Monolithic Power Systems, Inc. (MPWR)

$

1124.15

-59.00 (-5.25%)

Key metrics

Financial statements

Free cash flow per share

14.7223

Market cap

53.9 Billion

Price to sales ratio

20.2387

Debt to equity

0.0042

Current ratio

4.7713

Income quality

0.4754

Average inventory

498.2 Million

ROE

0.5664

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

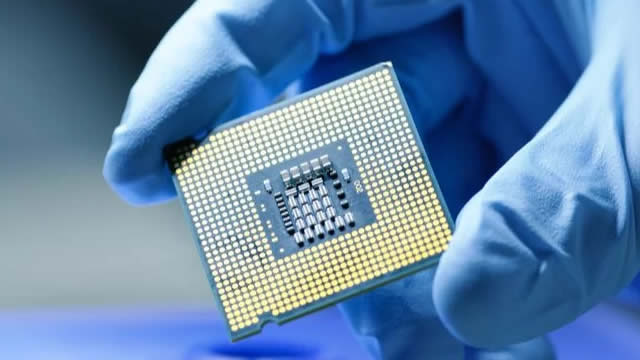

Monolithic Power Systems, Inc. engages in the design, development, marketing, and sale of semiconductor-based power electronics solutions across various sectors, including computing and storage, automotive, industrial, communications, and consumer markets. The company earned an interest income of $27,093,000.00 showcasing its financial investments. The financial data pertains to the fiscal year 2024 reflecting its operational performance during that period. The income before tax ratio is 0.26 indicating the company's pre-tax margin. Additionally, the earnings per share (EPS) is reported at $36.76 which signifies the company's profitability on a per-share basis. The net total of other income and expenses is $33,554,000.00 reflecting non-core financial activities and providing further insight into the company's financial health. In its product offerings, Monolithic Power Systems provides direct current (DC) to DC integrated circuits (ICs) designed to convert and control voltages for a variety of electronic systems, such as portable devices, wireless LAN access points, computers, notebooks, monitors, infotainment applications, and medical equipment. Furthermore, the company offers lighting control ICs that cater to backlighting systems for LCD panels in multiple applications, including notebook computers, monitors, car navigation systems, and televisions. The stock is priced at $916.36 positioning it in the higher-end market. It has an average trading volume of 671,350.00 indicating moderate liquidity in the marketplace. With a mid-range market capitalization of $53,854,654,050.00 the company is considered a steady performer in the sector. It is a key player in the Semiconductors industry, contributing significantly to the overall market landscape. Monolithic Power Systems, Inc. belongs to the Technology sector, driving innovation and growth while providing solutions through a comprehensive network of third-party distributors, value-added resellers, and direct sales to original equipment manufacturers, original design manufacturers, and electronic manufacturing service providers across regions, including China, Taiwan, Europe, South Korea, Southeast Asia, Japan, the United States, and internationally.

Is Monolithic Power Systems, Inc. (MPWR) a good investment?

Investing in Monolithic Power Systems, Inc. (MPWR) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as A-, with a Bullish outlook. Always conduct your own research before investing.

What is Monolithic Power Systems, Inc. (MPWR)'s stock forecast?

Analysts predict Monolithic Power Systems, Inc. stock to fluctuate between $438.86 (low) and $1,188.66 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Monolithic Power Systems, Inc.'s market capitalization?

As of 2026-01-30, Monolithic Power Systems, Inc.'s market cap is $53,854,654,050, based on 47,907,000 outstanding shares.

How does Monolithic Power Systems, Inc. compare to competitors like Nvidia Corp?

Compared to Nvidia Corp, Monolithic Power Systems, Inc. has a Lower Market-Cap, indicating a difference in performance.

Does Monolithic Power Systems, Inc. pay dividends?

Monolithic Power Systems, Inc. pays dividends. The current dividend yield is 0.69%, with a payout of $1.56 per share.

How can I buy Monolithic Power Systems, Inc. (MPWR) stock?

To buy Monolithic Power Systems, Inc. (MPWR) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for MPWR. Place an order (Market, Limit, etc.).

