Semilux International Ltd. Ordinary Shares (SELX)

$

1.45

-0.02 (-1.38%)

Key metrics

Financial statements

Free cash flow per share

-8.2421

Market cap

1.8 Billion

Price to sales ratio

184.2303

Debt to equity

0.5808

Current ratio

2.8152

Income quality

0.8834

Average inventory

38.1 Million

ROE

-0.0975

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

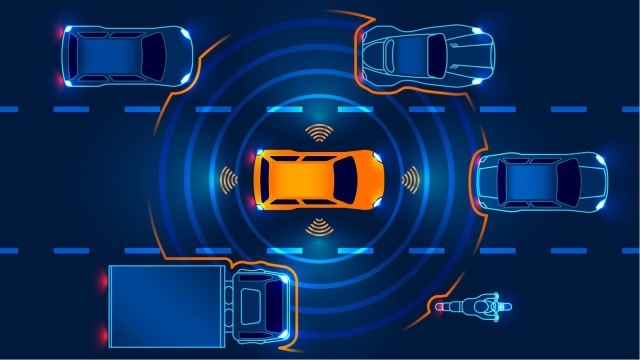

Semilux International Ltd. is an optical technology company that specializes in designing and producing optics and fluorescent modules tailored to client needs. The company achieved a revenue of $32,840,000.00 indicating its niche market focus, while the gross profit stands at -$15,209,000.00 highlighting the company's profitability from core operations. Furthermore, the EBITDA ratio is -1.06 showcasing the company's operational efficiency. The firm reported depreciation and amortization expenses of $24,397,000.00 reflecting the wear and tear of its assets. Additionally, the company earned an interest income of $14,680,000.00 which underscores its strategic financial investments. Semilux International's innovative products, including solid state AI LiDAR, AI ADB headlight systems, and AI optical image fusion systems, alongside their design services, cater to the autonomous driving and intelligent lighting industries as well as unmanned aerial vehicles. Founded in 2009 and headquartered in Taichung, Taiwan, this company is pivotal in advancing optical technologies. Currently, the stock is affordable at $1.45 suitable for budget-conscious investors. However, the stock has a low average trading volume of 6,208.00 indicating lower market activity. With a market capitalization of $54,271,110.00 the company is classified as a small-cap player. Semilux International Ltd. is a key player in the Hardware, Equipment & Parts industry, contributing significantly to the overall market landscape. It belongs to the Technology sector, driving innovation and growth. As it continues to develop its state-of-the-art optical products and systems, the company solidifies its position as a valuable contributor to technological advancements in both its sectors and beyond.

Is Semilux International Ltd. Ordinary Shares (SELX) a good investment?

Investing in Semilux International Ltd. Ordinary Shares (SELX) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as D+, with a Bearish outlook. Always conduct your own research before investing.

What is Semilux International Ltd. Ordinary Shares (SELX)'s stock forecast?

Analysts predict Semilux International Ltd. Ordinary Shares stock to fluctuate between $1 (low) and $2.63 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Semilux International Ltd. Ordinary Shares's market capitalization?

As of 2025-05-29, Semilux International Ltd. Ordinary Shares's market cap is $54,271,110, based on 37,428,352 outstanding shares.

How does Semilux International Ltd. Ordinary Shares compare to competitors like Meta Platforms, Inc. Class A Common Stock?

Compared to Meta Platforms, Inc. Class A Common Stock, Semilux International Ltd. Ordinary Shares has a Lower Market-Cap, indicating a difference in performance.

How can I buy Semilux International Ltd. Ordinary Shares (SELX) stock?

To buy Semilux International Ltd. Ordinary Shares (SELX) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for SELX. Place an order (Market, Limit, etc.).

What is the best time to invest in Semilux International Ltd. Ordinary Shares?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

How did Semilux International Ltd. Ordinary Shares perform in the last earnings report?

Revenue: $32,840,000 | EPS: -$6.30 | Growth: -436.90%.

Where can I find Semilux International Ltd. Ordinary Shares's investor relations reports?

Visit https://www.semilux.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Semilux International Ltd. Ordinary Shares?

You can explore historical data from here

What is the all-time high and low for Semilux International Ltd. Ordinary Shares stock?

All-time high: $4.39 (2024-02-16) | All-time low: $0.77 (2024-02-26).

What are the key trends affecting Semilux International Ltd. Ordinary Shares stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

globenewswire.com

a year ago

Taipei, Taiwan, May 15, 2024 (GLOBE NEWSWIRE) -- Semilux International Ltd. (“Semilux” or the “Company”) (NASDAQ: SELX), today announced that it filed its annual report on Form 20-F (the “Form 20-F”) for the year ended December 31, 2023 with the U.S. Securities and Exchange Commission. The Form 20-F can be accessed by visiting either the SEC's website at www.sec.gov or the Company's website at https://investors.semilux.com.

investorplace.com

a year ago

Semilux International (NASDAQ: SELX ) stock is falling on Monday as the optical technology company's shares give up unexpected gains on Friday. SELX stock has been volatile recently with its shares jumping 69% during normal trading hours on Friday.

globenewswire.com

a year ago

Taipei, Taiwan, Feb. 22, 2024 (GLOBE NEWSWIRE) -- Semilux International Ltd. ("Semilux" or the "Company") (NASDAQ: SELX), a provider of application-specific integrated circuit (“ASIC”), LiDAR and ADB components and solutions, today announced that it has entered into a common stock purchase agreement (the "Agreement") with White Lion Capital, LLC ("White Lion Capital"), a Nevada limited liability company. The Agreement governs a committed equity facility that provides the Company with the right, without the obligation, to sell White Lion Capital up to $50 million of its common stock, subject to certain limitations and conditions. The Company intends to use the net proceeds from the transaction for working capital to advance the Company's ASIC, LiDAR, and ADB technologies to meet the industry's growing demand for safety standards.

globenewswire.com

a year ago

Taipei, Feb. 15, 2024 (GLOBE NEWSWIRE) -- Chenghe Acquisition Co. (“Chenghe”), a special purpose acquisition company, today announced the completion of its previously announced business combination (the “Business Combination”), with Taiwan Color Optics, Inc. (“TCO”), a Taiwan-based provider of LiDAR and ADB components and solutions, and their newly formed holding company, Semilux International Ltd. (“Semilux”), a Cayman Islands exempted company with limited liability. Ordinary shares of Semilux International Ltd. are expected to commence trading on the Nasdaq Capital Market under the ticker symbol “SELX” on February 16, 2024. The Business Combination was approved at a special meeting of Chenghe's stockholders on February 2, 2024. Upon the closing of the Business Combination, trading of Chenghe's Class A ordinary shares and units will cease.

See all news