Edwards Lifesciences Corporation (EW)

$

75.87

-0.57 (-0.75%)

Key metrics

Financial statements

Free cash flow per share

1.3856

Market cap

44.5 Billion

Price to sales ratio

7.3412

Debt to equity

0.0686

Current ratio

4.0043

Income quality

0.7456

Average inventory

1.1 Billion

ROE

0.1047

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

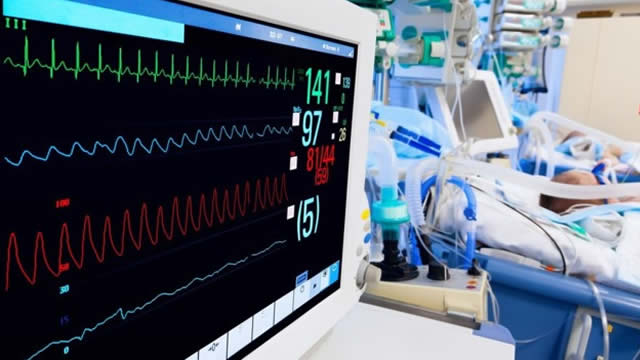

Edwards Lifesciences Corporation specializes in providing innovative products and technologies aimed at treating structural heart disease, as well as critical care and surgical monitoring solutions in various global markets including the United States, Europe, and Japan. The company recorded an operating income of $1,636,200,000.00 reflecting its earnings from core operations. It reported a substantial revenue of $6,067,600,000.00 showcasing its strong market presence in the industry. The company offers transcatheter heart valve replacement products, allowing for minimally invasive heart valve replacements, along with transcatheter valve repair and replacement products targeting mitral and tricuspid valve diseases. Additionally, the company provides the PASCAL and Cardioband transcatheter valve repair systems, which facilitate minimally-invasive therapies. In terms of surgical structural heart solutions, it offers solutions like the aortic surgical valve under the INSPIRIS name and KONECT RESILIA, a pre-assembled aortic tissue valved conduit designed for patients needing valve and root replacements alongside the ascending aorta. The HARPOON Beating Heart Mitral Valve Repair System is also available for patients suffering from degenerative mitral regurgitation. Furthermore, Edwards Lifesciences delivers critical care solutions including advanced hemodynamic monitoring systems that assess heart function and fluid status in surgical and intensive care settings, as well as the Acumen Hypotension Prediction Index software, which provides timely alerts to clinicians regarding dangerously low blood pressure. The company reported an income before tax of $1,272,900,000.00 showcasing its pre-tax profitability, and the operating income ratio stands at $0.27 indicating the company's operational profitability margin. In the financial market, the stock is reasonably priced at $74.41 appealing to a broad range of investors and reflecting the company’s robust standing. The stock has a high average trading volume of 3,832,540.00 indicating strong liquidity which can attract both new and seasoned investors. With a mid-range market capitalization of $44,543,279,048.00 the company continues to be a steady performer within its sector. It is a key player in the Medical - Devices industry, contributing significantly to the overall market landscape while driving innovation and growth in the Healthcare sector.

Is Edwards Lifesciences Corporation (EW) a good investment?

Investing in Edwards Lifesciences Corporation (EW) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as C-, with a Bearish outlook. Always conduct your own research before investing.

What is Edwards Lifesciences Corporation (EW)'s stock forecast?

Analysts predict Edwards Lifesciences Corporation stock to fluctuate between $65.94 (low) and $87.89 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Edwards Lifesciences Corporation's market capitalization?

As of 2026-02-17, Edwards Lifesciences Corporation's market cap is $44,543,279,048, based on 587,100,027 outstanding shares.

How does Edwards Lifesciences Corporation compare to competitors like Eli Lilly & Co.?

Compared to Eli Lilly & Co., Edwards Lifesciences Corporation has a Lower Market-Cap, indicating a difference in performance.

How can I buy Edwards Lifesciences Corporation (EW) stock?

To buy Edwards Lifesciences Corporation (EW) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for EW. Place an order (Market, Limit, etc.).

What is the best time to invest in Edwards Lifesciences Corporation?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has Edwards Lifesciences Corporation stock ever split?

Edwards Lifesciences Corporation's last stock split was 3:1 on 2020-06-01.

How did Edwards Lifesciences Corporation perform in the last earnings report?

Revenue: $6,067,600,000 | EPS: $1.84 | Growth: -73.64%.

Where can I find Edwards Lifesciences Corporation's investor relations reports?

Visit https://www.edwards.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Edwards Lifesciences Corporation?

You can explore historical data from here

What is the all-time high and low for Edwards Lifesciences Corporation stock?

All-time high: $131.73 (2021-12-30) | All-time low: $58.93 (2024-07-25).

What are the key trends affecting Edwards Lifesciences Corporation stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

reuters.com

U.S. medical device maker Edwards Lifesciences has scrapped its anti-copycat policy that triggered a complaint from an Indian rival, EU antitrust regulators said on Monday as they closed their investigation into the company.

businesswire.com

IRVINE, Calif.--(BUSINESS WIRE)--Edwards Lifesciences Corporation (NYSE: EW) today announced it will participate in Citi's Unplugged Medtech and Life Sciences Access Day on February 26, 2026. Scott Ullem, chief financial officer, is scheduled to present at 10:15 a.m. ET. A live webcast of the presentation will be available on the Edwards Lifesciences investor relations website at http://ir.edwards.com/, with an archived version accessible later the same day. About Edwards Lifesciences Edwards L.

globenewswire.com

Shareholders should contact the firm immediately as there may be limited time to enforce your rights. Shareholders should contact the firm immediately as there may be limited time to enforce your rights.

zacks.com

Edwards' Q4 EPS lags estimates but revenues top as TAVR and TMTT surge. Shares rise with 2026 sales growth seen at 8%-10%.

seekingalpha.com

Edwards Lifesciences Corporation (EW) Q4 2025 Earnings Call Transcript

zacks.com

The headline numbers for Edwards Lifesciences (EW) give insight into how the company performed in the quarter ended December 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

reuters.com

Edwards Lifesciences on Tuesday forecast 2026 profit above estimates, betting on robust demand for its artificial heart valves and other medical devices, sending its shares up 3% in after-hours trading.

businesswire.com

IRVINE, Calif.--(BUSINESS WIRE)--Edwards Lifesciences (NYSE: EW) today reported financial results for the quarter and full-year ended Dec. 31, 2025. Highlights and Outlook Q4 sales grew 13.3% to $1.57 billion1, constant currency2 sales grew 11.6% Q4 TAVR sales grew 12.0% to $1.16 billion1; constant currency2 sales grew 10.6% Q4 TMTT sales grew more than 40% to $156 million1 from repair and replacement therapies Q4 EPS of $0.111; adjusted2 EPS of $0.58 FY 2025 sales grew 11.5%, 10.7% constant cu.

zacks.com

EW gears up for Q4 earnings as investors watch TAVR momentum, fast-growing TMTT sales and steady surgical heart demand.

marketbeat.com

Healthcare stocks rallied in 2025, breaking a two-year slump as investors chased steadier rates, better valuations, and improving earnings. The problem: mid-single-digit gains still lagged tech, leaving the sector feeling like a missed opportunity.

See all news