MSC Industrial Direct Co., Inc. (MSM)

$

91.66

+0.96 (1.05%)

Key metrics

Financial statements

Free cash flow per share

4.7323

Market cap

5.1 Billion

Price to sales ratio

1.3632

Debt to equity

0.4213

Current ratio

1.9196

Income quality

1.8437

Average inventory

647.2 Million

ROE

0.1446

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

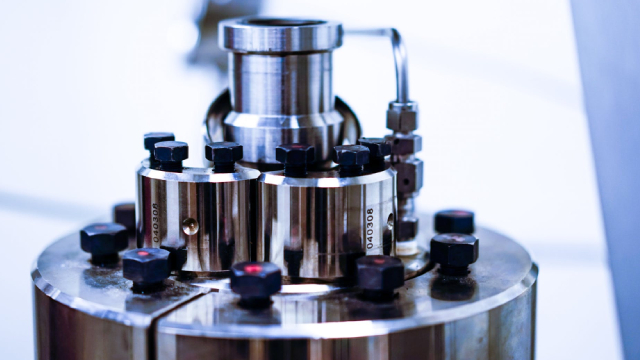

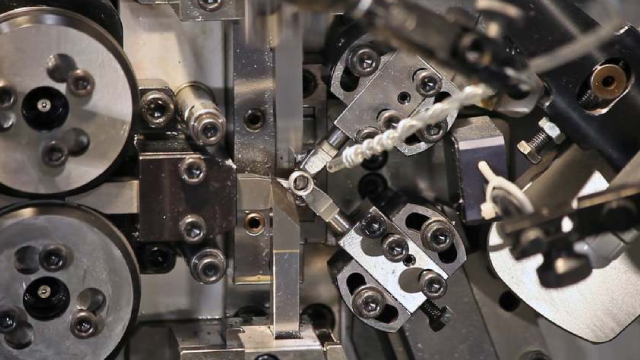

MSC Industrial Direct Co., Inc., along with its subsidiaries, is actively engaged in the distribution of metalworking and maintenance, repair, and operations (MRO) products and services across the United States, Canada, Mexico, and the United Kingdom. The operating income ratio is 0.10 indicating the company's operational profitability margin. Its diverse MRO product offerings encompass cutting tools, measuring instruments, tooling components, metalworking items, fasteners, flat stock products, raw materials, abrasives, hand and power tools, safety and janitorial supplies, plumbing supplies, materials handling products, power transmission components, and electrical supplies. With a robust catalog of approximately 1.9 million stock-keeping units available through multiple channels, including its e-commerce platform at mscdirect.com, inventory management solutions, and a network of call centers and branches, the company demonstrates significant reach. The weighted average number of shares outstanding is 56,257,000.00 highlighting the company's shareholder base, while the diluted EPS is $4.58 accounting for potential share dilution. The income before tax ratio is 0.09 reflecting the pre-tax margin, further supporting the organization’s financial standing. The financial data pertains to the fiscal year 2024. Operating from a distribution framework that comprises 28 branch offices, 11 customer fulfillment centers, and seven regional inventory centers, MSC Industrial Direct serves a broad spectrum of clients, including individual machine shops, Fortune 1000 manufacturing firms, and government agencies, alongside manufacturers of varying sizes. Founded in 1941, the company is headquartered in Melville, New York. As an established entity in the market, the stock is reasonably priced at $91.66 appealing to a broad range of investors. This investment option features an average trading volume of 566,610.00 indicating moderate liquidity, making it attractive for potential shareholders. With a mid-range market capitalization of $5,103,243,828.00 the company is a steady performer in the market. It is a key player in the Industrial - Distribution industry, contributing significantly to the overall market landscape. Furthermore, it belongs to the Industrials sector, driving innovation and growth, thus positioning itself as a vital component in fostering advancements within the industry.

Is MSC Industrial Direct Co., Inc. (MSM) a good investment?

Investing in MSC Industrial Direct Co., Inc. (MSM) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B+, with a Bullish outlook. Always conduct your own research before investing.

What is MSC Industrial Direct Co., Inc. (MSM)'s stock forecast?

Analysts predict MSC Industrial Direct Co., Inc. stock to fluctuate between $68.10 (low) and $92.68 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is MSC Industrial Direct Co., Inc.'s market capitalization?

As of 2025-07-10, MSC Industrial Direct Co., Inc.'s market cap is $5,103,243,828, based on 55,675,800 outstanding shares.

How does MSC Industrial Direct Co., Inc. compare to competitors like GE Aerospace?

Compared to GE Aerospace, MSC Industrial Direct Co., Inc. has a Lower Market-Cap, indicating a difference in performance.

Does MSC Industrial Direct Co., Inc. pay dividends?

MSC Industrial Direct Co., Inc. pays dividends. The current dividend yield is 4.66%, with a payout of $0.85 per share.

How can I buy MSC Industrial Direct Co., Inc. (MSM) stock?

To buy MSC Industrial Direct Co., Inc. (MSM) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for MSM. Place an order (Market, Limit, etc.).

What is the best time to invest in MSC Industrial Direct Co., Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has MSC Industrial Direct Co., Inc. stock ever split?

MSC Industrial Direct Co., Inc.'s last stock split was 2:1 on 1998-05-26.

How did MSC Industrial Direct Co., Inc. perform in the last earnings report?

Revenue: $3,820,951,000 | EPS: $4.60 | Growth: -25.08%.

Where can I find MSC Industrial Direct Co., Inc.'s investor relations reports?

Visit https://www.mscdirect.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for MSC Industrial Direct Co., Inc.?

You can explore historical data from here

What is the all-time high and low for MSC Industrial Direct Co., Inc. stock?

All-time high: $105.77 (2023-10-17) | All-time low: $68.10 (2025-04-07).

What are the key trends affecting MSC Industrial Direct Co., Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

zacks.com

Does MSC Industrial (MSM) have what it takes to be a top stock pick for momentum investors? Let's find out.

zacks.com

After reaching an important support level, MSC Industrial Direct Company, Inc. (MSM) could be a good stock pick from a technical perspective. MSM recently experienced a "golden cross" event, which saw its 50-day simple moving average breaking out above its 200-day simple moving average.

zacks.com

While the top- and bottom-line numbers for MSC Industrial (MSM) give a sense of how the business performed in the quarter ended May 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

seekingalpha.com

MSC Industrial Direct Co., Inc. (NYSE:MSM ) Q3 2025 Earnings Conference Call July 1, 2025 8:30 AM ET Company Participants Erik David Gershwind - CEO & Director Kristen Actis-Grande - Executive VP & CFO Martina McIsaac - President & COO Ryan Thomas Mills - Head of Investor Relations Conference Call Participants Christopher M. Dankert - Loop Capital Markets LLC, Research Division David John Manthey - Robert W.

zacks.com

MSC Industrial (MSM) came out with quarterly earnings of $1.08 per share, beating the Zacks Consensus Estimate of $1.03 per share. This compares to earnings of $1.33 per share a year ago.

zacks.com

MSC Industrial (MSM) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

zacks.com

MSC Industrial (MSM) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

zacks.com

The headline numbers for MSC Industrial (MSM) give insight into how the company performed in the quarter ended February 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

zacks.com

MSC Industrial (MSM) came out with quarterly earnings of $0.72 per share, beating the Zacks Consensus Estimate of $0.68 per share. This compares to earnings of $1.18 per share a year ago.

zacks.com

MSC Industrial (MSM) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

See all news