Lincoln Electric Holdings, Inc. (LECO)

$

223.47

+2.99 (1.34%)

Key metrics

Financial statements

Free cash flow per share

9.4848

Market cap

12.5 Billion

Price to sales ratio

3.0946

Debt to equity

0.9402

Current ratio

1.7834

Income quality

1.4124

Average inventory

559.2 Million

ROE

0.3468

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

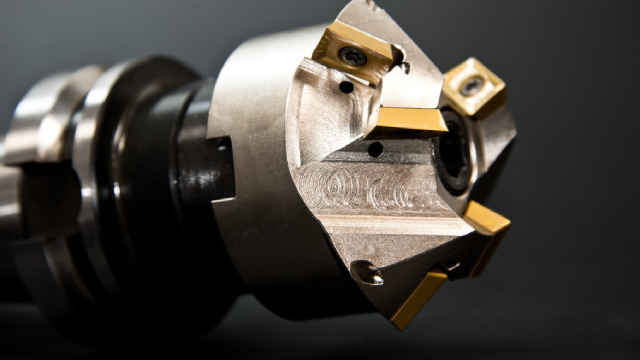

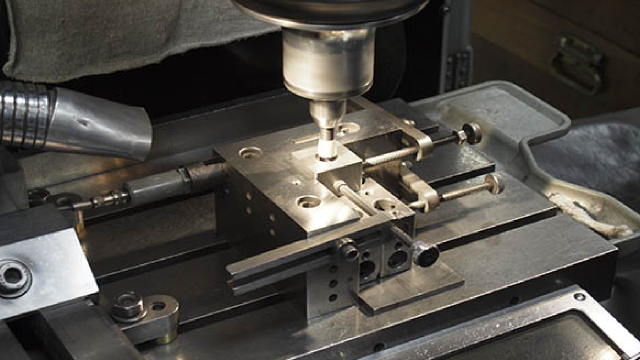

Lincoln Electric Holdings, Inc., through its subsidiaries, is engaged in the design, development, manufacturing, and worldwide sale of welding, cutting, and brazing products. The company operates across three segments: Americas Welding, International Welding, and The Harris Products Group. Its extensive product range includes arc welding power sources, plasma cutters, wire feeding systems, robotic welding packages, integrated automation systems, fume extraction equipment, consumable electrodes, fluxes, and welding accessories, alongside specialty welding consumables and fabrication products. The company also offers computer numeric controlled plasma and oxy-fuel cutting systems as well as regulators and torches for oxy-fuel welding, cutting, and brazing, and consumables for the brazing and soldering alloys market. Additionally, Lincoln Electric has retail operations in the United States and manufactures copper and aluminum headers, distributor assemblies, and manifolds specifically for the heating, ventilation, and air conditioning sector in both the United States and Mexico. The company serves a diverse range of industries, including general fabrication, energy and process, automotive and transportation, construction and infrastructure, as well as heavy fabrication, shipbuilding, and maintenance and repair markets. It markets its products directly to end users, as well as through industrial distributors, retailers, and agents. The EBITDA ratio is 0.18 highlighting the company's operational efficiency. The company recorded a net income of $466,108,000.00 reflecting its profitability. The weighted average number of shares outstanding is 56,639,000.00 showcasing the company's shareholder base. The gross profit ratio is 0.37 indicative of the efficiency of the company's production and sales operations. Moreover, the company reported depreciation and amortization expenses of $88,238,000.00 reflecting the wear and tear of its assets. In the market, the stock is reasonably priced at $223.47 appealing to a broad range of investors. However, it has a low average trading volume of 382,881.00 indicating lower market activity. With a mid-range market capitalization of $12,475,503,261.00 the company is recognized as a steady performer. It stands as a key player in the Manufacturing - Tools & Accessories industry, contributing significantly to the overall market landscape. Furthermore, it belongs to the Industrials sector, driving innovation and growth within its field.

Is Lincoln Electric Holdings, Inc. (LECO) a good investment?

Investing in Lincoln Electric Holdings, Inc. (LECO) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B, with a Bullish outlook. Always conduct your own research before investing.

What is Lincoln Electric Holdings, Inc. (LECO)'s stock forecast?

Analysts predict Lincoln Electric Holdings, Inc. stock to fluctuate between $161.11 (low) and $225.25 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Lincoln Electric Holdings, Inc.'s market capitalization?

As of 2025-07-10, Lincoln Electric Holdings, Inc.'s market cap is $12,475,503,261, based on 55,826,300 outstanding shares.

How does Lincoln Electric Holdings, Inc. compare to competitors like GE Aerospace?

