NVIDIA Corporation (NVDA)

$

185.61

-5.52 (-2.97%)

Key metrics

Financial statements

Free cash flow per share

3.1785

Market cap

4.7 Trillion

Price to sales ratio

24.8658

Debt to equity

0.0910

Current ratio

4.4676

Income quality

0.8383

Average inventory

17.4 Billion

ROE

1.0382

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

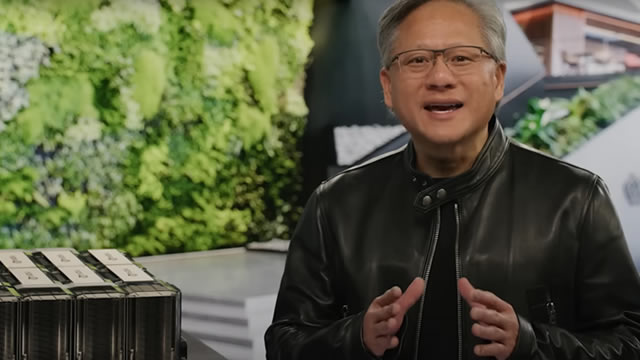

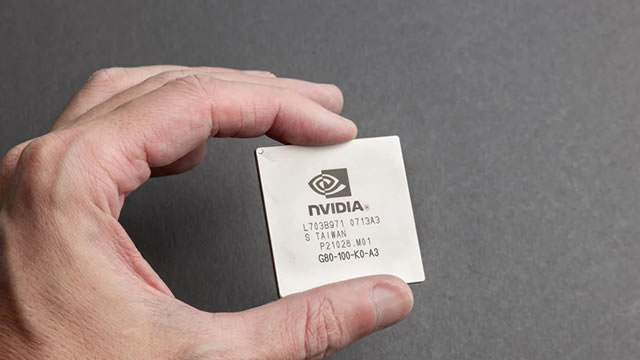

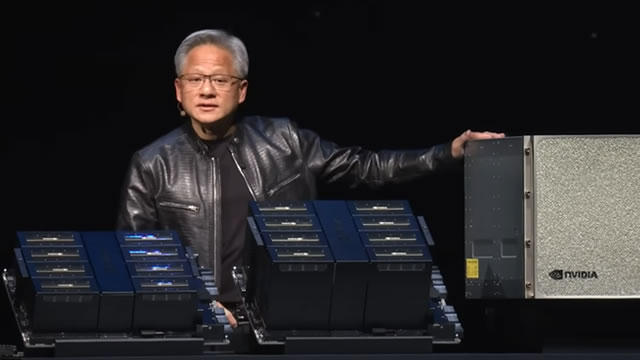

NVIDIA Corporation is a prominent provider of graphics, compute, and networking solutions across the United States, Taiwan, China, and globally. The net income ratio is 0.56 reflecting the company's profitability margin. Additionally, the cost of revenue for the company is $32,639,000,000.00 showcasing its production and operational expenses. The EBITDA ratio is 0.66 highlighting the company's operational efficiency. Furthermore, the net total of other income and expenses is $2,573,000,000.00 reflecting non-core financial activities that influence overall performance. The company reported depreciation and amortization expenses of $1,864,000,000.00 reflecting the wear and tear of its assets as it continually invests in technology and innovation. NVIDIA operates through various segments, including Graphics and Compute & Networking, offering a wide range of products like GeForce GPUs, Quadro/NVIDIA RTX GPUs, and AI-driven solutions tailored for diverse markets such as gaming, professional visualization, datacenter, and automotive sectors. It has established strategic collaborations, such as with Kroger Co., enhancing its reach and effectiveness in various industries. On the financial side, the stock is reasonably priced at $176.67 appealing to a broad range of investors. The stock has a high average trading volume of 181,687,511.00 indicating strong liquidity that allows for flexibility in trading. With a large market capitalization of $4,519,046,951,756.00 the company stands as a dominant player within its field. It is a key player in the Semiconductors industry, contributing significantly to the overall market landscape with innovative products and strategic initiatives. Moreover, it belongs to the Technology sector, driving innovation and growth while meeting the challenges of rapidly evolving technological landscapes. Through its comprehensive solutions and financial performance, NVIDIA remains a pivotal entity in advancing the capabilities of graphics and computing technologies on a global scale.

