Enstar Group Limited (ESGR)

$

337.91

+1.55 (0.46%)

Key metrics

Financial statements

Free cash flow per share

60.0328

Market cap

5 Billion

Price to sales ratio

5.1995

Debt to equity

0.3138

Current ratio

0

Income quality

2.3777

Average inventory

0

ROE

0.0608

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

Enstar Group Limited engages in the acquisition and management of insurance and reinsurance companies, as well as portfolios of insurance and reinsurance businesses in run-off, particularly in the property and casualty, and other non-life lines sectors. The company reported an income before tax of $661,000,000.00 showcasing its pre-tax profitability. Additionally, the net income ratio is 0.48 reflecting the company's profitability margin. The total costs and expenses for the company are $544,000,000.00 reflecting its overall spending. Notably, the gross profit stands at $1,205,000,000.00 highlighting the company's profitability from core operations. Furthermore, the diluted EPS is $35.90 accounting for potential share dilution. Enstar Group also provides a range of consulting services to the insurance and reinsurance industry, including claims inspection, claims validation, reinsurance asset collection, syndicate management, and IT consulting services. The company operates across various regions, including Bermuda, the United States, the United Kingdom, Australia, and other Continental European countries. Established in 1993, the company was originally known as Castlewood Holdings Limited before rebranding to Enstar Group Limited in January 2007 and is headquartered in Hamilton, Bermuda. In terms of market positioning, the stock is priced at $337.91 positioning it in the higher-end market. It is important to note that the stock has a low average trading volume of 112,408.00 indicating lower market activity. With a mid-range market capitalization of $5,038,271,891.00 the company is regarded as a steady performer. Enstar Group Limited is a key player in the Insurance - Diversified industry, contributing significantly to the overall market landscape. It belongs to the Financial Services sector, driving innovation and growth within its field. This combination of factors reflects the company's stability and influence, as it continues to develop within the intricacies of the insurance and reinsurance markets.

What is Enstar Group Limited (ESGR)'s stock forecast?

Analysts predict Enstar Group Limited stock to fluctuate between $315.94 (low) and $348.48 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Enstar Group Limited's market capitalization?

As of 2025-07-01, Enstar Group Limited's market cap is $5,038,271,891, based on 14,910,100 outstanding shares.

How does Enstar Group Limited compare to competitors like JPMorgan Chase & Co.?

Compared to JPMorgan Chase & Co., Enstar Group Limited has a Lower Market-Cap, indicating a difference in performance.

Does Enstar Group Limited pay dividends?

Enstar Group Limited pays dividends. The current dividend yield is 2.78%, with a payout of $3 per share.

How can I buy Enstar Group Limited (ESGR) stock?

To buy Enstar Group Limited (ESGR) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for ESGR. Place an order (Market, Limit, etc.).

What is the best time to invest in Enstar Group Limited?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

How did Enstar Group Limited perform in the last earnings report?

Revenue: $1,205,000,000 | EPS: $36.83 | Growth: -46.79%.

Where can I find Enstar Group Limited's investor relations reports?

Visit https://www.enstargroup.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Enstar Group Limited?

You can explore historical data from here

What is the all-time high and low for Enstar Group Limited stock?

All-time high: $348.48 (2024-07-26) | All-time low: $169.04 (2022-10-03).

What are the key trends affecting Enstar Group Limited stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

