FormFactor, Inc. (FORM)

$

70.49

-2.84 (-4.03%)

Key metrics

Financial statements

Free cash flow per share

0.0688

Market cap

5.7 Billion

Price to sales ratio

7.4861

Debt to equity

0.0329

Current ratio

4.2982

Income quality

2.5787

Average inventory

109.8 Million

ROE

0.0406

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

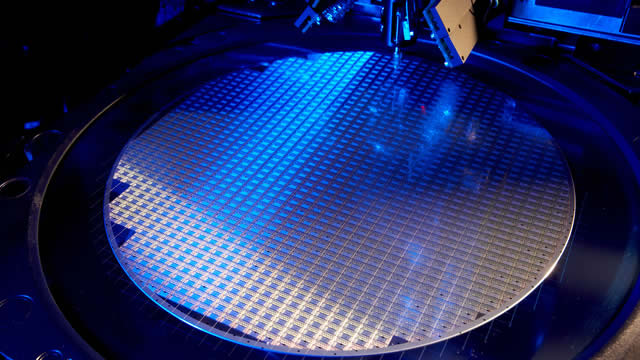

FormFactor, Inc. designs, manufactures, and sells a range of products including probe cards, analytical probes, probe stations, metrology systems, thermal systems, and cryogenic systems tailored for semiconductor companies and scientific institutions. The cost of revenue for the company is $455,676,000.00 showcasing its production and operational expenses. Operating in two segments, Probe Cards and Systems, the company provides probe cards suitable for testing various semiconductor device types, such as systems on a chip, mobile application processors, and graphic processors, among others. Additionally, it offers analytical probes used in applications like device characterization, electrical simulation model development, and failure analysis for universities and semiconductor manufacturers. The company earned an interest income of $14,111,000.00 showcasing its financial investments, and incurred an interest expense of $418,000.00 reflecting its debt servicing obligations. Furthermore, FormFactor provides probing systems that enable semiconductor design engineers to capture and analyze precise data, surface metrology systems for quality control in semiconductor production, as well as thermal subsystems and precision cryogenic instruments. The net income ratio is 0.09 reflecting the company's profitability margin, while the operating income ratio is 0.08 indicating the company's operational profitability margin. Alongside its diverse product offerings, the company also provides on-site probe card maintenance and training services, and markets its products through a direct sales force, representatives, and distributors across various regions including the United States, Taiwan, and Europe. Currently, the stock is affordable at $35.23 suitable for budget-conscious investors. It has an average trading volume of 1,084,718.00 indicating moderate liquidity in the market. With a mid-range market capitalization of $5,464,180,168.00 the company is a steady performer within the semiconductor landscape. It is a key player in the Semiconductors industry, contributing significantly to the overall market landscape. Furthermore, it belongs to the Technology sector, driving innovation and growth. This unique positioning enables FormFactor, Inc. to continually adapt and thrive in a competitive environment while delivering value to its stakeholders.

Is FormFactor, Inc. (FORM) a good investment?

Investing in FormFactor, Inc. (FORM) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B, with a Bearish outlook. Always conduct your own research before investing.

What is FormFactor, Inc. (FORM)'s stock forecast?

Analysts predict FormFactor, Inc. stock to fluctuate between $22.58 (low) and $85.49 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is FormFactor, Inc.'s market capitalization?

As of 2026-01-30, FormFactor, Inc.'s market cap is $5,464,180,168, based on 77,517,097 outstanding shares.

How does FormFactor, Inc. compare to competitors like Nvidia Corp?

Compared to Nvidia Corp, FormFactor, Inc. has a Lower Market-Cap, indicating a difference in performance.

How can I buy FormFactor, Inc. (FORM) stock?

To buy FormFactor, Inc. (FORM) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for FORM. Place an order (Market, Limit, etc.).

What is the best time to invest in FormFactor, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

How did FormFactor, Inc. perform in the last earnings report?

Revenue: $763,599,000 | EPS: $0.90 | Growth: -15.09%.

Where can I find FormFactor, Inc.'s investor relations reports?

Visit https://www.formfactor.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for FormFactor, Inc.?

You can explore historical data from here

What is the all-time high and low for FormFactor, Inc. stock?

All-time high: $85.49 (2026-01-22) | All-time low: $18.15 (2022-11-03).

What are the key trends affecting FormFactor, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

defenseworld.net

FormFactor (NASDAQ: FORM - Get Free Report) is anticipated to issue its Q4 2025 results after the market closes on Wednesday, February 4th. Analysts expect the company to announce earnings of $0.35 per share and revenue of $210.2910 million for the quarter. Individuals may review the information on the company's upcoming Q4 2025 earning report for

zacks.com

FormFactor (FORM) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might help the stock continue moving higher in the near term.

zacks.com

Here is how FormFactor (FORM) and Sandisk Corporation (SNDK) have performed compared to their sector so far this year.

globenewswire.com

LIVERMORE, Calif., Jan. 02, 2026 (GLOBE NEWSWIRE) -- FormFactor, Inc. (Nasdaq: FORM) is pleased to announce its participation in the 28th Annual Needham Growth Conference on January 13th and 14th, 2026.

fool.com

New York City-based Shannon River Fund Management added 968,161 shares of FormFactor in the third quarter. The move increased its exposure by an estimated $35.26 million.

zacks.com

Does FormFactor (FORM) have what it takes to be a top stock pick for momentum investors? Let's find out.

globenewswire.com

LIVERMORE, Calif., Dec. 04, 2025 (GLOBE NEWSWIRE) -- FormFactor, Inc. (Nasdaq: FORM) today announced that it will be joining 14 other companies in collectively hosting the 14th Annual NYC Summit investor conference, being held Tuesday, December 16th at Mastro's Steakhouse New York.

zacks.com

FormFactor (FORM) reported earnings 30 days ago. What's next for the stock?

globenewswire.com

FARMERS BRANCH, Texas and LIVERMORE, Calif., Nov. 12, 2025 (GLOBE NEWSWIRE) -- The City of Farmers Branch, Texas and FormFactor, Inc. (NASDAQ: FORM) today announced that FormFactor, a leading global supplier of test and measurement technologies for the semiconductor industry, has begun site work and equipment installation for its new Farmers Branch advanced manufacturing facility.

zacks.com

Lam Research, Cirrus Logic and FormFactor have been highlighted in this Industry Outlook article.

See all news