Compared to GE Aerospace, Lincoln Electric Holdings, Inc. has a Lower Market-Cap, indicating a difference in performance.

Does Lincoln Electric Holdings, Inc. pay dividends?

Lincoln Electric Holdings, Inc. pays dividends. The current dividend yield is 1.43%, with a payout of $0.75 per share.

How can I buy Lincoln Electric Holdings, Inc. (LECO) stock?

To buy Lincoln Electric Holdings, Inc. (LECO) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for LECO. Place an order (Market, Limit, etc.).

What is the best time to invest in Lincoln Electric Holdings, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Lincoln Electric Holdings, Inc. stock ever split?

Lincoln Electric Holdings, Inc.'s last stock split was 2:1 on 2011-06-01.

How did Lincoln Electric Holdings, Inc. perform in the last earnings report?

Revenue: $4,008,670,000 | EPS: $8.23 | Growth: -13.46%.

Where can I find Lincoln Electric Holdings, Inc.'s investor relations reports?

Visit https://www.lincolnelectric.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Lincoln Electric Holdings, Inc.?

You can explore historical data from here

What is the all-time high and low for Lincoln Electric Holdings, Inc. stock?

All-time high: $261.13 (2024-03-21) | All-time low: $110.52 (2021-02-12).

What are the key trends affecting Lincoln Electric Holdings, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

businesswire.com

CLEVELAND--(BUSINESS WIRE)-- #LEA--Lincoln Electric Holdings, Inc., (the “Company”) (Nasdaq: LECO) announced today that it will release its second quarter 2025 results on Thursday, July 31, 2025, prior to market open. An investor conference call and webcast will take place at 10:00 a.m. (ET) later that day. The event is available via webcast in listen-only mode and can be accessed here or on the Company's Investor Relations home page at https://ir.lincolnelectric.com. To participate via telephone, ple.

seekingalpha.com

Lincoln Electric, a US-based global manufacturer of welding products, is now a $10 billion (by market cap) welding products leader. LECO increased its dividend for 30 consecutive years, with a 10-year dividend growth rate of 11.9%. The company moved its revenue from $2.5 billion in FY 2015 to $4.0 billion in FY 2024, a compound annual growth rate of 5.4%.

fool.com

Lincoln Electric (LECO -4.36%) investors were hoping Wednesday that their company's first quarterly earnings report of 2025 wouldn't be indicative of how the rest of the year would go. The welding-products maker missed on the consensus analyst profitability estimate, and the market punished it by sending its stock to a more than 4% loss in price.

zacks.com

The headline numbers for Lincoln Electric (LECO) give insight into how the company performed in the quarter ended March 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

zacks.com

Lincoln Electric Holdings (LECO) came out with quarterly earnings of $2.16 per share, missing the Zacks Consensus Estimate of $2.22 per share. This compares to earnings of $2.23 per share a year ago.

businesswire.com

CLEVELAND--(BUSINESS WIRE)-- #LEA--Lincoln Electric Holdings, Inc. (the “Company”) (Nasdaq: LECO) today reported first quarter 2025 net income of $118.5 million, or diluted earnings per share (EPS) of $2.10, which included special item after-tax net charges of $3.4 million, or $0.06 EPS. This compares with prior year period net income of $123.4 million, or $2.14 EPS, which included special item after-tax net charges of $5.2 million, or $0.09 EPS. Excluding special items, first quarter 2025 adjusted ne.

businesswire.com

CLEVELAND--(BUSINESS WIRE)-- #LEA--Lincoln Electric Holdings, Inc., (Nasdaq: LECO) announced today that its Board of Directors has declared a quarterly cash dividend of $0.75 per common share, payable July 15, 2025, to shareholders of record as of June 30, 2025. Business Lincoln Electric is the world leader in the engineering, design, and manufacturing of advanced arc welding solutions, automated joining, assembly and cutting systems, plasma and oxy-fuel cutting equipment, and has a leading global pos.

zacks.com

Lincoln Electric (LECO) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

fool.com

Explore the exciting world of Lincoln Electric (LECO 2.31%) with our expert analysts in this Motley Fool Scoreboard episode. Check out the video below to gain valuable insights into market trends and potential investment opportunities!

businesswire.com

CLEVELAND--(BUSINESS WIRE)-- #LEA--Lincoln Electric Holdings, Inc., (the “Company”) (Nasdaq: LECO) announced today that it will release its first quarter 2025 results on Wednesday, April 30, 2025, prior to market open. An investor conference call and webcast will take place at 10:00 a.m. (ET) later that day. The event is available via webcast in listen-only mode and can be accessed here or on the Company's Investor Relations home page at https://ir.lincolnelectric.com. To participate via telephone, pl.

See all news