Micron Technology, Inc. (MU)

$

96.18

-0.20 (-0.21%)

Key metrics

Financial statements

Free cash flow per share

7.0556

Market cap

104.3 Billion

Price to sales ratio

3.3313

Debt to equity

0.3075

Current ratio

3.1343

Income quality

2.7982

Average inventory

8.9 Billion

ROE

0.1011

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

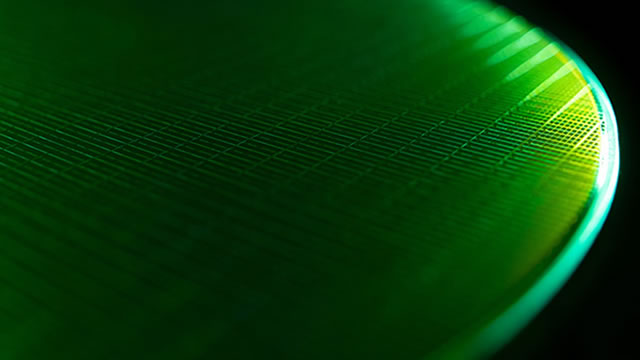

Micron Technology, Inc. designs, manufactures, and sells memory and storage products worldwide, with total costs and expenses amounting to $24,057,000,000.00 reflecting its overall spending. The cost of revenue for the company is $19,498,000,000.00 showcasing its production and operational expenses in providing a diverse portfolio that includes DRAM, NAND, and NOR memory products. The net total of other income and expenses is -$64,000,000.00 reflecting non-core financial activities that impact its financial performance. The net income ratio is 0.03 indicating the company's profitability margin, while the operating expenses amount to $4,309,000,000.00 encompassing various operational costs incurred in the manufacturing and delivery of its innovative memory solutions across multiple markets. Micron operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Storage Business Unit, and Embedded Business Unit, providing memory products for diverse applications such as cloud servers, enterprise solutions, graphics, and mobile devices. The stock is reasonably priced at $96.18 appealing to a broad range of investors, and it features a high average trading volume of 23,708,152.00 indicating strong liquidity in the market. With a large market capitalization of $107,487,882,600.00 the company stands as a dominant player within the Semiconductors industry, significantly contributing to the overall market landscape. Micron belongs to the Technology sector, driving innovation and growth, and positioning itself as a key player in shaping the future of memory and storage technology on a global scale. These attributes reinforce Micron's stability and potential for investors looking to engage with a pivotal entity in the technological arena.

Is Micron Technology, Inc. (MU) a good investment?

Investing in Micron Technology, Inc. (MU) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B, with a Bullish outlook. Always conduct your own research before investing.

What is Micron Technology, Inc. (MU)'s stock forecast?

Analysts predict Micron Technology, Inc. stock to fluctuate between $61.54 (low) and $157.54 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Micron Technology, Inc.'s market capitalization?

As of 2025-05-29, Micron Technology, Inc.'s market cap is $107,487,882,600, based on 1,117,570,000 outstanding shares.

How does Micron Technology, Inc. compare to competitors like Microsoft Corp?

Compared to Microsoft Corp, Micron Technology, Inc. has a Lower Market-Cap, indicating a difference in performance.

Does Micron Technology, Inc. pay dividends?

Micron Technology, Inc. pays dividends. The current dividend yield is 0.53%, with a payout of $0.12 per share.

How can I buy Micron Technology, Inc. (MU) stock?

To buy Micron Technology, Inc. (MU) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for MU. Place an order (Market, Limit, etc.).

What is the best time to invest in Micron Technology, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Micron Technology, Inc. stock ever split?

Micron Technology, Inc.'s last stock split was 2:1 on 2000-05-02.

How did Micron Technology, Inc. perform in the last earnings report?

Revenue: $25,111,000,000 | EPS: $0.70 | Growth: -113.11%.

Where can I find Micron Technology, Inc.'s investor relations reports?

Visit https://www.micron.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Micron Technology, Inc.?

You can explore historical data from here

What is the all-time high and low for Micron Technology, Inc. stock?

All-time high: $157.54 (2024-06-18) | All-time low: $48.43 (2022-12-22).

What are the key trends affecting Micron Technology, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

seekingalpha.com

Micron Technology, Inc. remains a Strong Buy due to robust fundamentals, AI-driven growth, and significant undervaluation with a 38% upside potential. The company is positioned at the forefront of the AI revolution, with aggressive R&D and innovative memory solutions powering major AI smartphones and data centers. Micron's solid balance sheet and financial flexibility support ongoing innovation and growth, while forward P/E ratios indicate further undervaluation.

zacks.com

MU shares are up 23% in a month on AI and trade relief. Solid growth ahead, but margin concerns lead to a hold recommendation.

fool.com

Shares of Micron Technology (MU -1.43%) have been on fire in the past month, jumping an incredible 43% as of this writing thanks to the broader recovery in tech stocks amid signs that the tariff-fueled global trade war could be cooling down.

fool.com

Micron Technology (MU -2.13%) stock investors are happy to see the company's excellent start in 2025.

globenewswire.com

BOISE, Idaho, May 21, 2025 (GLOBE NEWSWIRE) -- Micron Technology, Inc. (Nasdaq: MU) announced today that it will hold its fiscal third quarter earnings conference call on Wednesday, June 25, 2025, at 2:30 p.m. Mountain time.

zacks.com

In the most recent trading session, Micron (MU) closed at $95.45, indicating a +0.14% shift from the previous trading day.

zacks.com

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.

zacks.com

In the closing of the recent trading day, Micron (MU) stood at $85.86, denoting a +0.83% change from the preceding trading day.

zacks.com

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

seekingalpha.com

I initially rated Micron Technology as “Hold” due to near-term challenges. Now I upgraded it to “Buy”, anticipating growth from Apple's iPhone 17 DRAM incorporation (September). Micron's Q2 FY2025 results showed strong sales and EPS, driven by HBM and DRAM segments, despite NAND segment pressures on gross profit margins. AI and non-AI demand, particularly from data centers and the upcoming iPhone 17, are expected to drive significant DRAM revenue growth, supporting a 51% upside potential for the stock price.

See all news