What is the best time to invest in Monolithic Power Systems, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

How did Monolithic Power Systems, Inc. perform in the last earnings report?

Revenue: $2,207,100,000 | EPS: $36.76 | Growth: 309.35%.

Where can I find Monolithic Power Systems, Inc.'s investor relations reports?

Visit https://www.monolithicpower.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Monolithic Power Systems, Inc.?

You can explore historical data from here

What is the all-time high and low for Monolithic Power Systems, Inc. stock?

All-time high: $1,188.66 (2026-01-30) | All-time low: $301.69 (2022-10-13).

What are the key trends affecting Monolithic Power Systems, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

zacks.com

MPWR heads into Q4 earnings with revenues expected to jump on strength across Enterprise Data, automotive, storage and computing verticals.

zacks.com

Here is how Monolithic Power (MPWR) and FormFactor (FORM) have performed compared to their sector so far this year.

seekingalpha.com

Monolithic Power Systems trades at a 67 EBITDA multiple, far exceeding its sector median that trades at 19. This premium valuation is well deserved. The firm is significantly growing its topline, with growth coming from a tailwind of increasing demand for more compute, manufacturing automation, and the electrification of automotives. This topline growth is being passed through to the bottom line, enabling the company to earn cash for every increment in revenue growth.

zacks.com

Here is how Monolithic Power (MPWR) and Advanced Energy Industries (AEIS) have performed compared to their sector so far this year.

zacks.com

Monolithic (MPWR) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

globenewswire.com

Schaffhausen, Switzerland, Dec. 12, 2025 (GLOBE NEWSWIRE) -- Monolithic Power Systems, Inc. (Nasdaq: MPWR), a global company that provides high-performance, semiconductor-based power electronics solutions, announced today its fourth quarter dividend of $1.56 per share of common stock to all stockholders of record as of the close of business on December 31, 2025. The dividend will be paid on January 15, 2026.

benzinga.com

Monolithic Power Systems (NASDAQ:MPWR) experienced a significant Power Inflow alert, a key bullish indicator that is closely tracked by traders who value order flow analytics, specifically institutional and retail order flow data.At 10:05 AM EST on October 31, MPWR triggered a Power Inflow signal at a price of $948.32. MPWR had seen a very steep decrease in the stock price leading up to the Power Inflow alert, dropping by as much as 6% in the opening hour of trading.

fool.com

Monolithic Power Systems reported better-than-expected Q3 sales and earnings. The company's gross margin saw a modest decline last quarter.

benzinga.com

Monolithic Power Systems (NASDAQ:MPWR) experienced a significant Power Inflow alert, a key bullish indicator that is closely tracked by traders who value order flow analytics, specifically institutional and retail order flow data.At 10:05 AM EST on October 31, MPWR triggered a Power Inflow signal at a price of $948.32. MPWR had seen a very steep decrease in the stock price leading up to the Power Inflow alert, dropping by as much as 6% in the opening hour of trading.

seekingalpha.com

Monolithic Power Systems, Inc. ( MPWR ) Q3 2025 Earnings Call October 30, 2025 5:00 PM EDT Company Participants Arthur Lee Bernie Blegen - Executive VP & CFO Michael R. Hsing - Founder, Chairman, President & CEO Tony Balow Conference Call Participants Joshua Buchalter - TD Cowen, Research Division Ross Seymore - Deutsche Bank AG, Research Division Joseph Quatrochi - Wells Fargo Securities, LLC, Research Division Quinn Bolton - Needham & Company, LLC, Research Division Tore Svanberg - Stifel, Nicolaus & Company, Incorporated, Research Division Richard Schafer - Oppenheimer & Co. Inc., Research Division Gary Mobley - Loop Capital Markets LLC, Research Division Christopher Caso - Wolfe Research, LLC Wei Chia - Citigroup Inc., Research Division Jack Egan - Charter Equity Research Presentation Arthur Lee Welcome, everyone, to the MPS Third Quarter 2025 Earnings Webinar.

See all news