Is NVIDIA Corporation (NVDA) a good investment?

Investing in NVIDIA Corporation (NVDA) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B+, with a Bearish outlook. Always conduct your own research before investing.

What is NVIDIA Corporation (NVDA)'s stock forecast?

Analysts predict NVIDIA Corporation stock to fluctuate between $86.62 (low) and $212.19 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is NVIDIA Corporation's market capitalization?

As of 2026-02-03, NVIDIA Corporation's market cap is $4,519,046,951,756, based on 24,347,001,518 outstanding shares.

How does NVIDIA Corporation compare to competitors like Alphabet Inc. Class C Capital Stock?

Compared to Alphabet Inc. Class C Capital Stock, NVIDIA Corporation has a Higher Market-Cap, indicating a difference in performance.

Does NVIDIA Corporation pay dividends?

NVIDIA Corporation pays dividends. The current dividend yield is 0.02%, with a payout of $0.01 per share.

How can I buy NVIDIA Corporation (NVDA) stock?

To buy NVIDIA Corporation (NVDA) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for NVDA. Place an order (Market, Limit, etc.).

What is the best time to invest in NVIDIA Corporation?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has NVIDIA Corporation stock ever split?

NVIDIA Corporation's last stock split was 10:1 on 2024-06-10.

How did NVIDIA Corporation perform in the last earnings report?

Revenue: $130,497,000,000 | EPS: $2.97 | Growth: 0%.

Where can I find NVIDIA Corporation's investor relations reports?

Visit https://www.nvidia.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for NVIDIA Corporation?

You can explore historical data from here

What is the all-time high and low for NVIDIA Corporation stock?

All-time high: $212.19 (2025-10-29) | All-time low: $10.81 (2022-10-13).

What are the key trends affecting NVIDIA Corporation stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

reuters.com

Nvidia is nearing a deal to invest $20 billion in OpenAI as part of its latest funding round, Bloomberg News reported citing people familiar with the matter.

cnbc.com

OpenAI and Nvidia, the two companies at the center of the AI boom, have yet to make progress on a $100 billion agreement from September. Since the deal was announced, Nvidia has invested in other AI labs, while OpenAI has forged agreements with rival chipmakers.

youtube.com

Nvidia CEO Jensen Huang said the chipmaker's plan to invest in OpenAI remains "on track" after recent reports suggested brewing tension between the two sides. Tune into the full interview on CNBC's "Mad Money" tonight, Tuesday, Feb. 3 at 6 p.m.

reuters.com

Nvidia -backed British artificial intelligence group Nscale Global Holdings has hired Goldman Sachs and JPMorgan to prepare for an initial public offering, people familiar with the matter said.

reuters.com

Nvidia would consider investing in OpenAI's next fundraising round and also in the startup's eventual IPO, CEO Jensen Huang told CNBC in an interview on Tuesday.

fool.com

Nvidia is the world's top supplier of the data center chips powering the artificial intelligence (AI) revolution. The company will report its latest quarterly operating results on Feb. 25, and they could dictate the direction of its stock from here.

cnbc.com

Nvidia CEO Jensen Huang said the chipmaker's plan to invest in OpenAI remains "on track" in an interview with CNBC's Jim Cramer. "There's no controversy at all.

zacks.com

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

247wallst.com

An exclusive report by Reuters says that OpenAI has partially turned its back on Nvidia Corp.

globenewswire.com

As NVIDIA (NVDA), Alphabet (GOOGL), Palantir (PLTR), Microsoft (MSFT), and Meta Platforms (META) Expand Share Counts to Fund Capital-Intensive AI, ReelTime Media (RLTR) Moves in the Opposite Direction, Strengthening Per-Share Value. As NVIDIA (NVDA), Alphabet (GOOGL), Palantir (PLTR), Microsoft (MSFT), and Meta Platforms (META) Expand Share Counts to Fund Capital-Intensive AI, ReelTime Media (RLTR) Moves in the Opposite Direction, Strengthening Per-Share Value.

See all news