Crane Company (CR)

$

171.4

-1.87 (-1.09%)

Key metrics

Financial statements

Free cash flow per share

4.2178

Market cap

10 Billion

Price to sales ratio

4.6919

Debt to equity

0.1406

Current ratio

2.0826

Income quality

1.5025

Average inventory

386 Million

ROE

0.2092

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

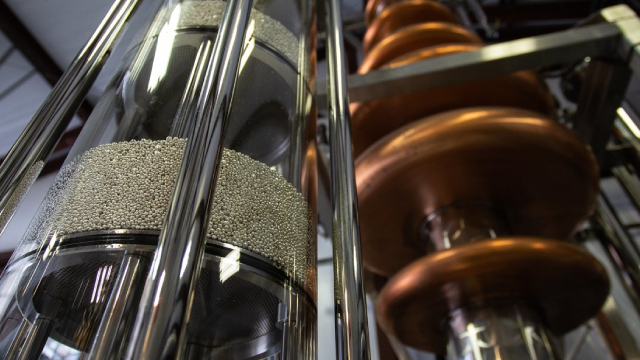

Crane Company, along with its subsidiaries, specializes in the manufacturing and sale of engineered industrial products across diverse regions including the Americas, Europe, the Middle East, Asia, and Australia. The company operates through four distinct segments: Aerospace & Electronics, Process Flow Technologies, Payment & Merchandising Technologies, and Engineered Materials. Within the Aerospace & Electronics segment, critical components and systems are supplied, encompassing original equipment and aftermarket parts primarily targeting the commercial aerospace and military aerospace, defense, and space markets. This segment also includes pressure sensors for aircraft engine control, braking systems for fighter jets, power conversion solutions for spacecraft, and lubrication systems. The Process Flow Technologies segment focuses on engineered fluid handling equipment crucial for mission-critical applications, providing process valves, commercial valves, pumps, and related systems. Meanwhile, Payment & Merchandising Technologies delivers electronic equipment and software rooted in proprietary capabilities that cover payment verification, authentication, automation solutions, remote diagnostics, and productivity-enhancing software solutions. The Engineered Materials segment produces fiberglass-reinforced plastic panels and coils, predominantly serving the recreational vehicle market and applications in commercial and industrial buildings. Crane Company recorded a substantial revenue of $2,131,200,000.00 reflecting its strong market presence, while its operating income ratio is 0.17 indicating the company's operational profitability margin. Additionally, the company earned an interest income of $5,500,000.00 showcasing its financial investments, and reported an operating income of $355,800,000.00 reflecting its earnings from core operations. The net total of other income and expenses is -$17,300,000.00 which underscores its non-core financial activities. In the broader market perspective, the stock is reasonably priced at $173.27 appealing to a broad range of investors seeking opportunities. Despite this attractiveness, the stock has a low average trading volume of 349,309.00 indicating lower market activity compared to its peers. With a mid-range market capitalization of $9,855,703,966.00 the company stands as a steady performer within its industry. It is a key player in the Industrial - Machinery industry, contributing significantly to the overall market landscape, and it belongs to the Industrials sector where it drives continuous innovation and growth.

Is Crane Company (CR) a good investment?

Investing in Crane Company (CR) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B+, with a Bearish outlook. Always conduct your own research before investing.

What is Crane Company (CR)'s stock forecast?

Analysts predict Crane Company stock to fluctuate between $127.04 (low) and $188.52 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Crane Company's market capitalization?

As of 2025-05-30, Crane Company's market cap is $9,855,703,966, based on 57,501,190 outstanding shares.

How does Crane Company compare to competitors like GE Aerospace?

Compared to GE Aerospace, Crane Company has a Lower Market-Cap, indicating a difference in performance.

Does Crane Company pay dividends?

Crane Company pays dividends. The current dividend yield is 0.51%, with a payout of $0.23 per share.

How can I buy Crane Company (CR) stock?

To buy Crane Company (CR) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for CR. Place an order (Market, Limit, etc.).

What is the best time to invest in Crane Company?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has Crane Company stock ever split?

Crane Company's last stock split was 3:2 on 1998-09-15.

How did Crane Company perform in the last earnings report?

