Starbucks Corporation (SBUX)

$

81.9

-0.46 (-0.56%)

Key metrics

Financial statements

Free cash flow per share

2.4332

Market cap

93.1 Billion

Price to sales ratio

2.5374

Debt to equity

-3.6282

Current ratio

0.7558

Income quality

1.7799

Average inventory

2.2 Billion

ROE

-0.3483

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

Starbucks Corporation, along with its subsidiaries, operates as a global roaster, marketer, and retailer of specialty coffee, offering a diverse range of products. The total costs and expenses for the company are $30,767,400,000.00 reflecting its overall spending. It operates through three primary segments: North America, International, and Channel Development. The company's stock is identified with the symbol 'SBUX' in the market. Its extensive network of stores provides an array of coffee and tea beverages, whole beans, and ground coffees, alongside single-serve options and ready-to-drink beverages. Various food products, such as pastries, breakfast sandwiches, and lunch items, are also available. The net income ratio is 0.10 reflecting the company's profitability margin, while the earnings per share (EPS) is reported at $3.31 indicating the company's profitability on a per-share basis. Furthermore, the income before tax ratio is 0.14 reflecting the pre-tax margin. As of October 3, 2021, Starbucks operated 16,826 company-operated and licensed stores in North America and 17,007 stores internationally, showcasing its vast reach. Established in 1971 and headquartered in Seattle, Washington, the company is well-regarded for its distinctive brands, including Starbucks, Teavana, Seattle's Best Coffee, Evolution Fresh, Ethos, Starbucks Reserve, and Princi. In the financial landscape, the stock is reasonably priced at $81.90 appealing to a broad range of investors. This pricing, combined with a high average trading volume of 9,428,550.00 indicates strong liquidity within the market. With a significant market capitalization of $93,095,730,000.00 the company is a dominant player not only in the specialty coffee sector but also as a key player in the Restaurants industry, contributing significantly to the overall market landscape. Additionally, it belongs to the Consumer Cyclical sector, driving innovation and growth while shaping industry trends. Through its robust business model and strategic positioning, Starbucks continues to influence consumer preferences and expand its global reach.

Is Starbucks Corporation (SBUX) a good investment?

Investing in Starbucks Corporation (SBUX) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as C+, with a Bearish outlook. Always conduct your own research before investing.

What is Starbucks Corporation (SBUX)'s stock forecast?

Analysts predict Starbucks Corporation stock to fluctuate between $75.50 (low) and $117.46 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Starbucks Corporation's market capitalization?

As of 2025-09-12, Starbucks Corporation's market cap is $93,095,730,000, based on 1,136,700,000 outstanding shares.

How does Starbucks Corporation compare to competitors like Amazon.Com Inc?

Compared to Amazon.Com Inc, Starbucks Corporation has a Lower Market-Cap, indicating a difference in performance.

Does Starbucks Corporation pay dividends?

Starbucks Corporation pays dividends. The current dividend yield is 2.69%, with a payout of $0.61 per share.

How can I buy Starbucks Corporation (SBUX) stock?

To buy Starbucks Corporation (SBUX) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for SBUX. Place an order (Market, Limit, etc.).

What is the best time to invest in Starbucks Corporation?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has Starbucks Corporation stock ever split?

Starbucks Corporation's last stock split was 2:1 on 2015-04-09.

How did Starbucks Corporation perform in the last earnings report?

Revenue: $36,176,200,000 | EPS: $3.31 | Growth: -8.06%.

Where can I find Starbucks Corporation's investor relations reports?

Visit https://www.starbucks.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Starbucks Corporation?

You can explore historical data from here

What is the all-time high and low for Starbucks Corporation stock?

All-time high: $120.76 (2021-09-10) | All-time low: $68.39 (2022-05-12).

