IDEX Corporation (IEX)

$

180.91

-1.23 (-0.68%)

Key metrics

Financial statements

Free cash flow per share

7.3686

Market cap

13.8 Billion

Price to sales ratio

4.1917

Debt to equity

0.5034

Current ratio

2.7874

Income quality

1.2885

Average inventory

448 Million

ROE

0.1263

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

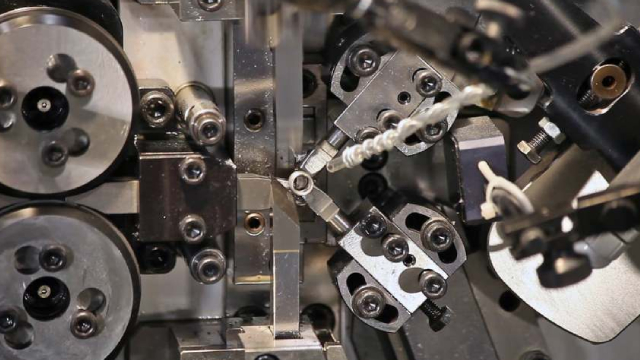

The financial data pertains to the fiscal year 2024. IDEX Corporation, together with its subsidiaries, reported a substantial revenue of $3,268,800,000.00 reflecting its strong market presence. The company operates through three segments: Fluid & Metering Technologies (FMT), Health & Science Technologies (HST), and Fire & Safety/Diversified Products (FSDP). The FMT segment designs, produces, and distributes positive displacement pumps, small volume provers, flow meters, injectors, and other fluid-handling pump modules and systems, catering to various industries including food, chemicals, and energy. Furthermore, the company reported an income before tax of $639,300,000.00 showcasing its pre-tax profitability. It also recorded an operating income of $677,200,000.00 reflecting its earnings from core operations. The gross profit stands at $1,445,200,000.00 highlighting the company's profitability from these operational activities. The HST segment focuses on precision fluidics and biocompatible medical devices, serving markets such as pharmaceuticals and life sciences. Meanwhile, the FSDP segment provides essential equipment and systems for the fire and rescue industry, as well as for commercial paint dispensing applications. The stock is priced at $182.14 positioning it in the higher-end market. With a mid-range market capitalization of $13,666,773,586.00 the company is a steady performer. The stock has an average trading volume of 694,931.00 indicating moderate liquidity. IDEX Corporation is a key player in the Industrial - Machinery industry, contributing significantly to the overall market landscape. It belongs to the Industrials sector, driving innovation and growth. Through its diverse segments, the company continues to establish a solid foundation for future expansion and resilience in varying market conditions, ensuring its position as a vital contributor to the industries it serves.

Is IDEX Corporation (IEX) a good investment?

Investing in IDEX Corporation (IEX) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B+, with a Bearish outlook. Always conduct your own research before investing.

What is IDEX Corporation (IEX)'s stock forecast?

Analysts predict IDEX Corporation stock to fluctuate between $153.36 (low) and $238.22 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is IDEX Corporation's market capitalization?

As of 2025-05-30, IDEX Corporation's market cap is $13,666,773,586, based on 75,544,600 outstanding shares.

How does IDEX Corporation compare to competitors like GE Aerospace?

Compared to GE Aerospace, IDEX Corporation has a Lower Market-Cap, indicating a difference in performance.

Does IDEX Corporation pay dividends?

IDEX Corporation pays dividends. The current dividend yield is 1.46%, with a payout of $0.71 per share.

How can I buy IDEX Corporation (IEX) stock?

To buy IDEX Corporation (IEX) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for IEX. Place an order (Market, Limit, etc.).

What is the best time to invest in IDEX Corporation?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has IDEX Corporation stock ever split?

IDEX Corporation's last stock split was 3:2 on 2007-05-22.

How did IDEX Corporation perform in the last earnings report?

Revenue: $3,268,800,000 | EPS: $6.67 | Growth: -15.36%.

Where can I find IDEX Corporation's investor relations reports?

Visit https://www.idexcorp.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for IDEX Corporation?

You can explore historical data from here

What is the all-time high and low for IDEX Corporation stock?

All-time high: $246.36 (2024-03-22) | All-time low: $153.36 (2025-04-07).

What are the key trends affecting IDEX Corporation stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

zacks.com

IEX is set to benefit from the solid momentum across its FSDP & FMT segments. However, increasing expenses remain a concern.

globenewswire.com

IDEX Biometrics ASA held the annual general meeting on 21 May 2025. All resolutions were passed as proposed in the notice and agenda update for the meeting.

globenewswire.com

In connection with the first quarter 2025 report released earlier today, IDEX Biometrics CEO Anders Storbråten will host a presentation at Arctic Securities at 12:00 CET today.

globenewswire.com

IDEX Biometrics ASA's first quarter 2025 report is attached to this notice. Recent highlights: On 11 March 2025 IDEX Biometrics announced a new strategy with a fundamental shift in how the company would take its unique technology and products to market New CEO appointed – Anders Storbråten Securing a new debt facility of NOK 30 million, converted to shares Heights convertible bond renegotiated and amended Range of operational improvement initiatives under way – target quarterly run rate OPEX from end Q3 2025 in the range of $1.5-1.7 million.

globenewswire.com

Reference is made to the stock exchange announcements issued by IDEX Biometrics ASA (the "Company") on 11 March and 11 April 2025 regarding the successful loan financing of NOK 30 million and the subsequent conversion of such debt to shares in the Company at a subscription price of NOK 0.01 per share, resulting in the issuance of 3,000,000,000 new shares ("Debt Conversion” and “Debt Conversion Shares"), the subsequent offering of up to 600,000,000 new shares at a subscription price equal to the subscription price in the Debt Conversion ("Subsequent Offering" and the "Offer Shares"), and the amendment of a certain senior convertible bond (the "Convertible Bond") issued by an affiliate of Heights Capital Management ("Heights") to the Company, whereby, among other things, the principal amount of the Convertible Bond was reduced to an aggregate principal amount of NOK 49,980,000.

globenewswire.com

The Nomination Committee of IDEX Biometrics ASA proposes that Morten Opstad, Annika Olsson and Adriana Saitta, all current board members and European residents and nationals, form the new board of directors, with Morten Opstad serving as the Chair. The proposal is that they continue for a new term of two years.

globenewswire.com

Reference is made to the announcement by IDEX Biometrics ASA on 5 May 2025 regarding the results of the exercise of Warrants B. A total of 36,767 Warrants B were exercised, resulting in an aggregate subscription for 36,767 new shares, each Warrant B having an exercise price of NOK 0.15.

globenewswire.com

Reference is made to the announcement by IDEX Biometrics ASA (the "Company") on 12 December 2024 regarding the listing of Warrants A and Warrants B on Oslo Stock Exchange. Warrants B were exercisable between 31 March 2025 and 11 April 2025, and all Warrants B not exercised within such time lapsed without compensation to the holder.

seekingalpha.com

IDEX Corporation (NYSE:IEX ) Q1 2025 Earnings Call May 1, 2025 9:00 AM ET Company Participants Jim Giannakouros - Investor Relations Eric Ashleman - President and Chief Executive Officer Abhi Khandelwal - Senior Vice President and Chief Financial Officer Conference Call Participants Mike Halloran - Baird Nathan Jones - Stifel Vlad Bystricky - Citigroup Joe Giordano - Cowen Bryan Blair - Oppenheimer Deane Dray - RBC Capital Markets Brett Linzey - Mizuho Matt Summerville - D.A. Davidson Operator Greetings.

zacks.com

Strength in the Health & Science Technologies segment aids IEX's first-quarter results.

See all news