Nordson Corporation (NDSN)

$

211.99

+3.02 (1.42%)

Key metrics

Financial statements

Free cash flow per share

8.1339

Market cap

11.2 Billion

Price to sales ratio

4.1844

Debt to equity

0.7979

Current ratio

2.5328

Income quality

1.2003

Average inventory

474.6 Million

ROE

0.1580

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

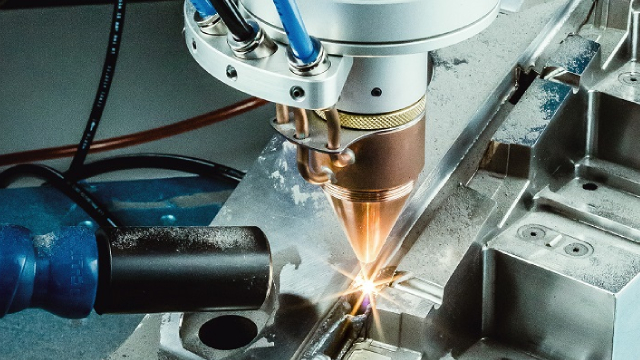

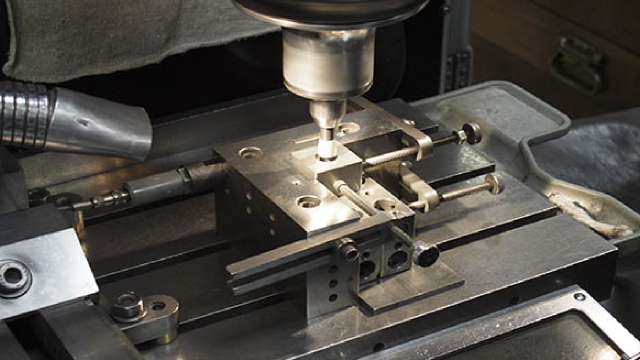

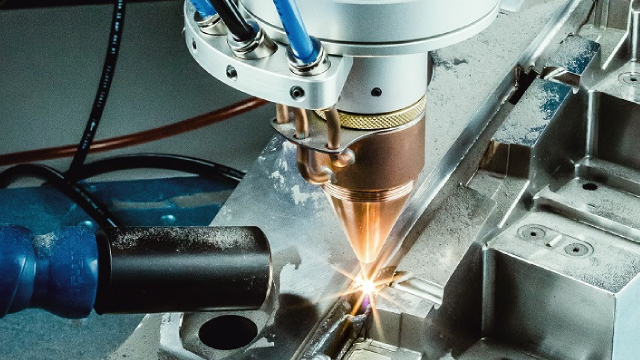

Nordson Corporation engineers, manufactures, and markets a diverse range of products and systems designed to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids on a global scale. The company reported depreciation and amortization expenses of $136,175,000.00 reflecting the wear and tear of its assets. Operating through its two segments, Industrial Precision Solutions (IPS) and Advanced Technology Solutions (ATS), Nordson offers dispensing, coating, and laminating systems for adhesives, lotions, and various liquids, catering to sectors such as disposable products and roll goods. The total costs and expenses for the company are $2,015,920,000.00 reflecting its overall spending. The IPS segment specializes in automated adhesive dispensing for packaged goods industries, thermoplastic melt stream systems, and product assembly for paper and converting applications, as well as for plastic, metal, and wood products. Additionally, it offers a variety of automated and manual dispensing products for adhesives and sealants, along with specialized systems for curing and painting processes. On the other hand, the ATS segment focuses on automated dispensing for fluid applications, gas plasma treatment systems for surface cleaning, and precision dispensers for medical delivery devices. The company incurred an interest expense of $88,924,000.00 reflecting its debt servicing obligations. The EBITDA ratio is $0.30 highlighting the company's operational efficiency. The stock is identified with the symbol '$NDSN' in the market, underscoring its recognition among investors. Currently, the stock is priced at $208.97 positioning it in the higher-end market. Despite this, the stock has a low average trading volume of 381,920.00 indicating lower market activity, which may suggest a more selective investor interest. With a mid-range market capitalization of $12,064,711,283.00 the company is a steady performer in its field. It is a key player in the Industrial - Machinery industry, contributing significantly to the overall market landscape with its innovative solutions. Furthermore, it belongs to the Industrials sector, driving innovation and growth within its areas of expertise, while maintaining a focus on delivering high-quality products and services that meet evolving market needs.