What are the key trends affecting Starbucks Corporation stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

investopedia.com

Starbucks (SBUX) CEO Brian Niccol made $95.8 million in 2024. The average barista made just $14,674.

forbes.com

Let us take a market reading. Both the NVIDIA and Apple monthly price cycles decline through the month of September.

youtube.com

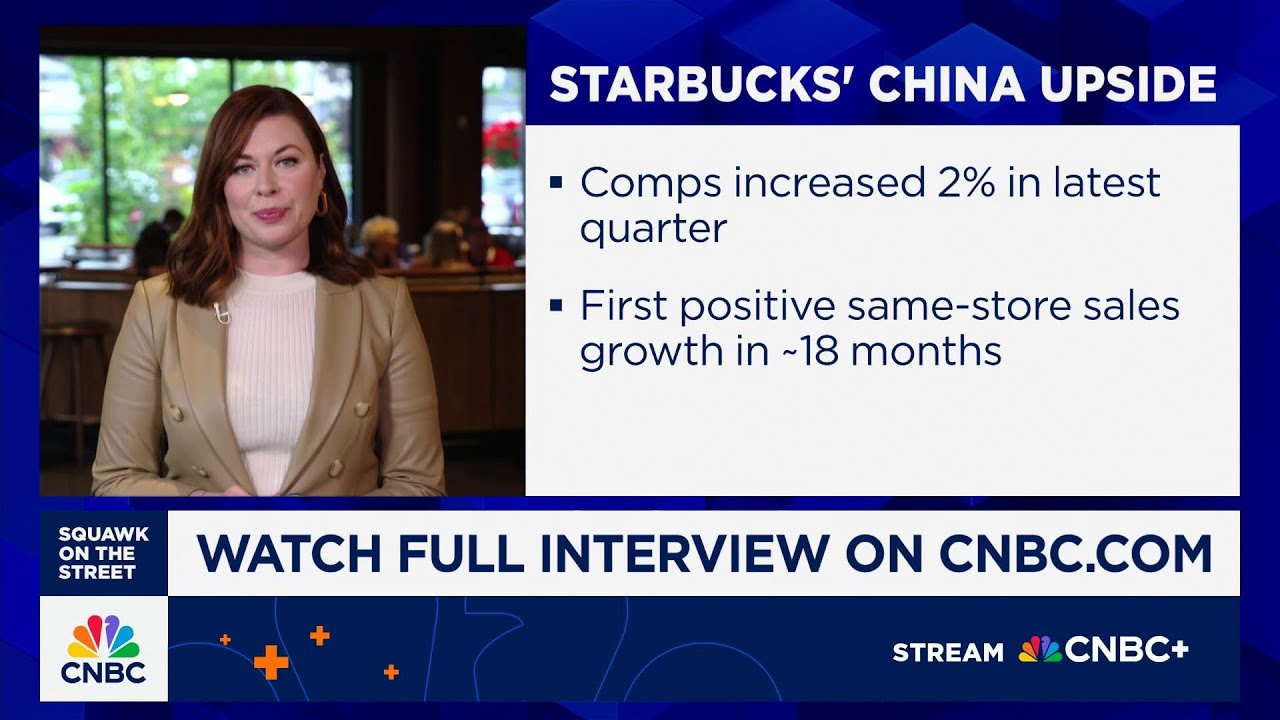

CNBC's Kate Rogers joins 'Squawk on the Street' with details from her interview with Starbucks CEO Brian Niccol.

youtube.com

Starbucks CEO Brian Niccol told CNBC that he is "really excited about the opportunity for growth in China," a market that the coffee giant has struggled in since the pandemic. Since lockdowns have been lifted, local rivals who can undercut the chain on pricing have stolen market share from the U.S. company.

youtube.com

CNBC's Kate Rogers speaks to Starbucks CEO Brian Niccol to discuss the company's turnaround strategy.

cnbc.com

Brian Niccol's turnaround strategy is bringing back some customers, but investors were expecting faster results.

businessinsider.com

Brian Niccol, known for his turnaround campaign at Chipotle, has been CEO of Starbucks for a year. When he took the job last September, he rolled out a plan to turn the coffee giant's business around.

zacks.com

Starbucks (SBUX) concluded the recent trading session at $84.17, signifying a -1.47% move from its prior day's close.

wsj.com

Long before lattes and Frappuccinos blanketed the globe, Gordon Bowker was a 20-something in Seattle who wanted fresh-roasted beans.

cnbc.com

Starbucks is giving 1,000 of its cafes makeovers by the end of 2026. The upgraded locations are meant to encourage customers to stay longer.

See all news