Comcast Corporation (CMCSA)

$

34.28

-0.35 (-1.02%)

Key metrics

Financial statements

Free cash flow per share

3.9935

Market cap

129 Billion

Price to sales ratio

1.0438

Debt to equity

1.1441

Current ratio

0.6453

Income quality

1.8264

Average inventory

0

ROE

0.1842

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

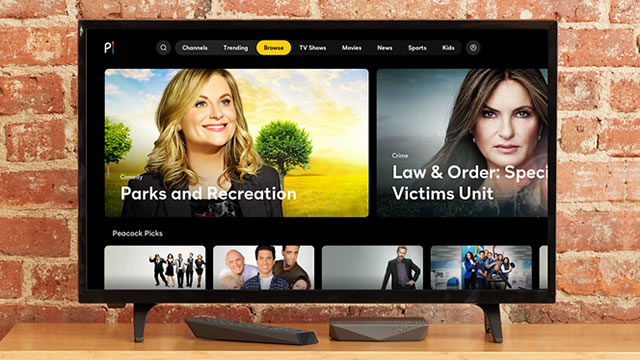

Comcast Corporation operates globally as a media and technology company, delivering a diverse range of services through its various segments, including Cable Communications, Media, Studios, Theme Parks, and Sky. The Cable Communications segment provides broadband, video, voice, wireless, and additional services to both residential and business customers under the Xfinity brand, alongside comprehensive advertising services. This segment's gross profit stands at $86,705,000,000.00 highlighting the company's profitability from core operations. Additionally, the company recorded an operating income of $23,297,000,000.00 reflecting its earnings from these operations. The operating expenses amount to $63,408,000,000.00 encompassing various operational costs incurred in delivering its services. Furthermore, the net total of other income and expenses is -$4,624,000,000.00 reflecting non-core financial activities. The Media segment manages NBCUniversal's television and streaming platforms, featuring national, regional, and international cable networks, as well as the NBC and Telemundo broadcasts and Peacock networks. Meanwhile, the Studios segment oversees NBCUniversal's film and television studio production and distribution operations. Comcast's Theme Parks segment operates Universal theme parks across multiple locations, including Orlando, Florida; Hollywood, California; Osaka, Japan; and Beijing, China. The Sky segment offers direct-to-consumer services, such as video, broadband, voice, and wireless phone services, in addition to its entertainment networks, the Sky News broadcast network, and Sky Sports networks. Notably, the company owns the Philadelphia Flyers and the Wells Fargo Center arena in Philadelphia, Pennsylvania, while also providing the streaming service Peacock. Founded in 1963, Comcast Corporation is headquartered in Philadelphia, Pennsylvania. The stock is affordable at $34.28 making it suitable for budget-conscious investors who are seeking entry points into the market. Furthermore, it has a high average trading volume of 25,597,675.00 indicating strong liquidity, which attracts active traders. With a large market capitalization of $127,667,632,800.00 the company is a dominant player, establishing a significant presence within the media and technology landscape. It is a key player in the Telecommunications Services industry, contributing significantly to the overall market landscape, showcasing its influence and capability. As it belongs to the Communication Services sector, Comcast drives innovation and growth, positioning itself strategically for future opportunities and challenges within the dynamic environment it operates in.

Is Comcast Corporation (CMCSA) a good investment?

Investing in Comcast Corporation (CMCSA) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as A, with a Bearish outlook. Always conduct your own research before investing.

What is Comcast Corporation (CMCSA)'s stock forecast?

Analysts predict Comcast Corporation stock to fluctuate between $31.44 (low) and $45.31 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Comcast Corporation's market capitalization?

As of 2025-05-29, Comcast Corporation's market cap is $127,667,632,800, based on 3,724,260,000 outstanding shares.

How does Comcast Corporation compare to competitors like T-Mobile US, Inc.?

Compared to T-Mobile US, Inc., Comcast Corporation has a Lower Market-Cap, indicating a difference in performance.

Does Comcast Corporation pay dividends?

Comcast Corporation pays dividends. The current dividend yield is 3.73%, with a payout of $0.33 per share.

How can I buy Comcast Corporation (CMCSA) stock?

To buy Comcast Corporation (CMCSA) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for CMCSA. Place an order (Market, Limit, etc.).

What is the best time to invest in Comcast Corporation?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has Comcast Corporation stock ever split?

Comcast Corporation's last stock split was 2:1 on 2017-02-21.

How did Comcast Corporation perform in the last earnings report?

Revenue: $123,731,000,000 | EPS: $4.14 | Growth: 10.99%.

Where can I find Comcast Corporation's investor relations reports?

Visit https://corporate.comcast.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Comcast Corporation?

You can explore historical data from here

What is the all-time high and low for Comcast Corporation stock?

All-time high: $61.80 (2021-09-02) | All-time low: $28.39 (2022-10-13).

What are the key trends affecting Comcast Corporation stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

seekingalpha.com

Comcast remains a 'strong buy' due to its undervalued stock price and long-term growth potential, despite recent revenue declines in legacy segments. The Connectivity & Platforms business, especially domestic wireless and broadband, is driving growth, offsetting declines in video and voice revenue. Management is proactively addressing challenges with initiatives like Project Genesis, network upgrades, and a five-year price guarantee to retain customers.

zacks.com

Comcast (CMCSA) closed the most recent trading day at $34.63, moving -0.92% from the previous trading session.

prnewswire.com

$6.1M Broadband Expansion Brings Local Connectivity, New Services and Community Support to Greenwood GREENWOOD, S.C. , May 23, 2025 /PRNewswire/ -- Comcast has completed an American Rescue Plan Act State and Local Fiscal Recovery Funds grant expansion project, with a $6.1 million program subsidy, in Greenwood, South Carolina.

proactiveinvestors.co.uk

In a film industry where financing has become scarce and mid-budget projects are often left to languish, Eli Roth is defying the narrative. His newly launched production company, The Horror Section, isn't just about making films.

investopedia.com

More people are paying to watch ads while they stream video, according to new research.

benzinga.com

BofA Securities analyst Jessica Reif Ehrlich maintained a Buy rating on Charter Communications, Inc. CHTR last Friday, with a price target of $450.

seekingalpha.com

Comcast Corporation (NASDAQ:CMCSA ) MoffettNathanson 2025 Media, Internet & Communications Conference May 15, 2025 8:50 AM ET Company Participants Jason Armstrong - Chief Financial Officer Conference Call Participants Craig Moffett - MoffettNathanson Craig Moffett Good morning everybody and thank you for joining us for today's session with Comcast and for the Moffett-Nathanson Media, Internet, and Communications Conference, our 12th. Jason, thank you for being here.

businesswire.com

PHILADELPHIA--(BUSINESS WIRE)--Xfinity Unlocks Free Access To Sunday Night Soccer on MLS Season Pass For All Customers.

deadline.com

Media and technology shares followed broader markets higher as the U.S. and China announced a 90-day pause in punishing tariffs that risked economic havoc on both nations.

cnbc.com

Media giants' annual pitch to advertisers kicks off in the Upfronts this week, and discussions are clouded by economic uncertainty. Media ad chiefs say chief marketing officers across industries are making contingency plans in light of the trade war.

See all news