WisdomTree Emerging Markets Corporate Bond Fund (EMCB)

$

65.2

+0.02 (0.03%)

Key metrics

Financial statements

Free cash flow per share

Market cap

Price to sales ratio

Debt to equity

Current ratio

Income quality

Average inventory

ROE

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

Under normal circumstances, the fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in corporate debt. The manager attempts to maintain an aggregate portfolio duration of between two and ten years under normal market conditions. The fund may invest up to 20% of its net assets in derivatives, such as swaps and forward currency contracts. It is non-diversified.

News

etftrends.com

a year ago

By Behnood Noei, CFA Director, Fixed Income In 2023, a dominant theme for markets was the return of income in fixed income. Fast-forward to 2024, and despite a significant rally in spreads and a fall in yields during the fourth quarter, we believe this theme is still alive and well.

seekingalpha.com

3 years ago

In emerging markets valuations look attractive today after the losses across financial markets early this year. PIMCO's investment process is founded upon our macroeconomic outlook and our in-house country and credit research.

seekingalpha.com

3 years ago

Performance of emerging markets local currency bonds has been negatively impacted by the U.S. dollar's strength since mid-year, despite the higher real yields and upside growth surprises in many emerging markets. Currency returns can be volatile, and external factors can have a bigger short-term impact on an emerging markets currency (EMFX) even if relatively attractive fundamentals may provide longer-term support.

seekingalpha.com

4 years ago

We review CEF market valuation and performance over the first full week of October and highlight recent market events. The CEF market took advantage of the rally in stocks and mostly shrugged off the continued rise in Treasury yields.

seekingalpha.com

4 years ago

International diversification for bond allocations is, in theory, an attractive concept, but in practice it's not working out so great in 2021 for US investors, based on a set of ETFs. A key headwind for foreign bonds is the rebound in the US dollar.

seekingalpha.com

4 years ago

We have seen a sharp growth in the issuance of not only green bonds but also sustainability bonds and social bonds, which are closely related. When thinking about issuance outside of the corporate space, sovereigns and state-owned enterprises in Latin America are leading in that respect, with Asia closely following.

seekingalpha.com

4 years ago

Emerging markets offer attractive alternatives to fixed income investors searching for yield amid the trillions of dollars of negative-, zero-, and low-yielding debt globally. Within emerging market hard currency investment grade bonds, we think it is prudent to be shorter duration or at least hedge the Treasury risk component, given the low yield per unit of duration today.

etf.com

5 years ago

There's something comforting about the list of the ETFs with the highest trading spreads.

seekingalpha.com

5 years ago

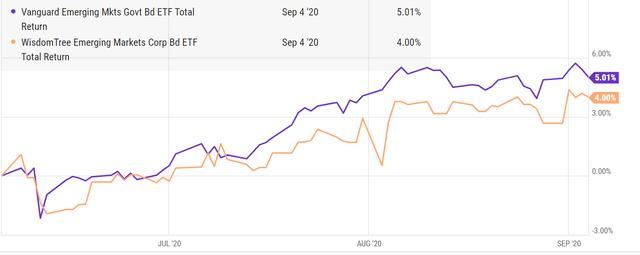

The US dollar has weakened in 2020 and conditions point toward further weakness. EM government bonds historically carry less volatility and risk than EM corporate bonds.

See all news