and 5G edge computing. The cost of revenue for the company is $19,542,120,000.00 showcasing its production and operational expenses. In terms of financial performance, the company achieved a significant net income of $1,048,854,000.00 showcasing its strong financial health. The net total of other income and expenses is -$47,289,000.00 reflecting non-core financial activities. The financial data pertains to the fiscal year 2025 during which the company recorded an operating income of $1,252,994,000.00 reflecting its earnings from core operations. Additionally, the company provides a wide array of solutions including complete servers, storage, modular blade servers, networking devices, and server management software, along with support and services, ensuring customers have tailored and optimized server solutions, highlighting its commitment to innovation and quality. In the investment landscape, the stock is affordable at $45.81 suitable for budget-conscious investors. With a high average trading volume of 27,359,870.00 it indicates strong liquidity, making it easier for investors to buy and sell shares. The company operates with a mid-range market capitalization of $17,377,825,810.00 categorizing it as a steady performer within its sector. It is a key player in the Computer Hardware industry, contributing significantly to the overall market landscape. Furthermore, it belongs to the Technology sector, actively driving innovation and growth in the technological space. Through direct sales, distributors, and system integrators, Super Micro Computer, Inc. maintains its prominence both domestically and internationally, fostering ongoing development and support for its diverse clientele.

Is Super Micro Computer, Inc. (SMCI) a good investment?

Investing in Super Micro Computer, Inc. (SMCI) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B-, with a Bullish outlook. Always conduct your own research before investing.

What is Super Micro Computer, Inc. (SMCI)'s stock forecast?

Analysts predict Super Micro Computer, Inc. stock to fluctuate between $25.71 (low) and $66.44 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Super Micro Computer, Inc.'s market capitalization?

As of 2026-02-02, Super Micro Computer, Inc.'s market cap is $17,377,825,810, based on 596,971,000 outstanding shares.

How does Super Micro Computer, Inc. compare to competitors like Nvidia Corp?

Compared to Nvidia Corp, Super Micro Computer, Inc. has a Lower Market-Cap, indicating a difference in performance.

How can I buy Super Micro Computer, Inc. (SMCI) stock?

To buy Super Micro Computer, Inc. (SMCI) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for SMCI. Place an order (Market, Limit, etc.).

What is the best time to invest in Super Micro Computer, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Super Micro Computer, Inc. stock ever split?

Super Micro Computer, Inc.'s last stock split was 10:1 on 2024-10-01.

How did Super Micro Computer, Inc. perform in the last earnings report?

Revenue: $21,972,042,000 | EPS: $1.77 | Growth: 0%.

Where can I find Super Micro Computer, Inc.'s investor relations reports?

Visit https://www.supermicro.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Super Micro Computer, Inc.?

You can explore historical data from here

What is the all-time high and low for Super Micro Computer, Inc. stock?

All-time high: $122.90 (2024-03-08) | All-time low: $3.41 (2022-04-08).

What are the key trends affecting Super Micro Computer, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

proactiveinvestors.com

Super Micro Computer (NASDAQ:SMCI) is set to report fiscal second quarter 2026 earnings after the close on Tuesday, with Wedbush analysts saying the report could show meaningful upside or downside depending on margins, supply chain conditions, and guidance. Wall Street analysts expect Super Micro to report revenue of $10.44 billion, more than doubling from $5.6 billion in the year-ago quarter, and earnings per share of $0.49, down about 20% year-over-year.

zacks.com

Super Micro Computer heads into Q2 FY26 with AI-server momentum, Blackwell/B300 platforms and DCBBS traction despite inventory and cash flow strains.

fool.com

Super Micro Computer (SMCI +1.40%) is facing slowing growth, but its expanding role in AI infrastructure and edge computing could flip the script. With new partnerships and analyst targets pointing higher, this stock may be closer to a breakout than the chart suggests.

seekingalpha.com

Super Micro Computer remains rated Hold due to persistent margin pressures and unresolved accounting concerns, despite strong AI-driven revenue growth. SMCI's Q2 '26 guidance suggests robust demand, with a $13B+ backlog and potential for further expansion, but margin contraction overshadows topline momentum. Gross margin deterioration—now at 10 consecutive quarters—remains a critical risk; recovery hinges on successful adoption of higher-margin DCBBS products.

zacks.com

In the latest trading session, Super Micro Computer (SMCI) closed at $30.78, marking a -2.9% move from the previous day.

seekingalpha.com

I am maintaining my Hold rating on the YieldMax SMCI Option Income Strategy ETF (SMCY) due to ongoing vulnerabilities in Super Micro Computer (SMCI) fundamentals. SMCY's synthetic covered call strategy delivers high yield — 211% TTM — but capital erosion persists as SMCI's price and margins decline. Weekly distributions offer greater compounding potential, yet income and total returns remain pressured by SMCI's execution and margin disappointments.

fool.com

The highest-growth U.S. telecom is down 33% off its highs, giving investors a buying opportunity. This server-maker recently saw shares cut in half, but is set to grow by leaps and bounds as AI proliferates.

businesswire.com

SAN JOSE, Calif.--(BUSINESS WIRE)--Super Micro Computer, Inc. (SMCI), a Total IT Solution Provider for AI/ML, HPC, Cloud, Storage, and 5G/Edge, today announced that it will host its second quarter fiscal 2026 financial results conference call on Tuesday, February 3rd, 2026, at 5:00 p.m. ET / 2:00 p.m. PT. The webcast will be available at https://ir.supermicro.com. A replay of the webcast will be available shortly after the call at the same website and will remain accessible for one year. About.

proactiveinvestors.com

Super Micro Computer Inc (NASDAQ:SMCI) could see revenue gains from strong demand for AI servers and racks, but margins are likely to remain under pressure, according to a Bank of America analyst note on Thursday. The investment bank maintained an Underperform rating on the stock, with a price target of $34, slightly above Wednesday's close of $32.24.

seekingalpha.com

Super Micro Computer, Inc. is downgraded to Hold due to persistent shipment delays, volatile operations, and low profit margins despite strong AI infrastructure demand. SMCI's growth catalysts include advanced liquid cooling, rapid full-rack solutions, global expansion, and a major Nvidia partnership, but these are offset by operational risks. Q2'26 revenue guidance is supply-driven, reflecting deferred Q1 sales rather than underlying demand acceleration, raising concerns on sustainability.

See all news