Powell Industries, Inc. (POWL)

$

170.33

-6.39 (-3.75%)

Key metrics

Financial statements

Free cash flow per share

4.0623

Market cap

2.1 Billion

Price to sales ratio

2.0118

Debt to equity

0.0028

Current ratio

1.9208

Income quality

0.3852

Average inventory

87 Million

ROE

0.3548

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

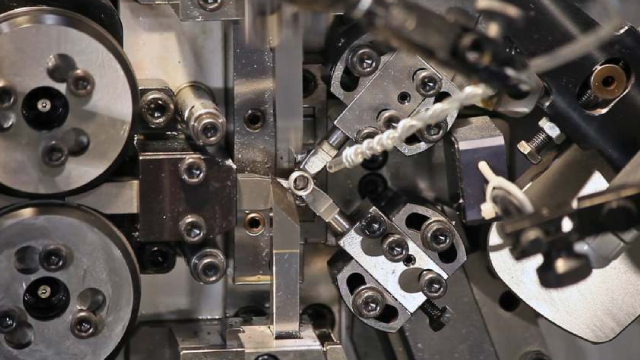

Powell Industries, Inc., along with its subsidiaries, specializes in the design, development, manufacturing, sale, and servicing of custom-engineered equipment and systems for the distribution, control, and monitoring of electrical energy. The company incurred an interest expense of $0.00 reflecting its debt servicing obligations. The cost of revenue for the company is $739,268,000.00 showcasing its production and operational expenses, while the gross profit ratio is 0.27 reflecting the efficiency of the company's production and sales operations. Additionally, the net total of other income and expenses is $17,315,000.00 reflecting non-core financial activities. The company incurred an income tax expense of $46,240,000.00 indicating its tax obligations. Its principal products include integrated power control room substations, custom-engineered modules, electrical houses, medium-voltage circuit breakers, monitoring and control communications systems, motor control centers, and bus duct systems, alongside traditional and arc-resistant distribution switchgears and control gears. Used across various industries such as oil and gas refining, petrochemical, and mining, Powell’s versatile offerings cater to voltage ranges from 480 volts to 38,000 volts. Furthermore, the company provides value-added services including spare parts, field service inspection, installation, commissioning, modification and repair, as well as retrofit components for existing systems. Established in 1947 and headquartered in Houston, Texas, Powell operates in multiple regions including the United States, Canada, and Europe. In the financial sector, the stock is priced at $164.03 positioning it in the higher-end market, while the stock has a low average trading volume of 499,636.00 indicating lower market activity. With a mid-range market capitalization of $2,054,980,351.00 the company is a steady performer that is recognized as a key player in the Electrical Equipment & Parts industry, contributing significantly to the overall market landscape. It belongs to the Industrials sector, driving innovation and growth while ensuring a strong presence in its field. The combination of strategic operations and dedicated service offerings positions Powell Industries favorably within the market, emphasizing its role in electrical energy solutions.

What is Powell Industries, Inc. (POWL)'s stock forecast?

Analysts predict Powell Industries, Inc. stock to fluctuate between $122 (low) and $364.98 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Powell Industries, Inc.'s market capitalization?

As of 2025-04-01, Powell Industries, Inc.'s market cap is $2,054,980,351, based on 12,064,700 outstanding shares.

How does Powell Industries, Inc. compare to competitors like GE Aerospace?

Compared to GE Aerospace, Powell Industries, Inc. has a Lower Market-Cap, indicating a difference in performance.

How can I buy Powell Industries, Inc. (POWL) stock?

To buy Powell Industries, Inc. (POWL) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for POWL. Place an order (Market, Limit, etc.).

What is the best time to invest in Powell Industries, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

How did Powell Industries, Inc. perform in the last earnings report?

Revenue: $1,012,356,000 | EPS: $12.51 | Growth: 172.55%.

Where can I find Powell Industries, Inc.'s investor relations reports?

Visit https://www.powellind.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Powell Industries, Inc.?

You can explore historical data from here

What is the all-time high and low for Powell Industries, Inc. stock?

All-time high: $364.98 (2024-11-11) | All-time low: $18.81 (2022-04-11).

What are the key trends affecting Powell Industries, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

zacks.com

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

zacks.com

Powell Industries is making strides in the electrical equipment and petrochemical markets, which makes the stock worth a watch amid certain challenges.

zacks.com

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

seekingalpha.com

Powell Industries is upgraded to a strong buy due to market overreaction, solid Q1 performance, and a robust financial position with zero debt. Q1 revenues increased by 24.4% y/y, driven by strong demand in Oil & Gas and Electric Utility sectors, despite slight margin contractions. The company's diversification across sectors, strong cash position, and positive outlook for 2025 support long-term growth potential.

globenewswire.com

HOUSTON , March 06, 2025 (GLOBE NEWSWIRE) -- Powell Industries, Inc. (NASDAQ: POWL), a leading supplier of custom engineered solutions for the management, control and distribution of electrical energy, today announced its participation in upcoming investor events.

zacks.com

POWL benefits from strength across its businesses, solid bookings and shareholder-friendly policies. However, rising costs and expenses are concerning.

zacks.com

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

seekingalpha.com

Powell Industries reported a 24.4% year-on-year revenue increase to $241.1 million in Q1 FY25, despite moderated growth in core markets like petrochemicals and oil and gas. Strong order activity across the end markets and benefits from robust backlog and expanded capacity should fuel topline growth in FY25. Anticipated volume growth and benefits from focus on operational improvements are expected to support margins in the quarters ahead.

See all news