Revenue: $2,131,200,000 | EPS: $5.15 | Growth: 14.19%.

Where can I find Crane Company's investor relations reports?

Visit https://www.craneco.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Crane Company?

You can explore historical data from here

What is the all-time high and low for Crane Company stock?

All-time high: $188.52 (2024-11-25) | All-time low: $67.28 (2023-05-04).

What are the key trends affecting Crane Company stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

seekingalpha.com

23 days ago

Crane NXT's stock surged 7% after Q1 2025 results that exceeded analysts' expectations. The company's growth is driven by acquisitions, such as OpSec Security and De La Rue Authentication, aiming for $3 billion in annual revenue by 2028. Despite economic uncertainties and tariff impacts, Crane NXT's long-term prospects remain strong, with management optimistic about achieving high EBITDA margins and significant revenue growth.

globenewswire.com

24 days ago

Completes Acquisition of De La Rue Authentication, a Global Leader in Security and Authentication Technologies Increases Sales Growth Guidance to 6% to 8% for Full Year 2025; Maintaining Full Year EPS Guidance of $4.00 to $4.30 WALTHAM, Mass., May 07, 2025 (GLOBE NEWSWIRE) -- Crane NXT, Co. (NYSE: CXT) ("Crane NXT" or the "Company"), a premier industrial technology company, today announced its financial results for the first quarter ended March 31, 2025.

globenewswire.com

a month ago

WALTHAM, Mass., May 01, 2025 (GLOBE NEWSWIRE) -- Crane NXT, Co. (NYSE: CXT) ("Crane NXT" or the "Company"), a premier industrial technology company, today announced it has completed its acquisition of De La Rue Authentication Solutions, a global leader in security and authentication technologies, complementing the authentication and online brand protection solutions of OpSec Security (“OpSec”) and expanding the Company's portfolio to include security technologies for government-issued identification documents and credentials.

zacks.com

a month ago

Investors need to pay close attention to CR stock based on the movements in the options market lately.

seekingalpha.com

a month ago

Crane Company (NYSE:CR ) Q1 2025 Earnings Conference Call April 29, 2025 10:00 AM ET Company Participants Allison Poliniak - VP, IR Max Mitchell - Chairman, President, & CEO Alex Alcala - EVP & COO Rich Maue - EVP & CFO Conference Call Participants Damian Karas - UBS Scott Deuschle - Deutsche Bank Jeffrey Sprague - Vertical Research Partners Nathan Jones - Stifel Jordan Lyonnais - Bank of America Matt Summerville - D.A. Davidson Justin Ages - CJS Securities Tony Bancroft - Gabelli Funds Operator Welcome to the Crane Company First Quarter 2025 Earnings Conference Call.