Is Nordson Corporation (NDSN) a good investment?

Investing in Nordson Corporation (NDSN) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B+, with a Bullish outlook. Always conduct your own research before investing.

What is Nordson Corporation (NDSN)'s stock forecast?

Analysts predict Nordson Corporation stock to fluctuate between $165.03 (low) and $266.86 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Nordson Corporation's market capitalization?

As of 2025-05-30, Nordson Corporation's market cap is $12,064,711,283, based on 56,911,700 outstanding shares.

How does Nordson Corporation compare to competitors like GE Aerospace?

Compared to GE Aerospace, Nordson Corporation has a Lower Market-Cap, indicating a difference in performance.

Does Nordson Corporation pay dividends?

Nordson Corporation pays dividends. The current dividend yield is 1.14%, with a payout of $0.78 per share.

How can I buy Nordson Corporation (NDSN) stock?

To buy Nordson Corporation (NDSN) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for NDSN. Place an order (Market, Limit, etc.).

What is the best time to invest in Nordson Corporation?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Nordson Corporation stock ever split?

Nordson Corporation's last stock split was 2:1 on 2011-04-13.

How did Nordson Corporation perform in the last earnings report?

Revenue: $2,689,921,000 | EPS: $8.17 | Growth: -4.33%.

Where can I find Nordson Corporation's investor relations reports?

Visit https://www.nordson.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Nordson Corporation?

You can explore historical data from here

What is the all-time high and low for Nordson Corporation stock?

All-time high: $279.38 (2024-05-10) | All-time low: $165.03 (2025-04-09).

What are the key trends affecting Nordson Corporation stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

fool.com

Dividend King Nordson (NDSN 1.55%) was looking impressively regal on the stock market over the past few days, thanks largely to quarterly results that satisfied investors. With that tailwind at its back, according to data compiled by S&P Global Market Intelligence, the diversified industrial conglomerate's shares finished the week almost 10% higher in price.

seekingalpha.com

Nordson Corporation remains a high-quality business, but current valuation and economic uncertainty make it a Hold despite the 20% stock price decline. Recent results show modest revenue growth, but EPS declined; management's optimistic long-term targets may be hard to achieve given historical growth rates. Tariffs and macro uncertainty pose significant risks, and Nordson has struggled during past recessions, making aggressive growth assumptions questionable.

zacks.com

NDSN's Q2 fiscal 2025 revenues increase 5%, driven by the strong performance of the Advanced Technology Solutions segment.

seekingalpha.com

Nordson Corporation (NASDAQ:NDSN ) Q2 2025 Earnings Conference Call May 29, 2025 8:30 AM ET Company Participants Lara Mahoney - Vice President, Investor Relations and Corporate Communications Sundaram Nagarajan - President and Chief Executive Officer Daniel Hopgood - Executive Vice President and Chief Financial Officer Conference Call Participants Michael Halloran - Baird Andrew Buscaglia - BNP Paribas Saree Boroditsky - Jefferies Christopher Glynn - Oppenheimer Matt Summerville - D.A. Davidson Walter Liptak - Seaport Research Christopher Dankert - Loop Capital Markets Operator Thank you for standing by and welcome to the Nordson Corporation Second Quarter Fiscal Year 2025 Conference Call.

zacks.com

Although the revenue and EPS for Nordson (NDSN) give a sense of how its business performed in the quarter ended April 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

zacks.com

Nordson (NDSN) came out with quarterly earnings of $2.42 per share, beating the Zacks Consensus Estimate of $2.36 per share. This compares to earnings of $2.34 per share a year ago.

businesswire.com

WESTLAKE, Ohio--(BUSINESS WIRE)--Nordson Corporation (Nasdaq: NDSN) today reported results for the fiscal second quarter ended April 30, 2025. Sales were $683 million compared to the prior year's second quarter sales of $651 million. The second quarter 2025 sales included a favorable acquisition impact of 8%, offset by an organic sales decrease of 2% and unfavorable currency translation of less than 1%. Net income was $112 million, or $1.97 of earnings per diluted share, compared to prior year'.

zacks.com

Softness across all segments and rising costs are likely to ail NDSN's second-quarter fiscal 2025 results.

zacks.com

Evaluate the expected performance of Nordson (NDSN) for the quarter ended April 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

businesswire.com

WESTLAKE, Ohio--(BUSINESS WIRE)--Justin Hall promoted to Executive Vice President (EVP) and Medical and Fluid Solutions (MFS) segment leader.

See all news