IAMGOLD Corporation (IAG)

$

19.13

+1.15 (6.01%)

Key metrics

Financial statements

Free cash flow per share

0.3498

Market cap

11.3 Billion

Price to sales ratio

5.0768

Debt to equity

0.3061

Current ratio

1.6837

Income quality

1.4977

Average inventory

297.1 Million

ROE

0.1002

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

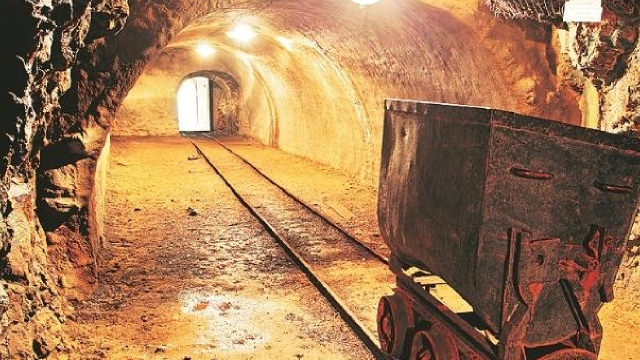

IAMGOLD Corporation, through its subsidiaries, explores, develops, and operates gold mining properties in North America, South America, and West Africa. The company owns interests in notable mining assets such as the Rosebel mine in Suriname, the Essakane mine in Burkina Faso, and the Boto gold project in Senegal, West Africa. Additionally, IAMGOLD operates the Westwood mine in Quebec, spanning 1,925 hectares, alongside the Côté gold project, which covers 586 square kilometers in Ontario, Canada. The company also engages in various exploration and development projects, including the Pitangui project in Brazil, the Karita project in Guinea, and the Diakha-Siribaya project in Mali, as well as the Nelligan and Monster Lake projects in Quebec. The operating expenses amount to -$394,100,000.00 encompassing various operational costs incurred, while the total costs and expenses for the company stand at $689,000,000.00 reflecting its overall spending. The net income ratio is 0.50 showcasing the company's profitability margin, and it incurred an income tax expense of $129,400,000.00 indicating its tax obligations. Furthermore, the gross profit ratio is 0.34 reflecting the efficiency of the company's production and sales operations. Incorporated in 1990 and headquartered in Toronto, Canada, IAMGOLD continues to be a significant player in the mining sector. The stock of IAMGOLD is currently affordable at $11.34 making it suitable for budget-conscious investors. Moreover, it has a high average trading volume of 8,373,619.00 indicating strong liquidity in the market. With a mid-range market capitalization of $11,344,586,997.00 the company demonstrates steady performance amid changing market conditions. IAMGOLD is a key player in the Gold industry, contributing significantly to the overall market landscape. It belongs to the Basic Materials sector, driving innovation and growth within the mining industry. This established presence allows IAMGOLD to navigate challenges effectively while maintaining its commitments to exploration, development, and sustainable mining practices.

Is IAMGOLD Corporation (IAG) a good investment?

Investing in IAMGOLD Corporation (IAG) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B, with a Bearish outlook. Always conduct your own research before investing.

What is IAMGOLD Corporation (IAG)'s stock forecast?

Analysts predict IAMGOLD Corporation stock to fluctuate between $5.02 (low) and $22.43 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is IAMGOLD Corporation's market capitalization?

As of 2026-02-06, IAMGOLD Corporation's market cap is $11,344,586,997, based on 593,025,980 outstanding shares.

How does IAMGOLD Corporation compare to competitors like Southern Copper Corporation?

Compared to Southern Copper Corporation, IAMGOLD Corporation has a Lower Market-Cap, indicating a difference in performance.

Does IAMGOLD Corporation pay dividends?

IAMGOLD Corporation pays dividends. The current dividend yield is 5.67%, with a payout of $0.13 per share.

How can I buy IAMGOLD Corporation (IAG) stock?

To buy IAMGOLD Corporation (IAG) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for IAG. Place an order (Market, Limit, etc.).

What is the best time to invest in IAMGOLD Corporation?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

How did IAMGOLD Corporation perform in the last earnings report?

Revenue: $1,633,000,000 | EPS: $1.52 | Growth: 700%.

Where can I find IAMGOLD Corporation's investor relations reports?

Visit https://www.iamgold.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for IAMGOLD Corporation?

You can explore historical data from here

What is the all-time high and low for IAMGOLD Corporation stock?

All-time high: $22.43 (2026-01-29) | All-time low: $0.92 (2022-09-26).

What are the key trends affecting IAMGOLD Corporation stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

zacks.com

The latest trading day saw Iamgold (IAG) settling at $19.2, representing a -1.84% change from its previous close.

zacks.com

The latest trading day saw Iamgold (IAG) settling at $21.33, representing a +1.57% change from its previous close.

newsfilecorp.com

Highlights: The Anik JV property is adjacent to IAMGOLD's Nelligan Gold Deposit Anik straddles the eastern continuation of the Nelligan Deformation Zone (NDZ), host to Nelligan Gold Deposit and on parallel gold structures immediately to the north of the NDZ. Drilling is underway in the north-central portion of the Anik property, with a planned program of 8 holes totaling 1,600 metres.

zacks.com

Iamgold (IAG) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, IAG broke through the 20-day moving average, which suggests a short-term bullish trend.

zacks.com

CGAU and IAG are gaining attention as strong production, solid cash generation and advancing projects highlight momentum among gold miners.

fool.com

Iamgold expects to hit its full-year financial targets. 2026 could be another banner year.

newsfilecorp.com

All monetary amounts are expressed in U.S. dollars, unless otherwise indicated. Toronto, Ontario--(Newsfile Corp. - January 19, 2026) - IAMGOLD Corporation (TSX: IMG) (NYSE: IAG) ("IAMGOLD" or the "Company") is pleased to report preliminary operating results for the fourth quarter and full year 2025.

zacks.com

Iamgold (IAG) reached $17.57 at the closing of the latest trading day, reflecting a -1.35% change compared to its last close.

zacks.com

IAG's Q3 gold output rose about 10% as Cote Gold ramped up, lifting revenue 61% year over year amid declines at Westwood and Essakane.

invezz.com

IAG share price started the year well, rising to a key resistance level at 430p, its highest level since January 2020, and a few points below its all-time high of 438p. It has been in a strong bull run, rising by 380% from its lowest point in 2022.

See all news