The Kroger Co. (KR)

$

71.25

+1.11 (1.56%)

Key metrics

Financial statements

Free cash flow per share

3.4321

Market cap

47.2 Billion

Price to sales ratio

0.3207

Debt to equity

3.5784

Current ratio

0.8777

Income quality

7.6275

Average inventory

7.3 Billion

ROE

0.0941

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

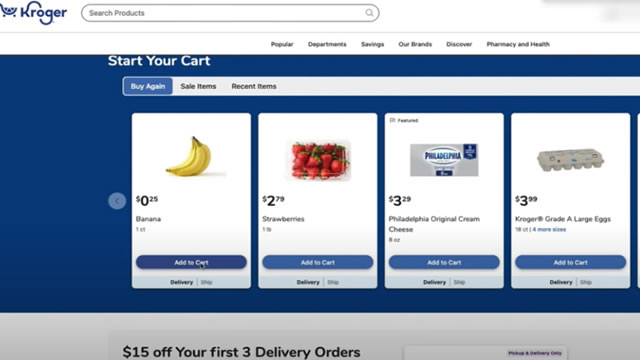

The Kroger Co. operates as a prominent retailer in the United States, managing a diverse array of store formats, including combination food and drug stores, multi-department stores, marketplace stores, and price impact warehouses. The operating income ratio is 0.03 indicating the company's operational profitability margin. Additionally, the gross profit stands at $33,403,000,000.00 highlighting the company's profitability from core operations. With a significant net income of $2,665,000,000.00 the company showcases its strong financial health. The income tax expense incurred by the company is $670,000,000.00 indicating its tax obligations, while the EBITDA is $7,641,000,000.00 a key indicator of the company's operational profitability. Kroger's combination stores feature a variety of offerings, including natural and organic food sections, pharmacies, general merchandise, and fresh produce. Multi-department stores provide a wide range of products such as apparel, home furnishings, electronic items, and toys. Its marketplace stores extend the grocery shopping experience with full-service grocery, pharmacy, and health and beauty care, alongside general merchandise. The price impact warehouse stores focus on grocery and health items, supplying essential categories like meat, dairy, baked goods, and fresh produce. Furthermore, Kroger manufactures and processes food products for its supermarkets and online sales and operates 1,613 fuel centers throughout the nation. As of January 29, 2022, the company ran 2,726 supermarkets under various banners across 35 states and the District of Columbia, a testament to its expansive reach since its establishment in 1883 in Cincinnati, Ohio. In addition to its operational achievements, Kroger's stock has garnered attention as it is reasonably priced at $65.58 appealing to a broad range of investors. The stock has a high average trading volume of 6,926,606.00 indicating strong liquidity in the market. With a mid-range market capitalization of $47,215,820,753.00 the company is recognized as a steady performer. It is a key player in the Grocery Stores industry, contributing significantly to the overall market landscape. Moreover, it belongs to the Consumer Defensive sector, driving innovation and growth within the retail space. Through its comprehensive offerings and financial performance, Kroger continues to play a vital role in meeting consumer needs while maintaining strong operational standards.

Is The Kroger Co. (KR) a good investment?

Investing in The Kroger Co. (KR) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as C, with a Bullish outlook. Always conduct your own research before investing.

What is The Kroger Co. (KR)'s stock forecast?

Analysts predict The Kroger Co. stock to fluctuate between $58.60 (low) and $74.90 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is The Kroger Co.'s market capitalization?

As of 2026-02-13, The Kroger Co.'s market cap is $47,215,820,753, based on 662,678,186 outstanding shares.

How does The Kroger Co. compare to competitors like WAL-MART STORES INC?

Compared to WAL-MART STORES INC, The Kroger Co. has a Lower Market-Cap, indicating a difference in performance.

Does The Kroger Co. pay dividends?

The Kroger Co. pays dividends. The current dividend yield is 1.92%, with a payout of $0.35 per share.

How can I buy The Kroger Co. (KR) stock?

To buy The Kroger Co. (KR) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for KR. Place an order (Market, Limit, etc.).

What is the best time to invest in The Kroger Co.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has The Kroger Co. stock ever split?

The Kroger Co.'s last stock split was 2:1 on 2015-07-14.

How did The Kroger Co. perform in the last earnings report?

Revenue: $147,123,000,000 | EPS: $3.70 | Growth: 23.75%.

Where can I find The Kroger Co.'s investor relations reports?

Visit https://www.thekrogerco.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for The Kroger Co.?

You can explore historical data from here

What is the all-time high and low for The Kroger Co. stock?

All-time high: $74.90 (2025-08-11) | All-time low: $38.22 (2021-10-18).

What are the key trends affecting The Kroger Co. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

marketbeat.com

The retail grocery sector woke up to a new reality this week. On Feb. 9, 2026, Kroger Co. NYSE: KR announced the immediate appointment of Greg Foran as its new Chief Executive Officer, a high-profile move that instantly reshuffled investor expectations.

seekingalpha.com

The Kroger Co. rallied on the new CEO appointment, leveraging Walmart experience to accelerate digital transformation and strategic growth. KR reaffirmed 2025 guidance, projecting EPS of $4.75–$4.80 and identical sales growth of 2.8%–3.0%, underscoring operational resilience. Despite mixed Q3 results and macro headwinds, KR maintains robust margins and announces a $2B buyback, supporting long-term value.

investopedia.com

Kroger is locked in a battle with Walmart in the grocery business. Now it's bringing in a CEO trained at the retail giant to help it compete.

proactiveinvestors.com

Kroger Co (NYSE:KR, XETRA:KOG) shares added more than 6% on Monday morning following the grocery chain's announcement that Greg Foran has been named as its new CEO. Foran succeeds Ron Sargent, who had served as interim CEO since March 2025, and will also join Kroger's Board of Directors.

pymnts.com

Grocery giant Kroger named former Walmart executive Greg Foran as its new CEO. Foran took the job Monday (Feb. 9) and succeeds Ron Sargent, who had been acting as the company's interim CEO since March, Kroger said in a Monday news release.

schaeffersresearch.com

Shares of Kroger Co (NYSE:KR) are up 7.7% to trade at $72.67 at last glance, after reports that the grocery chain named former Walmart (WMT) executive Greg Foran as its CEO.

marketwatch.com

Kroger's stock rallies after the grocer named Greg Foran, the former leader of Walmart U.S. as its new CEO after a nearly yearlong search.

prnewswire.com

Accomplished Food Retail Leader Brings Strong Experience as Company Advances Its Growth Strategy Ron Sargent Continues as Chairman of Kroger's Board of Directors CINCINNATI, Feb. 9, 2026 /PRNewswire/ -- The Kroger Co. (NYSE: KR) today announced its Board of Directors appointed Greg Foran as Chief Executive Officer, effective immediately. Foran will also join Kroger's Board of Directors and succeeds Ron Sargent, who served as interim CEO since March 2025.

barrons.com

Kroger plans to appoint former Walmart executive Greg Foran as its new CEO, The Wall Street Journal reported on Sunday.

nypost.com

The US grocer has been searching for a permanent CEO after the company ousted Rodney McMullen last year in the wake of a board investigation that found that his personal conduct was "inconsistent" with certain company policies.

See all news