Coinbase Global, Inc. (COIN)

$

164.32

+23.23 (14.14%)

Key metrics

Financial statements

Free cash flow per share

1.2146

Market cap

44.3 Billion

Price to sales ratio

6.8886

Debt to equity

0.5177

Current ratio

7.8942

Income quality

0.1013

Average inventory

0

ROE

0.0944

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

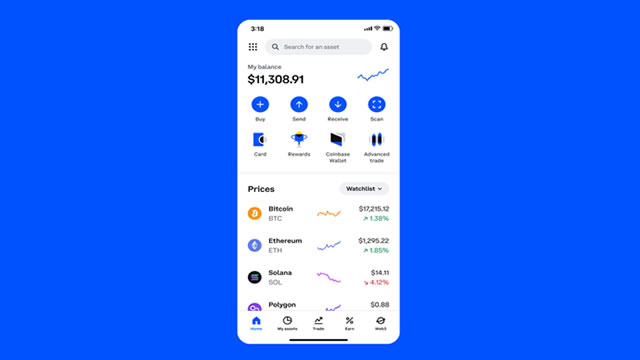

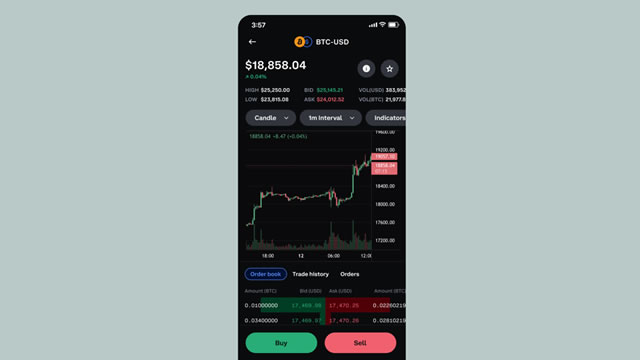

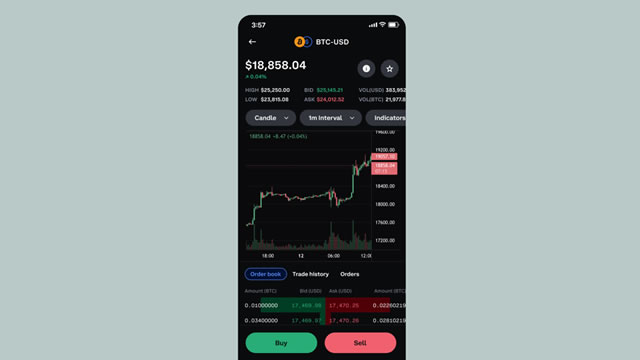

Coinbase Global, Inc. operates as a leading provider of financial infrastructure and technology for the cryptoeconomy, offering a range of services both in the United States and globally. The company incurred an income tax expense of $261,738,000.00 indicating its tax obligations. It recorded an operating income of $906,584,000.00 reflecting its earnings from core operations. The company's performance is further highlighted by the gross profit ratio of 0.82 which reflects the efficiency of its production and sales operations. Additionally, the net total of other income and expenses is $615,481,000.00 showcasing the impact of non-core financial activities on its overall profitability. Ultimately, Coinbase reported an income before tax of $1,522,065,000.00 demonstrating its pre-tax profitability and the strength of its financial performance in the evolving crypto landscape. In the competitive market, the stock is priced at $342.46 positioning it in the higher-end market. The stock has a high average trading volume of 10,428,329.00 indicating strong liquidity and investor interest. With a large market capitalization of $44,310,138,804.00 the company is a dominant player in the industry. It is a key player in the crypto industry, contributing significantly to the overall market landscape. Moreover, it belongs to the Financial Services sector, driving innovation and growth as it continues to expand its offerings and enhance its technological capabilities across the cryptoeconomy.

Is Coinbase Global, Inc. (COIN) a good investment?

Investing in Coinbase Global, Inc. (COIN) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B-, with a Bearish outlook. Always conduct your own research before investing.

What is Coinbase Global, Inc. (COIN)'s stock forecast?

Analysts predict Coinbase Global, Inc. stock to fluctuate between $139.36 (low) and $444.65 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Coinbase Global, Inc.'s market capitalization?

As of 2026-02-13, Coinbase Global, Inc.'s market cap is $44,310,138,804, based on 269,657,612 outstanding shares.

How does Coinbase Global, Inc. compare to competitors like Meta Platforms, Inc. Class A Common Stock?

Compared to Meta Platforms, Inc. Class A Common Stock, Coinbase Global, Inc. has a Lower Market-Cap, indicating a difference in performance.

How can I buy Coinbase Global, Inc. (COIN) stock?

To buy Coinbase Global, Inc. (COIN) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for COIN. Place an order (Market, Limit, etc.).

What is the best time to invest in Coinbase Global, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

How did Coinbase Global, Inc. perform in the last earnings report?

Revenue: $6,631,764,000 | EPS: $4.85 | Growth: -53.45%.

Where can I find Coinbase Global, Inc.'s investor relations reports?

Visit https://www.coinbase.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Coinbase Global, Inc.?

You can explore historical data from here

What is the all-time high and low for Coinbase Global, Inc. stock?

All-time high: $444.65 (2025-07-18) | All-time low: $31.55 (2023-01-06).

What are the key trends affecting Coinbase Global, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

seekingalpha.com

Coinbase remains a compelling long-term "Buy" after a ~50% decline, supported by resilient institutional participation and cost discipline. COIN is executing well amid a tough crypto environment, laying groundwork for profitable expansion when market conditions improve. Institutional trading revenue grew 31% y/y to $185 million, helping stabilize COIN's business as retail trading wanes.

zacks.com

COIN's Q4 results reflect lower consumer transaction revenues and other transaction revenues, higher operating expenses and reduced adjusted EBITDA.

zacks.com

Coinbase's Q4 earnings miss and a 65% stock plunge since October put COIN under pressure, but ETFs offer a way to stay in the crypto game.

seekingalpha.com

Coinbase reported Q4 2025 earnings a couple of days ago. If I had to use one word to summarize the earnings print, ugly is the word I'd have chosen. As I explained in a macro analysis a few days ago, empirical evidence suggests the crypto winter may last much longer. This is bad news for Coinbase. A closer look at CFO Alesia Haas's comments on the Q3 and Q4 earnings calls and the guidance for Q1 2026 suggests that Coinbase has a new priority for 2026.

proactiveinvestors.com

Coinbase Global Inc (NASDAQ:COIN) reported fourth quarter 2025 results that fell short of analyst expectations as crypto market activity softened during the period. The company posted revenue of $1.78 billion for the quarter, below the $1.85 billion consensus estimate, while earnings per share came in at $0.66 versus the $1.05 forecast.

finbold.com

February 12 proved an eventful day for Coinbase (NASDAQ: COIN) as the cryptocurrency exchange unveiled a disappointing earnings report and revealed an apparent trading stoppage that ultimately led to a 7.90% one-session drop in the stock market.

seekingalpha.com

Coinbase Global, Inc. (COIN) Q4 2025 Earnings Call Transcript

zacks.com

Although the revenue and EPS for Coinbase Global (COIN) give a sense of how its business performed in the quarter ended December 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

pymnts.com

The digital asset economy's early growth was driven primarily by speculative trading. It still is today.

marketwatch.com

The crypto exchange's stock bounced off a two-year low as it looked to ease investor worries amid a sharp crypto selloff.

See all news