JPMorgan Chase & Co. (JPM)

$

322.4

+12.24 (3.80%)

Key metrics

Financial statements

Free cash flow per share

-42.9404

Market cap

844.3 Billion

Price to sales ratio

3.0119

Debt to equity

1.3795

Current ratio

14.8533

Income quality

-2.0636

Average inventory

0

ROE

0.1595

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

JPMorgan Chase & Co. is a global financial services company that operates through four primary segments: Consumer & Community Banking (CCB), Corporate & Investment Bank (CIB), Commercial Banking (CB), and Asset & Wealth Management (AWM). The financial data pertains to the fiscal year 2025. Within the CCB segment, the company provides a variety of products and services, including deposits, investments, and loans tailored for consumers, along with lending, deposit management, and payment solutions for small businesses. The CIB segment delivers a comprehensive suite of investment banking services such as corporate strategy advisors, capital-raising activities in equity and debt markets, and loan origination. The gross profit ratio is 0.60 reflecting the efficiency of the company's production and sales operations. Furthermore, the net total of other income and expenses is $0.00 representing the outcomes of non-core financial activities. The operational strength is evidenced by an operating income of $72,595,000,000.00 reflecting the company's earnings from its core operations. Additionally, the company reported an income before tax of $72,595,000,000.00 showcasing its pre-tax profitability. In the CB segment, JPMorgan Chase offers diverse financial solutions including lending and asset management for small to large businesses, local governments, and nonprofits. They also cater to the commercial real estate sector, providing services to investors and developers across various property types. The AWM division focuses on multi-asset investment management solutions and offers a comprehensive range of financial services including brokerage and retirement products. Moreover, the stock is priced at $314.78 positioning it in the higher-end market with a significant presence. With a large market capitalization of $877,657,289,434.00 the company is a dominant player in the financial services landscape. The stock has a high average trading volume of 10,180,726.00 indicating strong liquidity, which is essential for investors. It is a key player in the Banks - Diversified industry, contributing significantly to the overall market landscape. Additionally, it belongs to the Financial Services sector, driving innovation and growth within the industry. Through its diverse offerings and strong market presence, JPMorgan Chase & Co. continues to play a vital role in the financial services arena.

Is JPMorgan Chase & Co. (JPM) a good investment?

Investing in JPMorgan Chase & Co. (JPM) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B, with a Bullish outlook. Always conduct your own research before investing.

What is JPMorgan Chase & Co. (JPM)'s stock forecast?

Analysts predict JPMorgan Chase & Co. stock to fluctuate between $202.16 (low) and $337.25 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is JPMorgan Chase & Co.'s market capitalization?

As of 2026-02-06, JPMorgan Chase & Co.'s market cap is $877,657,289,434, based on 2,722,262,064 outstanding shares.

How does JPMorgan Chase & Co. compare to competitors like VISA INC CLASS A COM?

Compared to VISA INC CLASS A COM, JPMorgan Chase & Co. has a Higher Market-Cap, indicating a difference in performance.

Does JPMorgan Chase & Co. pay dividends?

JPMorgan Chase & Co. pays dividends. The current dividend yield is 1.73%, with a payout of $1.50 per share.

How can I buy JPMorgan Chase & Co. (JPM) stock?

To buy JPMorgan Chase & Co. (JPM) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for JPM. Place an order (Market, Limit, etc.).

What is the best time to invest in JPMorgan Chase & Co.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has JPMorgan Chase & Co. stock ever split?

JPMorgan Chase & Co.'s last stock split was 3:2 on 2000-06-12.

How did JPMorgan Chase & Co. perform in the last earnings report?

Revenue: $280,345,000,000 | EPS: $20.09 | Growth: 1.52%.

Where can I find JPMorgan Chase & Co.'s investor relations reports?

Visit https://www.jpmorganchase.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for JPMorgan Chase & Co.?

You can explore historical data from here

What is the all-time high and low for JPMorgan Chase & Co. stock?

All-time high: $337.25 (2026-01-05) | All-time low: $101.28 (2022-10-12).

What are the key trends affecting JPMorgan Chase & Co. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

seekingalpha.com

JPMorgan: An Attractive Long-Term Idea For Income And Capital Gains

defenseworld.net

New York State Common Retirement Fund reduced its holdings in JPMorgan Chase and Co. (NYSE: JPM) by 6.6% during the undefined quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 3,335,036 shares of the financial services provider's stock after selling 233,800 shares

defenseworld.net

Bank of New York Mellon Corp lessened its stake in shares of JPMorgan Chase and Co. (NYSE: JPM) by 5.1% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 22,229,899 shares of the financial services provider's stock after

youtube.com

Rick Ducat turns to the financial space on Friday's Options Corner with a look at JPMorgan Chase (JPM). Shares remain virtually unchanged so far in 2026, though analyst upgrades offer potential for bullish price action.

proactiveinvestors.co.uk

Analysts at JPMorgan have resumed coverage of Rio Tinto Ltd at 'Overweight' with a £75.00 price target, signaling confidence in the mining giant's strategic positioning even as merger talks with Glencore PLC collapse. The note, a day after Rio Tinto confirmed it is no longer pursuing a merger or business combination with its rival, also saw the American investment bank's UK analyst also brought Glencore back under coverage, with a 'Neutral' rating and a £4.90 price target.

fool.com

Discover why JPMorgan Chase (JPM 2.24%) and its tech-driven strategy are capturing investor attention, and what recent moves in the banking sector could mean for future returns. Watch the video below for key insights and expert analysis.

zacks.com

JPM projects 2026 NII of $103B despite rate cuts, banking on loan growth, card balances and deposit gains. Does this justify betting on the stock?

businessinsider.com

Banks are pouring billions into AI, reshaping jobs, culture, and power on Wall Street. Generative AI is changing how jobs get done— from junior bankers to developers.

zacks.com

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does JPMorgan Chase & Co. (JPM) have what it takes?

reuters.com

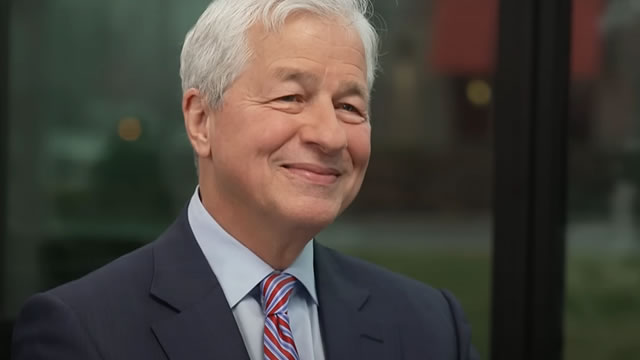

U.S. President Donald Trump's lawsuit against JPMorgan Chase and its CEO Jamie Dimon highlights a growing, and politically fraught, conflict in the administration's policy agenda for Wall Street, with big banks scoring wins but also facing setbacks.

See all news