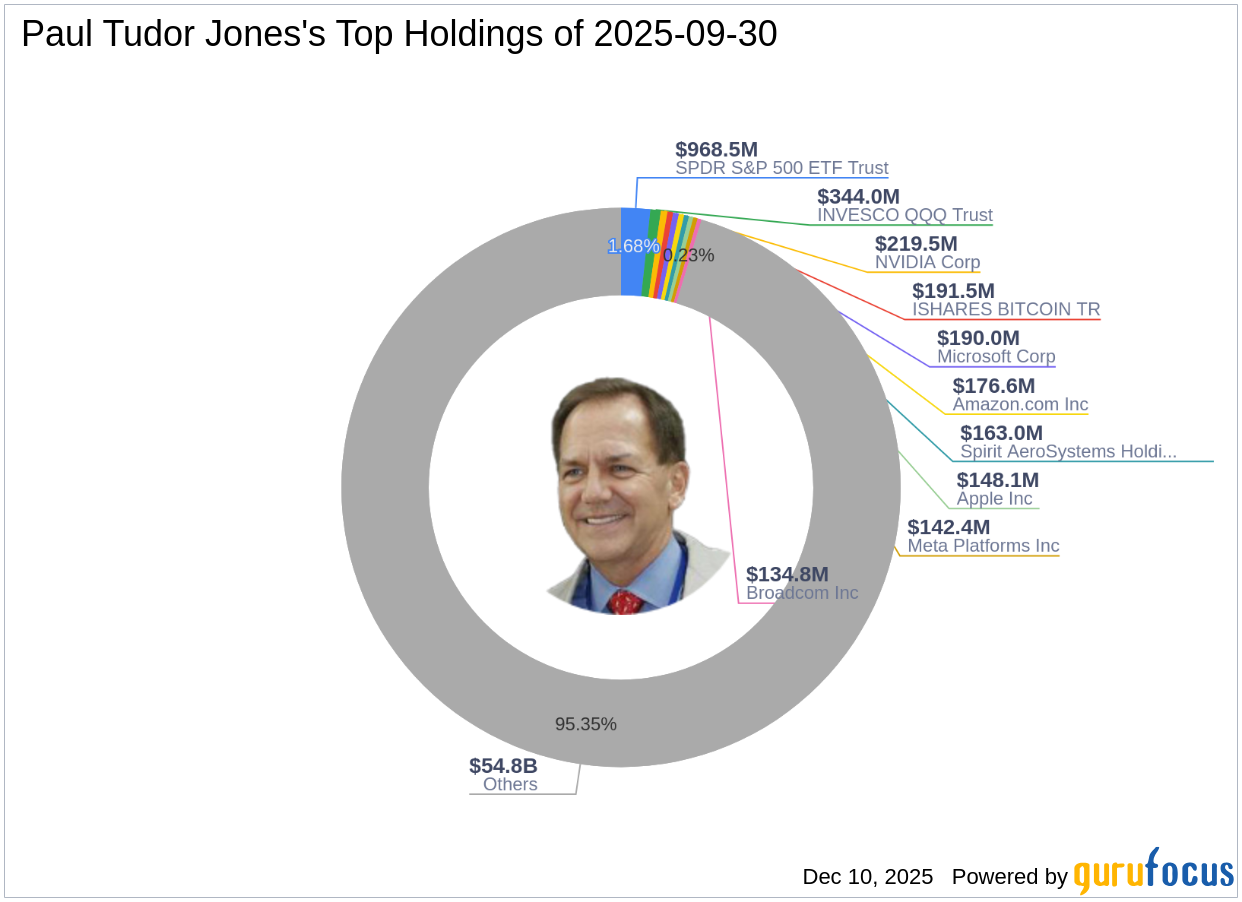

gurufocus.com

2 months ago

Insight into the Guru's Strategic Moves in Q3 2025 Paul Tudor Jones (Trades, Portfolio) recently submitted the 13F filing for the third quarter of 2025, provid

