Emerson Electric Co. (EMR)

$

119.74

-1.23 (-1.03%)

Key metrics

Financial statements

Free cash flow per share

4.9059

Market cap

66.5 Billion

Price to sales ratio

3.7777

Debt to equity

0.7715

Current ratio

0.7954

Income quality

1.6590

Average inventory

2.2 Billion

ROE

0.1166

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

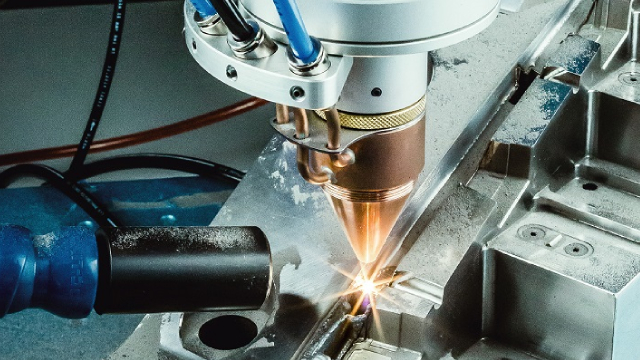

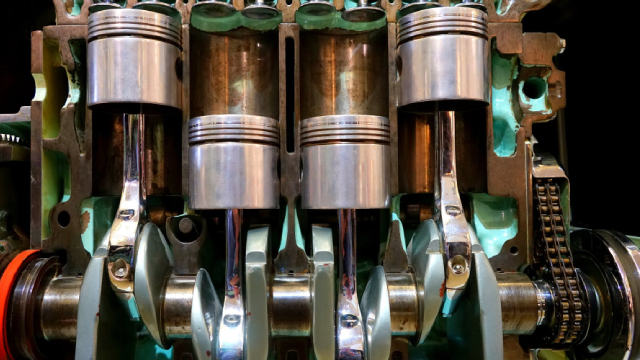

Emerson Electric Co., a prominent technology and engineering firm, serves a diverse range of customers across industrial, commercial, and residential markets worldwide, including regions such as the Americas, Asia, the Middle East, Africa, and Europe. The company operates through two primary segments: Automation Solutions and Commercial & Residential Solutions. The Automation Solutions segment specializes in measurement and analytical instrumentation, industrial valves and equipment, along with process control software and systems. This segment caters to various markets, including oil and gas, refining, chemicals, power generation, life sciences, food and beverage, automotive, pulp and paper, metals and mining, and municipal water supplies. The gross profit stands at $8,885,000,000.00 highlighting the company's profitability from core operations. The company's stock is identified with the symbol 'EMR' in the market, reflecting its presence in the financial landscape. Additionally, it achieved a significant net income of $1,968,000,000.00 showcasing its strong financial health. On the operational front, the cost of revenue for the company is $8,607,000,000.00 which showcases its production and operational expenses. The operating expenses amount to $6,219,000,000.00 encompassing various operational costs incurred throughout its segments. In the Commercial & Residential Solutions segment, the focus is on providing residential and commercial heating and air conditioning products, offering a wide array of components such as compressors, thermostats, and monitoring equipment. The stock of Emerson Electric Co. is reasonably priced at $119.74 appealing to a broad range of investors looking for investment opportunities. It boasts a high average trading volume of 3,350,047.00 indicating strong liquidity and active trading interest. With a large market capitalization of $67,353,750,000.00 the company maintains its status as a dominant player in the technology and engineering sector. It is a key player in the Industrial - Machinery industry, contributing significantly to the overall market landscape through its innovative solutions. Additionally, Emerson Electric Co. belongs to the Industrials sector, driving innovation and growth to meet the evolving needs of its customers and stakeholders. The company continues to strengthen its position by delivering top-notch products and services across its various segments.

Is Emerson Electric Co. (EMR) a good investment?

Investing in Emerson Electric Co. (EMR) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B, with a Bullish outlook. Always conduct your own research before investing.

What is Emerson Electric Co. (EMR)'s stock forecast?

Analysts predict Emerson Electric Co. stock to fluctuate between $90.06 (low) and $134.85 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Emerson Electric Co.'s market capitalization?

As of 2025-05-28, Emerson Electric Co.'s market cap is $67,353,750,000, based on 562,500,000 outstanding shares.

How does Emerson Electric Co. compare to competitors like GE Aerospace?

Compared to GE Aerospace, Emerson Electric Co. has a Lower Market-Cap, indicating a difference in performance.

Does Emerson Electric Co. pay dividends?

Emerson Electric Co. pays dividends. The current dividend yield is 1.75%, with a payout of $0.53 per share.

How can I buy Emerson Electric Co. (EMR) stock?

To buy Emerson Electric Co. (EMR) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for EMR. Place an order (Market, Limit, etc.).

What is the best time to invest in Emerson Electric Co.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Emerson Electric Co. stock ever split?

Emerson Electric Co.'s last stock split was 2:1 on 2006-12-12.

How did Emerson Electric Co. perform in the last earnings report?

Revenue: $17,492,000,000 | EPS: $3.44 | Growth: -85.04%.

Where can I find Emerson Electric Co.'s investor relations reports?

Visit https://www.emerson.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Emerson Electric Co.?

You can explore historical data from here

What is the all-time high and low for Emerson Electric Co. stock?

All-time high: $134.85 (2024-12-04) | All-time low: $72.41 (2022-09-27).

What are the key trends affecting Emerson Electric Co. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

247wallst.com

Investors love dividend stocks because they provide dependable passive income streams and an excellent opportunity for solid total return.

seekingalpha.com

Emerson Electric is well-positioned for growth in major megatrend spending cycles, including aerospace & defense, energy & LNG, and industrial automation. Management remains focused on mitigating tariff risks through surcharges and price increases, as well as adjusting its manufacturing footprint and supply chain to minimize impacts to margins. Management is focused on reducing debt, targeting a 2x leverage ratio, and allocating free cash flow to shareholder returns and strategic acquisitions.

seekingalpha.com

Emerson Electric Co. (NYSE:EMR ) Q2 2025 - Earnings Conference Call May 7, 2025 8:30 AM ET Company Participants Colleen Mettler - Vice President-Investor Relations Lal Karsanbhai - President and Chief Executive Officer Mike Baughman - Chief Financial Officer Ram Krishnan - Chief Operating Officer Conference Call Participants Andrew Obin - Bank of America Merrill Lynch Scott Davis - Melius Research Deane Dray - RBC Capital Markets Andy Kaplowitz - Citigroup Steve Tusa - JPMorgan Joe O'Dea - Wells Fargo Katie Fleischer - Keybanc Operator Good morning and welcome to the Emerson Second Quarter 2025 Earnings Conference Call. All participants will be in listen only mode.

zacks.com

The Zacks Manufacturing - Electronics industry benefits from solid momentum across major end markets. ETN, EMR, ENS and POWL are some notable stocks in the industry.

zacks.com

EMR's Q2 results are likely to benefit from solid momentum in the power end market and contributions from acquisitions. However, high operating expenses are likely to have affected its margins.

zacks.com

Emerson Electric (EMR) closed at $105.28 in the latest trading session, marking a +0.22% move from the prior day.

zacks.com

Emerson Electric (EMR) closed the most recent trading day at $101.07, moving +1.28% from the previous trading session.

zacks.com

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Emerson Electric (EMR) have what it takes?

zacks.com

In the latest trading session, Emerson Electric (EMR) closed at $99.57, marking a +0.91% move from the previous day.

zacks.com

EMR gains from strength across most of its businesses and a balanced capital allocation strategy. However, weakness in the Safety & Productivity business remains concerning.

See all news