The Eastern Company (EML)

$

22.37

-0.63 (-2.82%)

Key metrics

Financial statements

Free cash flow per share

115 Thousand

Market cap

137.5 Million

Price to sales ratio

0.5011

Debt to equity

0.5221

Current ratio

2.7700

Income quality

-0.8482

Average inventory

55.3 Million

ROE

-0.0686

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

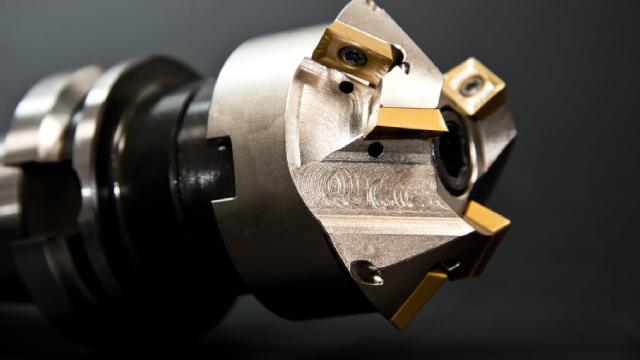

The Eastern Company designs, manufactures, and sells engineered solutions to industrial markets both in the United States and internationally. The company reported a net income ratio of -0.03 reflecting its profitability margin within the competitive landscape. Additionally, it earned an interest income of $0.00 showcasing its financial investments and diversified revenue streams. The net total of other income and expenses stands at -$3,074,684.00 indicating the impact of non-core financial activities. The company's reported depreciation and amortization expenses amount to $5,888,050.00 highlighting the wear and tear of its assets, which are critical to its manufacturing processes. In the market, The Eastern Company's stock is identified with the symbol 'EML', providing investors a vehicle to engage with its business growth and industrial contributions. The stock is affordable at $23.00 making it suitable for budget-conscious investors seeking value. Its low average trading volume of 10,223.00 indicates lower market activity, which could influence liquidity for potential buyers. With a market capitalization of $137,503,692.00 the company is classified as a small-cap player, positioning it uniquely within the investment landscape. It is a key player in the Manufacturing - Tools & Accessories industry, significantly contributing to the overall market landscape while innovating and growing. Furthermore, it belongs to the Industrials sector, driving forward advancements and securing its place within the broader economic framework.

Is The Eastern Company (EML) a good investment?

Investing in The Eastern Company (EML) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as C+, with a Bearish outlook. Always conduct your own research before investing.

What is The Eastern Company (EML)'s stock forecast?

Analysts predict The Eastern Company stock to fluctuate between $19.06 (low) and $35.03 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is The Eastern Company's market capitalization?

As of 2025-05-30, The Eastern Company's market cap is $137,503,692, based on 6,146,790 outstanding shares.

How does The Eastern Company compare to competitors like GE Aerospace?

Compared to GE Aerospace, The Eastern Company has a Lower Market-Cap, indicating a difference in performance.

Does The Eastern Company pay dividends?

The Eastern Company pays dividends. The current dividend yield is 1.83%, with a payout of $0.11 per share.

How can I buy The Eastern Company (EML) stock?

To buy The Eastern Company (EML) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for EML. Place an order (Market, Limit, etc.).

What is the best time to invest in The Eastern Company?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has The Eastern Company stock ever split?

The Eastern Company's last stock split was 3:2 on 2006-10-18.

How did The Eastern Company perform in the last earnings report?

Revenue: $272,751,967 | EPS: -$1.37 | Growth: -199.28%.

Where can I find The Eastern Company's investor relations reports?

Visit https://www.easterncompany.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for The Eastern Company?

You can explore historical data from here

What is the all-time high and low for The Eastern Company stock?

All-time high: $35.78 (2024-03-27) | All-time low: $15.30 (2023-03-16).