https://247wallst.com

a month ago

Live Updates Live Coverage Has Ended S&P 500 Extends Its Winning Streak 4:18 pm The S&P 500 closed up 0.6% for Tuesday, extending its winning streak to six straight days. Trade Talks Keep S&P 500 Moving Higher 1:51 pm “Ask, and ye shall receive.” Investors for example have been asking a lot lately, for proof that President Trump’s tariffs threats will result in trade deals that can benefit the U.S. economy. Today, Treasury Secretary Scott Bessent announced that the conclusion of a trade deal with India is almost set now, with deals with both Japan and South Korea likely to follow in short order. That’s exactly what investors wanted to hear. The S&P 500 is now up 0.7%, and so is “the Voo.” Trump Growls, Amazon Caves 12:13 pm Well, that was quick! No sooner had the White House expressed disapproval of an Amazon plan to inform customers of how much tariffs were raising the cost of goods sold on its site, than Amazon has abandoned the plan. Amazon spokesman Tim Doyle has just tossed the idea under the proverbial bus, admitting he “considered the idea” but it “was never approved and not going to happen.” Commerce Secretary Howard Lutnick (see above) commented: “Good move,” Amazon. Tariffs Threaten Supply Chain, Wall Street Shrugs 10:57 am Gene Seroka, the executive director of the Port of Los Angeles, is warning of a “precipitous drop” in shipments from China as “major American retailers stop … all shipments from China based on the tariffs” announced by President Trump earlier this month. Despite the warning, investors have resumed buying stocks, and the S&P 500 is now in positive territory, up 0.3%. Stock markets opened lower on Tuesday, threatening to break the S&P 500’s five-day winning streak, although the market is moving back towards breakeven now. The S&P 500 opened 0.3% lower this morning, and the Vanguard S&P 500 ETF (NYSEMKT: VOO) likewise opened down 0.3%. T In political news, White House press secretary Karoline Leavitt blasted a reported plan by Amazon.com (Nasdaq: AMZN), to display the cost of wares on its site next to the amount the cost was inflated by tariffs cost, as a “hostile and political act.” Things could be worse, though. Last night, Commerce Secretary Howard Lutnick promised to “reward … companies who manufacture domestically” by reducing tariffs on foreign auto parts used to manufacture cars in the U.S. General Motors (NYSE: GM) CEO Mary Barra responded to the news by promising to “invest even more in the U.S. economy.” Ford (NYSE: F) CEO agreed that the move “will help mitigate the impact of tariffs on automakers, suppliers and consumers.” Earnings Speaking of General Motors, the automotive giant reported this morning that its Q1 profits came in at $2.78, $0.17 ahead of analyst forecasts. Commercial truckmaker Paccar (Nasdaq: PCAR) on the other hand reported profits $0.14 below forecasts. In housing, we see LGI Homes (Nasdaq: LGIH) miss badly, but paintmaker Sherwin-Williams (NYSE: SHW) beat. In airlines, Jetblue Airways (Nasdaq: JBLU) reported a $0.59 per share loss, but this was $0.02 better than the $0.61 per share loss it was expected to report. Analyst Calls Analyst action is so far muted. Swiss bank UBS upgraded cranemaker Crane (NYSE: CR) to buy. Tariffs war and “market uncertainty” notwithstanding, UBS says it’s “increasingly confident in the long-term earnings outlook and M&A opportunity” for the company. Not everyone’s so confident, however. Already this morning we’re seeing downgrades outnumber upgrades, with Stifel cutting Builders FirstSource (Nasdaq: BLDR) to neutral, Bank of America lowering ConocoPhillips (NYSE: COP), also to neutral, and TD Cowen downgrading GLP-1 drugs compounder Hims & Hers (NYSE: HIMS) to hold, citing increased competition from Novo Nordisk (NYSE: NVO) and Eli Lilly (NYSE: LLY), and a lack of near-term catalysts to move the stock higher. The post S&P 500 (VOO) Live: Trump Administration Blasts Amazon.com, and the S&P 500 Tumbles appeared first on 24/7 Wall St..

businesswire.com

a month ago

STAMFORD, Conn.--(BUSINESS WIRE)--Crane Company ("Crane," NYSE: CR) today announced its financial results for the first quarter of 2025 and reaffirmed its full-year adjusted EPS outlook. Max Mitchell, Crane's Chairman, President and Chief Executive Officer, stated: "We delivered a very strong start to 2025, with exceptional results in the first quarter of 24.1% adjusted EPS growth driven by 7.5% core sales growth and strong operating leverage. Furthermore, demand trends across our strategic gro.

businesswire.com

2 months ago

STAMFORD, Conn.--(BUSINESS WIRE)--Crane Company (NYSE: CR) announces the following schedule and teleconference information for its first quarter 2025 earnings release: Earnings Release: April 28, 2025 after close of market by public distribution and the Crane Company website at www.craneco.com. Teleconference: April 29, 2025 at 10:00 AM (Eastern) hosted by Max H. Mitchell, President & CEO, Alex Alcala, Executive Vice President & COO, and Richard A. Maue, Executive Vice President & C.

globenewswire.com

2 months ago

WALTHAM, Mass., March 26, 2025 (GLOBE NEWSWIRE) -- Crane NXT, Co. (NYSE: CXT), a premier industrial technology company, today announced its schedule for the company's first quarter 2025 results.

businesswire.com

3 months ago

LONDONDERRY TOWNSHIP, Pa.--(BUSINESS WIRE)--Five months after announcing plans to restart Three Mile Island Unit 1 and launch the Crane Clean Energy Center, Constellation is ahead of schedule.

See all news