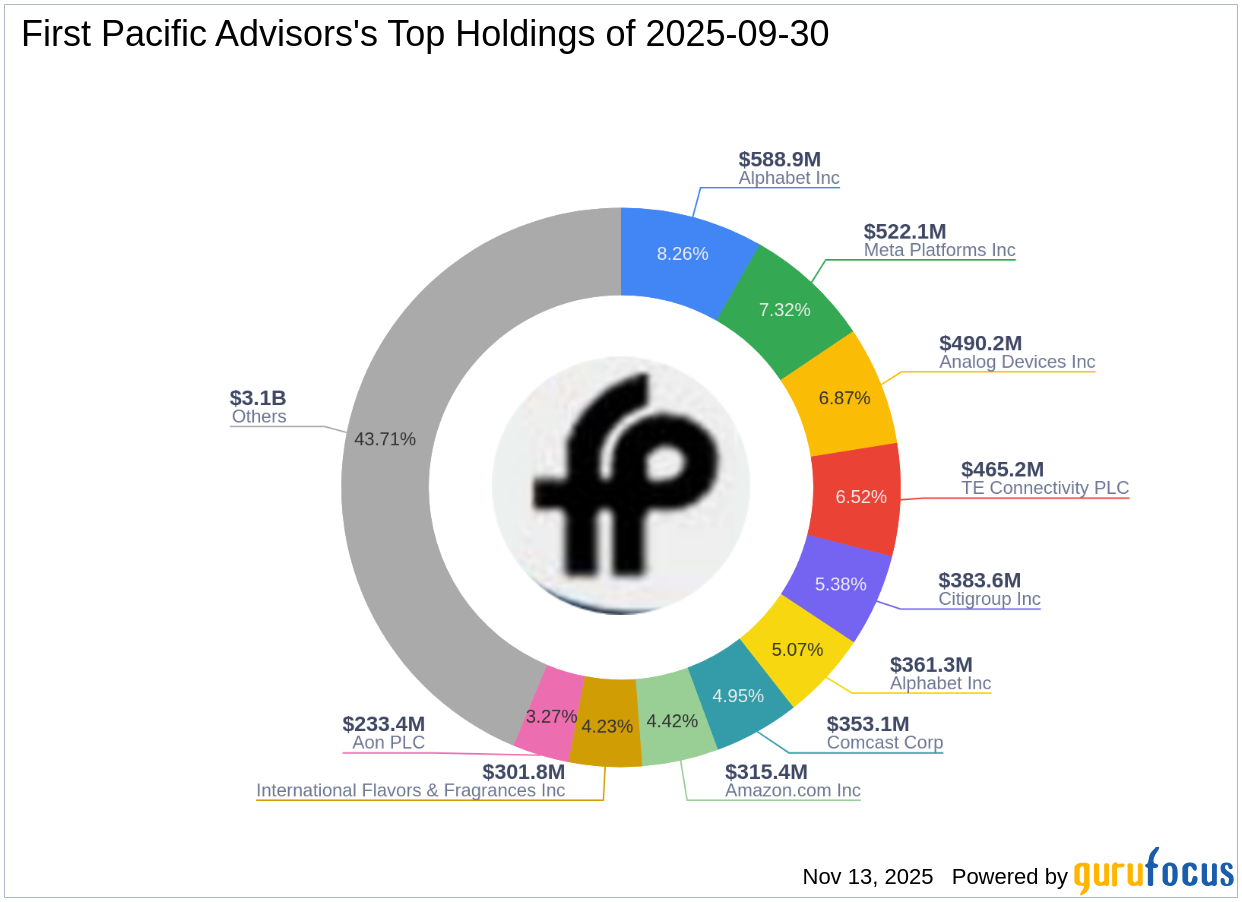

gurufocus.com

3 months ago

Exploring the Latest 13F Filing for Q3 2025 First Pacific Advisors (Trades, Portfolio) recently submitted the 13F filing for the third quarter of 2025, providi

globenewswire.com

4 months ago

HAMILTON, Bermuda, Nov. 05, 2025 (GLOBE NEWSWIRE) -- Enstar Group Limited (“Enstar”) today announced that it will pay cash dividends on its Series D and Series E preference shares.

globenewswire.com

8 months ago

Transaction supports leading global insurance group's next chapter as a private company Transaction supports leading global insurance group's next chapter as a private company

globenewswire.com

10 months ago

HAMILTON, Bermuda, May 05, 2025 (GLOBE NEWSWIRE) -- Enstar Group Limited (“Enstar”) (Nasdaq: ESGR) today announced that it will pay cash dividends on its Series D and Series E preference shares.

globenewswire.com

10 months ago

PEMBROKE, Bermuda, April 24, 2025 (GLOBE NEWSWIRE) -- AXIS Capital Holdings Limited (“AXIS Capital” or “AXIS” or the “Company”) (NYSE: AXS) and Enstar Group Limited (“Enstar”) (Nasdaq: ESGR) announced today that they have completed a loss portfolio transfer (“LPT”) transaction, covering reinsurance segment reserves predominantly attributable to casualty portfolios related to 2021 and prior underwriting years.

businesswire.com

10 months ago

PEMBROKE, Bermuda--(BUSINESS WIRE)---- $AXS #insurance--AXIS Capital Holdings Limited (“AXIS Capital” or “AXIS” or the “Company”) (NYSE: AXS) and Enstar Group Limited (“Enstar”) (Nasdaq: ESGR) announced today that they have completed a loss portfolio transfer (“LPT”) transaction, covering reinsurance segment reserves predominantly attributable to casualty portfolios related to 2021 and prior underwriting years. The LPT reinsurance agreement covers reinsurance segment reserves totalling $3.1 billion at September 30.

globenewswire.com

a year ago

HAMILTON, Bermuda, March 17, 2025 (GLOBE NEWSWIRE) -- Enstar Group Limited (“Enstar”) (Nasdaq: ESGR) today announced the expiration and final results of its previously announced cash tender offer (the “Tender Offer”) for any and all of the outstanding 5.750% Fixed-Rate Reset Junior Subordinated Notes due 2040 issued by Enstar's wholly owned subsidiary, Enstar Finance LLC, that Enstar guarantees on a junior subordinated basis (the “Notes”).

globenewswire.com

a year ago

HAMILTON, Bermuda, March 12, 2025 (GLOBE NEWSWIRE) -- Enstar Group Limited (“Enstar”) (Nasdaq: ESGR) today announced the pricing of $350 million aggregate principal amount of its 7.500% Fixed-Rate Reset Junior Subordinated Notes due 2045 (the “Notes”). The offering is expected to close on March 18, 2025, subject to satisfaction of customary closing conditions.

globenewswire.com

a year ago

HAMILTON, Bermuda, March 10, 2025 (GLOBE NEWSWIRE) -- Enstar Group Limited (“Enstar”) (Nasdaq: ESGR) today announced that it has commenced a cash tender offer (the “Tender Offer”) for any and all of the outstanding 5.750% Fixed-Rate Reset Junior Subordinated Notes due 2040 issued by Enstar's wholly owned subsidiary, Enstar Finance LLC, that Enstar guarantees on a junior subordinated basis (the “Notes”). The table below sets forth additional information with respect to the Notes and the Tender Offer.

See all news