What are the key trends affecting The Eastern Company stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

businesswire.com

NEW YORK--(BUSINESS WIRE)--JPMorgan Chase & Co. (NYSE: JPM) (“JPMorganChase” or the “Firm”) plans to host conference calls to review financial results on the following dates: First-quarter 2026 – Tuesday, April 14, 2026 at 8:30 a.m. (Eastern) Second-quarter 2026 – Tuesday, July 14, 2026 at 8:30 a.m. (Eastern) Third-quarter 2026 – Tuesday, October 13, 2026 at 8:30 a.m. (Eastern) Fourth-quarter 2026 – Thursday, January 14, 2027 at 8:30 a.m. (Eastern) The financial results are scheduled to be.

businesswire.com

BOSTON--(BUSINESS WIRE)--Eastern Bank is pleased to welcome David Ciolfi as a Senior Vice President, Team Lead for Business Development with Cambridge Trust Private Banking, a Division of Eastern Bank. Mr. Ciolfi has over two decades of experience in financial and investment advisory services across private banking and wealth offerings. “David Ciolfi brings an entrepreneurial mindset and deep understanding of the private banking and wealth management needs in the Northeast region, and we are th.

accessnewswire.com

Not for distribution to U.S. news wire services or dissemination in the United States TORONTO, ON / ACCESS Newswire / May 20, 2025 / Electric Metals (USA) Limited ("EML" or the "Company") (TSXV:EML)(OTCQB:EMUSF) is pleased to announce the closing of its previously announced non-brokered private placement, raising gross proceeds of C$1,091,999 million. The financing will support the advancement of the Company's Emily Manganese Project in Minnesota, contributing to a critical U.S. domestic supply of high-purity manganese products, including high-purity manganese sulfate monohydrate (HPMSM), for the U.S. electric vehicle battery sector.

newsfilecorp.com

Toronto, Ontario--(Newsfile Corp. - May 20, 2025) - Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) ("Purepoint" or the "Company") is pleased to announce that mobilization is underway for the upcoming summer uranium drill program at its Dorado Project, part of the Purepoint-IsoEnergy Joint Venture in Saskatchewan's eastern Athabasca Basin. Drilling is scheduled to commence on or about May 26, 2025.

accessnewswire.com

Not for distribution to U.S. news wire services or dissemination in the United States. TORONTO, ON / ACCESS Newswire / May 12, 2025 / Electric Metals (USA) Limited ("EML" or the "Company") (TSXV:EML)(OTCQB:EMUSF) is pleased to announce its intention to complete a non-brokered private placement (the "Offering") of up to 10,000,00 units (the "Units") at a price of CAN$0.12 per Unit for gross proceeds of up to CAN$1,200,000.

zacks.com

Eastern's Q1 earnings decline year over year amid heavy-duty truck market slowdown, trims SG&A, boosts efficiency and eyes growth through strategic changes.

seekingalpha.com

The Eastern Company (NASDAQ:EML ) Q1 2025 Earnings Call May 7, 2025 9:00 AM ET Company Participants Marianne Barr - Investor Relations Ryan Schroeder - Chief Executive Officer Nicholas Vlahos - Chief Financial Officer Conference Call Participants Ross Davisson - Banetton Capital Operator Good morning, everyone, and welcome to The Eastern Company's First Quarter Fiscal Year 2025 Earnings Call. [Operator Instructions] Please note this conference is being recorded.

businesswire.com

ROSARIO, Argentina--(BUSINESS WIRE)--Bioceres Crop Solutions Corp. (NASDAQ: BIOX) (“Bioceres” or the “Company”), a leader in the development and commercialization of productivity solutions designed to regenerate agricultural ecosystems while making crops more resilient to climate change, will hold a conference call on Wednesday, May 21, 2025 at 8:30 a.m. Eastern Time to discuss its results for the fiscal third quarter ended March 31, 2025. A press release detailing these results will be issued.

newsfilecorp.com

Vancouver, British Columbia--(Newsfile Corp. - May 9, 2025) - Standard Uranium Ltd. (TSXV: STND) (OTCQB: STTDF) (FSE: 9SU0) ("Standard Uranium" or the "Company") is pleased to announce that it has signed a definitive property option agreement (the "Option Agreement"), dated May 8, 2025, with Vital Battery Metals Inc. (CSE: VBAM) (OTCQB: VBAMF) (FSE: C0O) (the "Optionee"), an arms-length party.

globenewswire.com

PLANTATION, Fla., May 08, 2025 (GLOBE NEWSWIRE) -- Alliance Entertainment Holding Corporation (Nasdaq: AENT), a premier distributor and fulfillment partner of entertainment and pop culture collectibles, will hold a conference call on Thursday, May 15, at 4:30 p.m. Eastern Time to discuss its results for the third quarter ended March 31, 2025. A press release detailing these results will be issued prior to the call.

See all news