iShares iBonds 2025 Term High Yield and Income ETF (IBHE)

$

23.2

+0.01 (0.04%)

Key metrics

Financial statements

Free cash flow per share

Market cap

Price to sales ratio

Debt to equity

Current ratio

Income quality

Average inventory

ROE

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

The fund will invest at least 80% of its assets in the component securities of the underlying index, and it will invest at least 90% of its assets in fixed income securities of the types included in the underlying index. The underlying index is composed of U.S. dollar-denominated, taxable, fixed-rate, high yield and BBB or equivalently rated corporate bonds scheduled to mature between January 1, 2025 and December 15, 2025, inclusive.

News

seekingalpha.com

7 months ago

iShares iBonds 2025 Term High Yield and Income ETF has a set termination date of December 2025, offering clear visibility into its maturity timeline and risk profile. The fund has a short duration of 0.57 years, which means it is less sensitive to interest rate and credit risk. This duration will continue to decrease as bonds mature. IBHE offers a 5.93% 30-day SEC yield and a 6.1% average yield to maturity, making it appealing for investors seeking higher returns compared to traditional money market funds.

seekingalpha.com

10 months ago

iShares iBonds 2025 Term High Yield and Income ETF has an attractive 7% yield, but it is not a long-term investment. It is a bond ladder rung. Bond ladder ETFs are designed to be held until redemption to limit the risk of price gyration. However, IBHE volatility has been very low for 4 years. If you think interest rates will go down, bond ladders can lock in high rates in your portfolio for a few more years.

seekingalpha.com

a year ago

iShares iBonds 2025 Term High Yield and Income ETF (IBHE) holds a portfolio of high-yielding US dollar-denominated bonds that mature in 2025. From July 2025, the fund will hold cash and cash equivalents until termination.

seekingalpha.com

a year ago

iShares iBonds 2025 Term High Yield and Income ETF is a less risky high-yield bond fund that will terminate at the end of 2025. The fund follows the Bloomberg 2025 Term High Yield and Income Index and uses representative sampling to construct its portfolio. 7% yield with no duration risk is an interesting prospect, but we tell you why we are staying out.

seekingalpha.com

2 years ago

The iShares iBonds 2025 Term High Yield and Income ETF is a fixed-term bond fund that seeks to track an index of high yield and income generating corporate bonds maturing in 2025. IBHE's portfolio consists of 173 bonds with an average yield to maturity of 8.2% and a 30-Day SEC Yield of 7.8%. With the current high interest rate environment and elevated default expectations, the forward return for investors buying IBHE today is only around 5%, making it less attractive compared to risk-free T-bills.

seekingalpha.com

2 years ago

Many investors lack appropriate exposure to corporate debt positions. iBonds ETFs provide structural and strategic benefits for investors.

seekingalpha.com

5 years ago

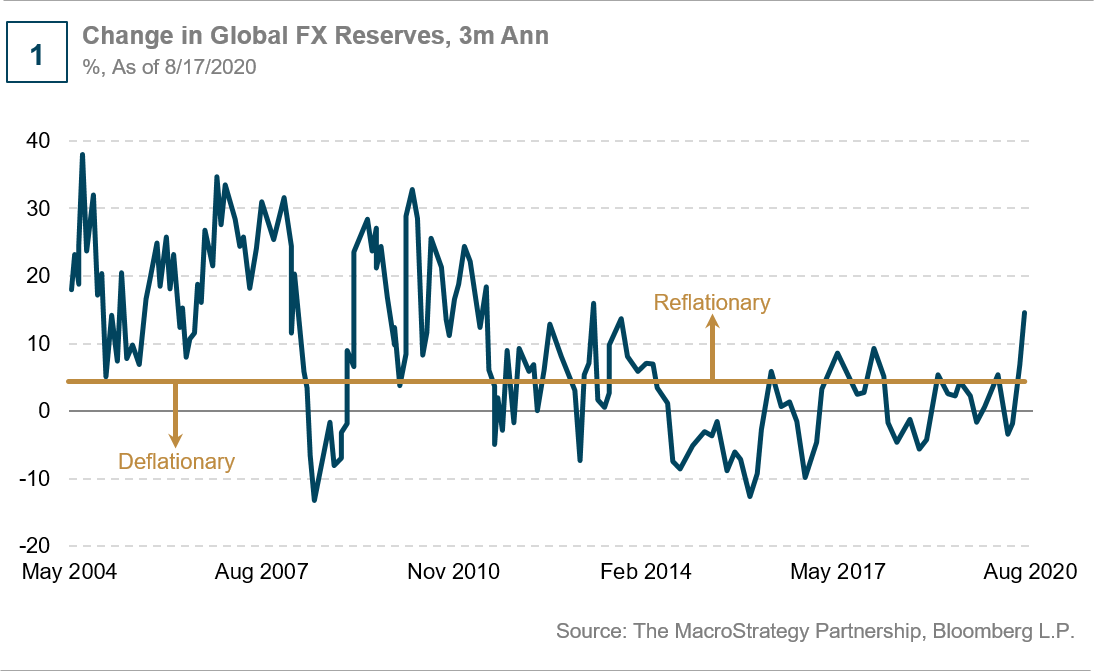

The sudden stop to markets induced by COVID-19 caused a substantial repricing of credit risk globally, and central banks, treasuries, and ministries of finance around the world responded unequivocally.

seekingalpha.com

5 years ago

We downgrade investment grade credit to neutral and increase our overweight in high yield as we see volatility rising after a rally in risk assets.

seekingalpha.com

5 years ago

We examine the effects of the crisis on the year-to-date liquidity of USD corporate bonds, as measured by the price liquidity ratio. The price liquidity ratio c

seekingalpha.com

5 years ago

This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

See all news