Equinox Gold Corp. (EQX)

$

18.76

+0.36 (1.92%)

Key metrics

Financial statements

Free cash flow per share

-0.0106

Market cap

14.2 Billion

Price to sales ratio

7.6865

Debt to equity

0.2683

Current ratio

1.5615

Income quality

-36.3589

Average inventory

454.8 Million

ROE

0.0451

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

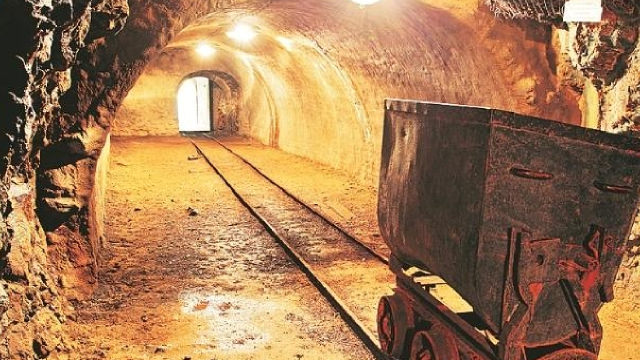

Equinox Gold Corp. engages in the operation, acquisition, exploration, and development of mineral properties, primarily focusing on gold and silver deposits. The company operates multiple gold mines and holds interests in several significant properties, including the Aurizona gold mine in Maranhão State, the RDM gold mine in Minas Gerais State, and both Fazenda and Santa Luz gold mines in Bahia State, Brazil. The gross profit stands at $462,157,118.00 highlighting the company’s profitability from core operations. Furthermore, Equinox Gold Corp. has interests in the Mesquite gold mine and Castle Mountain property in California, as well as the Los Filos Gold Mine in Guerrero State, Mexico. The company incurred an income tax expense of $152,857,821.00 indicating its tax obligations. It also holds a 60% interest in the Greenstone project located in Ontario, Canada. The diluted EPS is $0.36 accounting for potential share dilution, while the operating expenses amount to $22,249,790.00 encompassing various operational costs incurred during its activities. Additionally, the company reported selling, general, and administrative expenses of $16,063,359.00 which indicate its operational overhead costs. Previously known as Trek Mining Inc., Equinox Gold Corp. changed its name in December 2017 and has been incorporated since 2007, with its headquarters in Vancouver, Canada. In the current market arena, the stock is affordable at $10.80 making it suitable for budget-conscious investors. It demonstrates robust trading characteristics, boasting a high average trading volume of 10,063,103.00 which indicates strong liquidity. With a mid-range market capitalization of $14,788,168,800.00 Equinox Gold Corp. is considered a steady performer in the market. As a key player in the Gold industry, the company significantly contributes to the overall market landscape. Moreover, it belongs to the Basic Materials sector, driving innovation and growth in the field. This strategic positioning ensures that Equinox Gold Corp. maintains an important role in advancing its operational capabilities and meeting the demands of its investors.

Is Equinox Gold Corp. (EQX) a good investment?

Investing in Equinox Gold Corp. (EQX) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B-, with a Bullish outlook. Always conduct your own research before investing.

What is Equinox Gold Corp. (EQX)'s stock forecast?

Analysts predict Equinox Gold Corp. stock to fluctuate between $5.59 (low) and $18.96 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Equinox Gold Corp.'s market capitalization?

As of 2026-03-02, Equinox Gold Corp.'s market cap is $14,788,168,800, based on 788,281,919 outstanding shares.

How does Equinox Gold Corp. compare to competitors like Meta Platforms, Inc. Class A Common Stock?

Compared to Meta Platforms, Inc. Class A Common Stock, Equinox Gold Corp. has a Lower Market-Cap, indicating a difference in performance.

Does Equinox Gold Corp. pay dividends?

Equinox Gold Corp. pays dividends. The current dividend yield is 0%, with a payout of $0.02 per share.

How can I buy Equinox Gold Corp. (EQX) stock?

To buy Equinox Gold Corp. (EQX) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for EQX. Place an order (Market, Limit, etc.).

What is the best time to invest in Equinox Gold Corp.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Equinox Gold Corp. stock ever split?

Equinox Gold Corp.'s last stock split was 1:5 on 2019-08-20.

How did Equinox Gold Corp. perform in the last earnings report?

Revenue: $1,849,005,968 | EPS: $0.36 | Growth: -55.56%.

Where can I find Equinox Gold Corp.'s investor relations reports?

Visit https://www.equinoxgold.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Equinox Gold Corp.?

You can explore historical data from here

What is the all-time high and low for Equinox Gold Corp. stock?

All-time high: $18.96 (2026-02-25) | All-time low: $2.35 (2022-11-03).

What are the key trends affecting Equinox Gold Corp. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

globenewswire.com

Equinox Gold has received TSX approval for a normal course issuer bid to repurchase, for cancellation, up to 39,414,095 common shares of Equinox Gold.

zacks.com

Here is how Equinox Gold (EQX) and Glencore PLC (GLNCY) have performed compared to their sector so far this year.

globenewswire.com

VANCOUVER, British Columbia, Feb. 20, 2026 (GLOBE NEWSWIRE) -- Equinox Gold Corp. (TSX: EQX, NYSE American: EQX) (the “Company”) has filed its audited financial statements and related management's discussion and analysis for the three months and year ended December 31, 2025. The documents are available for download on the Company's profile on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov/edgar and on the Company's website at www.equinoxgold.com.

globenewswire.com

VANCOUVER, British Columbia, Feb. 18, 2026 (GLOBE NEWSWIRE) -- Equinox Gold Corp. (TSX: EQX, NYSE American: EQX) (“Equinox Gold” or the “Company”) is pleased to report its unaudited financial and operating results for the three months (“Q4”) and year (“Full Year”) ended December 31, 2025. These results are preliminary and could change based on final audited results.

globenewswire.com

VANCOUVER, British Columbia, Feb. 18, 2026 (GLOBE NEWSWIRE) -- Equinox Gold Corp. (TSX: EQX, NYSE American: EQX) (“Equinox Gold” or the “Company”) is pleased to announce that its Board of Directors (“Board”) has declared an inaugural quarterly cash dividend of US$0.015 per common share (“Share”) of the Company, which is payable on March 26, 2026 to shareholders of record as at the close of business on the record date of March 12, 2026. The Board has also approved a dividend policy under which the Company intends, subject to quarterly Board approval and certain relevant factors, to pay a regular quarterly dividend of US$0.015 per Share, or US$0.06 per Share annually.

zacks.com

Equinox Gold (EQX) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

zacks.com

EQX is likely to have benefited from higher gold prices and strong production in the fourth quarter.

zacks.com

Equinox Gold (EQX) is well positioned to outperform the market, as it exhibits above-average growth in financials.

globenewswire.com

Drilling at Equinox Gold's Valentine Mine has confirmed a new gold discovery and also additional high-grade mineralization outside of existing resources.

globenewswire.com

(All financial figures are in US dollars ) VANCOUVER, British Columbia, Jan. 23, 2026 (GLOBE NEWSWIRE) -- Equinox Gold Corp. (TSX: EQX, NYSE American: EQX) (“Equinox Gold” or the “Company”) completed the previously announced sale of its Aurizona Mine, RDM Mine and Bahia Complex located in Brazil (the “Brazil Operations”) to a subsidiary of the CMOC Group for total consideration of up to $1.015 billion (the “Transaction”). Equinox Gold received cash proceeds of $900 million, before closing adjustments, and will receive a production linked contingent cash payment of up to $115 million on January 23, 2027.

See all news