General Electric Company (GE)

$

245.91

+1.75 (0.71%)

Key metrics

Financial statements

Free cash flow per share

4.1196

Market cap

260.4 Billion

Price to sales ratio

6.5614

Debt to equity

1.0166

Current ratio

1.0754

Income quality

0.7593

Average inventory

10.1 Billion

ROE

0.3678

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

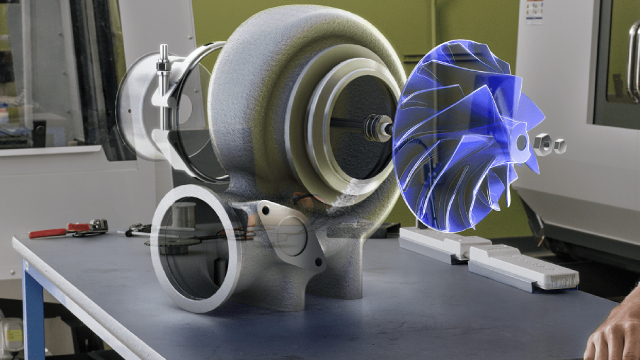

General Electric Company, operating under the name GE Aerospace, focuses on designing and producing both commercial and defense aircraft engines, alongside integrated engine components, electric power, and mechanical aircraft systems. The total costs and expenses for the company are $31,941,000,000.00 reflecting its overall spending. The gross profit stands at $14,394,000,000.00 highlighting the company's profitability from core operations. Notably, the company recorded an operating income of $6,657,000,000.00 demonstrating its ability to generate earnings from its primary business activities. The operating income ratio is 0.17 indicating the company's operational profitability margin. Additionally, the company reported a substantial revenue of $38,702,000,000.00 reflecting its strong market presence. GE Aerospace offers aftermarket services to enhance support for its products, ensuring longevity and reliability in the marketplace. With operations extending across various global regions, including the United States, Europe, China, Asia, the Americas, the Middle East, and Africa, General Electric Company has become a significant player in the aerospace industry since its incorporation in 1892 and is headquartered in Evendale, Ohio. In the financial landscape, the stock is reasonably priced at $244.16 appealing to a broad range of investors. The company boasts a large market capitalization of $262,235,964,900.00 solidifying its status as a dominant player within the industry. Furthermore, it belongs to the Industrials sector, driving innovation and growth throughout the market. The stock has a high average trading volume of 6,196,980.00 indicating strong liquidity and investor interest. As a key player in the Aerospace & Defense industry, GE Aerospace contributes significantly to the overall market landscape, showcasing its resilience and adaptability in an ever-evolving environment. This blend of strategic positioning and robust financial metrics underscores the company’s commitment to growth and operational efficiency, while it continues to serve a diverse customer base across multiple continents.

Is General Electric Company (GE) a good investment?

Investing in General Electric Company (GE) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B-, with a Bullish outlook. Always conduct your own research before investing.

What is General Electric Company (GE)'s stock forecast?

Analysts predict General Electric Company stock to fluctuate between $150.20 (low) and $246.86 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is General Electric Company's market capitalization?

As of 2025-05-30, General Electric Company's market cap is $262,235,964,900, based on 1,066,390,000 outstanding shares.

How does General Electric Company compare to competitors like Caterpillar Inc.?

Compared to Caterpillar Inc., General Electric Company has a Higher Market-Cap, indicating a difference in performance.

Does General Electric Company pay dividends?

General Electric Company pays dividends. The current dividend yield is 0.62%, with a payout of $0.36 per share.

How can I buy General Electric Company (GE) stock?

To buy General Electric Company (GE) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for GE. Place an order (Market, Limit, etc.).

What is the best time to invest in General Electric Company?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has General Electric Company stock ever split?

General Electric Company's last stock split was 1:8 on 2021-08-02.

How did General Electric Company perform in the last earnings report?

Revenue: $38,702,000,000 | EPS: $6.04 | Growth: -28.44%.

Where can I find General Electric Company's investor relations reports?

Visit https://www.geaerospace.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for General Electric Company?

You can explore historical data from here

What is the all-time high and low for General Electric Company stock?

All-time high: $246.86 (2025-05-30) | All-time low: $37.34 (2022-07-05).

What are the key trends affecting General Electric Company stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

reuters.com

GE Aerospace's CEO said on Wednesday he is seeing supply chain improvements that will support a 15% to 20% increase in deliveries this year of jet engines used on popular narrowbody aircraft, after snags challenged deliveries in 2024.

forbes.com

GE Aerospace (NYSE:GE) stock has risen by almost 40% this year, significantly surpassing the S&P 500, which has decreased by 1%. This remarkable surge prompts an important question for investors: Is GE stock now overvalued, and could it face a significant correction, possibly by 25-30% or even 40% to below $150?

zacks.com

GE Aerospace's limited distribution agreement with UAG expands the availability of CT7/T700 engine parts in the regions that are not currently served by distributors.

zacks.com

GE Aerospace clinches a deal to supply Ethiopian Airlines with GEnx engines for the fleet of 11 new Boeing 787 aircraft.

marketbeat.com

A multi-billion-dollar engine and services agreement between GE Aerospace NYSE: GE and Qatar Airways marks one of the aviation giant's largest widebody aircraft commitments to date.

zacks.com

GE clinches a deal to supply Qatar Airways with GEnx and GE9X engines for the fleet of Boeing 777-9 and 787 aircraft.

prnewswire.com

The largest widebody engine deal in GE Aerospace history, supporting Qatar Airways' rapid expansion and driving economic growth in the Middle East DOHA, Qatar , May 14, 2025 /PRNewswire/ -- GE Aerospace (NYSE:GE) and Qatar Airways today announced a significant expansion of their long-standing partnership with the signing of multiple deals for new GE9X and GEnx engines during U.S. President Donald J. Trump's visit to Doha.

fool.com

In this video, Motley Fool contributors Jason Hall and Tyler Crowe break down why GE Aerospace (GE 1.08%) is primed to be a much better investment than most of its customers, including airline giants like Delta Air Lines (DAL -0.26%).

invezz.com

Bank of America analyst Ronald Epstein continues to see further upside in GE Aerospace (NYSE: GE) even though the Boston headquartered firm has already rallied some 20% since early April. Epstein recommends buying GE shares at current levels as they're exceptionally positioned to weather the tariffs-related macroeconomic uncertainty in 2025.

seekingalpha.com

GE Aerospace's Q1 2025 earnings surged with a 60% rise in adjusted EPS and 11% YoY sales growth, driven by strong demand for aircraft engines. The Commercial Engines & Services division, contributing 75% of sales, saw a 35% YoY increase in operating profits, reflecting robust travel industry projections. Despite a recent stock pullback, the favorable aerospace market conditions present a buying opportunity, with potential for significant operating profit growth.

See all news