Intuitive Surgical, Inc. (ISRG)

$

496.73

-7.49 (-1.51%)

Key metrics

Financial statements

Free cash flow per share

6.3998

Market cap

180.8 Billion

Price to sales ratio

17.9589

Debt to equity

0

Current ratio

4.7279

Income quality

1.0707

Average inventory

1.7 Billion

ROE

0.1672

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

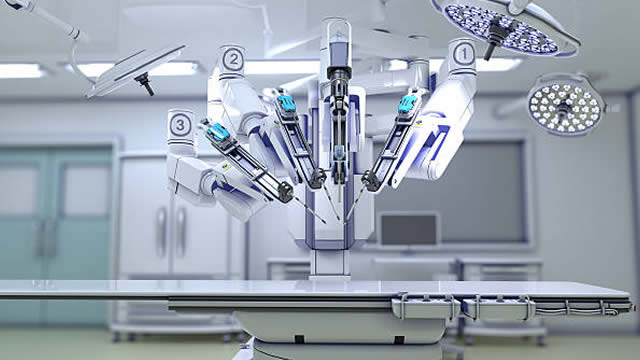

Intuitive Surgical, Inc. develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally. The EBITDA ratio is 0.33 highlighting the company's operational efficiency. The company reported a substantial revenue of $10,064,700,000.00 reflecting its strong market presence. Additionally, it reported an income before tax of $3,311,400,000.00 showcasing its pre-tax profitability. The cost of revenue for the company is $3,409,200,000.00 showcasing its production and operational expenses. The financial data pertains to the fiscal year 2025. The company offers the da Vinci Surgical System, which facilitates complex surgeries through a minimally invasive approach, along with the Ion endoluminal system that broadens its commercial offerings into diagnostic procedures, enabling minimally invasive biopsies in the lung. Additionally, it provides a suite of stapling, energy, and core instrumentation for its surgical systems, along with progressive learning pathways to support the use of its technology. Intuitive Surgical also offers a range of services to its customers, including support, installation, repair, and maintenance, while its integrated digital capabilities provide unified and connected offerings that streamline hospital performance with program-enhancing insights. The stock is priced at $438.72 positioning it in the higher-end market. It is characterized by a high average trading volume of 1,844,910.00 indicating strong liquidity. With a large market capitalization of $178,066,034,825.00 the company is a dominant player in its field. It is a key player in the Medical - Instruments & Supplies industry, contributing significantly to the overall market landscape. Furthermore, Intuitive Surgical belongs to the Healthcare sector, driving innovation and growth. The focus on delivering enhanced surgical solutions combined with robust financial metrics underscores its prominent role in advancing minimally invasive healthcare solutions, reflecting both market stability and a commitment to quality in patient care.

Is Intuitive Surgical, Inc. (ISRG) a good investment?

Investing in Intuitive Surgical, Inc. (ISRG) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as C-, with a Bearish outlook. Always conduct your own research before investing.

What is Intuitive Surgical, Inc. (ISRG)'s stock forecast?

Analysts predict Intuitive Surgical, Inc. stock to fluctuate between $425 (low) and $609.08 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Intuitive Surgical, Inc.'s market capitalization?

As of 2026-02-03, Intuitive Surgical, Inc.'s market cap is $178,066,034,825, based on 358,476,506 outstanding shares.

How does Intuitive Surgical, Inc. compare to competitors like Eli Lilly & Co.?

Compared to Eli Lilly & Co., Intuitive Surgical, Inc. has a Lower Market-Cap, indicating a difference in performance.

How can I buy Intuitive Surgical, Inc. (ISRG) stock?

To buy Intuitive Surgical, Inc. (ISRG) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for ISRG. Place an order (Market, Limit, etc.).

What is the best time to invest in Intuitive Surgical, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has Intuitive Surgical, Inc. stock ever split?

Intuitive Surgical, Inc.'s last stock split was 3:1 on 2021-10-05.

How did Intuitive Surgical, Inc. perform in the last earnings report?

Revenue: $10,064,700,000 | EPS: $8 | Growth: 22.32%.

Where can I find Intuitive Surgical, Inc.'s investor relations reports?

Visit https://www.intuitive.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Intuitive Surgical, Inc.?

You can explore historical data from here

What is the all-time high and low for Intuitive Surgical, Inc. stock?

All-time high: $616 (2025-01-23) | All-time low: $180.07 (2022-10-13).

What are the key trends affecting Intuitive Surgical, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

zacks.com

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

fool.com

Intuitive Surgical is an industry leader in surgical robotics. The company continues to sell many da Vinci systems, which power its parts and services revenue.

fool.com

Intuitive Surgical's quarterly update was strong, except for its weak guidance. Still, long-term prospects for this specialist in robotic surgery remain intact.

fool.com

Computer programs are being allowed to drive cars; it seems logical that they'll be allowed to perform surgery someday, too. Intuitive Surgical is a fast-growing company that is focused entirely on surgical robotics.

zacks.com

ISRG faces slower China tenders, local favoritism and pricing pressure, even as clinicians prefer da Vinci and management flags 2026 competition.

defenseworld.net

Cullen Frost Bankers Inc. grew its position in Intuitive Surgical, Inc. (NASDAQ: ISRG) by 4.4% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 82,056 shares of the medical equipment provider's stock after purchasing an additional 3,450 shares during the

fool.com

Intuitive Surgical faces continued challenges in Asia. The company's Ion system replacements are also declining, with lower da Vinci procedure volume growth projected for 2026.

zacks.com

Intuitive Surgical stock gains after Q4 EPS and revenue top estimates as system placements and procedure growth offset a decline in gross margin.

marketbeat.com

Robotic-assisted surgery stalwart Intuitive Surgical NASDAQ: ISRG blew investors away with its Q3 2025 earnings report back in October 2025. Shares closed up nearly 14% in reaction to the results, marking the healthcare stock's largest single-day post-earnings gain in recent memory.

See all news