Bel Fuse Inc. (BELFB)

$

201.19

-9.25 (-4.60%)

Key metrics

Financial statements

Free cash flow per share

3.6079

Market cap

2.5 Billion

Price to sales ratio

3.9074

Debt to equity

0.5832

Current ratio

3.0584

Income quality

0.8014

Average inventory

165.4 Million

ROE

0.1661

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

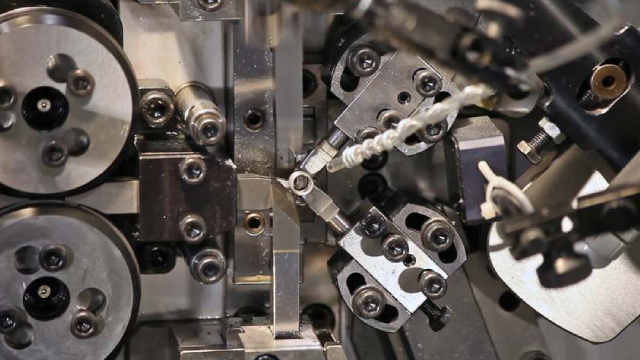

Bel Fuse Inc. designs, manufactures, markets, and sells a wide array of products employed across various industries, including networking, telecommunication, high-speed data transmission, commercial aerospace, military, broadcasting, transportation, e-Mobility, and consumer electronics, both domestically in the United States and internationally in regions such as Macao, the United Kingdom, Slovakia, Germany, and Switzerland. The company's diverse range of offerings includes magnetic products, such as integrated connector modules, power transformers, SMD power inductors, and SMPS transformers, along with ethernet discrete components. Additionally, it provides power solutions and protection products that encompass front-end power supplies, board-mount power, industrial power, external power sources, and circuit protection products. Connectivity solutions are another key area, featuring expanded beam fiber optic connectors, cable assemblies, active optical devices, copper-based connectors, radio frequency connectors, microwave devices, low loss cables, as well as ethernet, I/O, and industrial and power connectivity products. Bel Fuse Inc. sells its products under a variety of respected brand names, including Bel, TRP Connector, MagJack, Signal, Bel Power Solutions, Melcher, CUI, Stratos, Fibreco, Cinch, Johnson, Trompeter, Midwest Microwave, Semflex, and Stewart Connector. The operating expenses amount to $138,061,000.00 encompassing various operational costs incurred. The company earned an interest income of $4,754,000.00 showcasing its financial investments. It recorded an operating income of $64,297,000.00 reflecting its earnings from core operations, while the gross profit stands at $202,358,000.00 highlighting the company's profitability from its primary activities. The company's stock is identified with the symbol '$BELFB' in the market. The stock is reasonably priced at $ 142.08 appealing to a broad range of investors despite the low average trading volume of 162,113.00 indicating lower market activity. With a market capitalization of $ 2,537,395,404.00 the company is classified as a small-cap player, establishing itself as a key player in the Hardware, Equipment & Parts industry and contributing significantly to the overall market landscape. It belongs to the Technology sector, driving innovation and growth, thereby enhancing its position and reputation within the diverse sectors of technology and manufacturing.

Is Bel Fuse Inc. (BELFB) a good investment?

Investing in Bel Fuse Inc. (BELFB) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B, with a Bullish outlook. Always conduct your own research before investing.

What is Bel Fuse Inc. (BELFB)'s stock forecast?

Analysts predict Bel Fuse Inc. stock to fluctuate between $58 (low) and $214.32 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Bel Fuse Inc.'s market capitalization?

As of 2026-01-30, Bel Fuse Inc.'s market cap is $2,537,395,404, based on 12,611,936 outstanding shares.

How does Bel Fuse Inc. compare to competitors like Nvidia Corp?

Compared to Nvidia Corp, Bel Fuse Inc. has a Lower Market-Cap, indicating a difference in performance.

Does Bel Fuse Inc. pay dividends?

Bel Fuse Inc. pays dividends. The current dividend yield is 0.14%, with a payout of $0.07 per share.

How can I buy Bel Fuse Inc. (BELFB) stock?

To buy Bel Fuse Inc. (BELFB) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for BELFB. Place an order (Market, Limit, etc.).

What is the best time to invest in Bel Fuse Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Bel Fuse Inc. stock ever split?

Bel Fuse Inc.'s last stock split was 2:1 on 1999-12-02.

How did Bel Fuse Inc. perform in the last earnings report?

Revenue: $534,792,000 | EPS: $3.26 | Growth: -43.60%.

Where can I find Bel Fuse Inc.'s investor relations reports?

Visit https://www.belfuse.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Bel Fuse Inc.?

You can explore historical data from here

What is the all-time high and low for Bel Fuse Inc. stock?

All-time high: $214.32 (2026-01-28) | All-time low: $11.58 (2022-02-24).

What are the key trends affecting Bel Fuse Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

globenewswire.com

WEST ORANGE, N.J., Jan. 15, 2026 (GLOBE NEWSWIRE) -- Bel Fuse Inc. (Nasdaq: BELFA and BELFB) (“Bel” or “the Company”), a leading global manufacturer of products that power, protect and connect electronic circuits, is pleased to announce the appointment of Tom Smelker as President of Connectivity Solutions, effective January 26, 2026.

globenewswire.com

WEST ORANGE, N.J., Jan. 15, 2026 (GLOBE NEWSWIRE) -- Bel Fuse Inc. (Nasdaq: BELFA and BELFB) (“Bel” or “the Company”), a leading global manufacturer of products that power, protect and connect electronic circuits, today announced the anticipated retirement of Pete Bittner, President of Connectivity Solutions, effective April 3, 2026 after more than three decades of dedicated service.

zacks.com

Electronics stocks like TER, FLEX and BELFB are expected to benefit from investments in infrastructure and expanded capacity despite macroeconomic headwinds.

globenewswire.com

WEST ORANGE, N.J., Dec. 03, 2025 (GLOBE NEWSWIRE) -- Bel Fuse Inc. (Nasdaq: BELFA and BELFB) (“Bel” or “the Company”), a leading global manufacturer of products that power, protect and connect electronic circuits, today announced an anticipated impairment charge related to its noncontrolling minority investment in innolectric AG (“Innolectric”), a Germany-based e-Mobility technology company. As previously disclosed, Bel acquired a noncontrolling one-third (1/3) minority stake in Innolectric in February 2023, as a rising leader in the eMobility market driven by its innovative power products, strong intellectual property portfolio, and talented engineering team. Despite these strengths, factors including the exit of certain companies from the market, the softening of government incentives, and persistent weakness in the global electric vehicle (EV) sector have delayed high-volume sales and resulted in continued operating losses for Innolectric over the past two years. With challenges expected to persist heading into 2026 for Innolectric, Bel was informed by Innolectric's controlling majority owner that it would be unable to provide its pro-rata share of future funding. Bel also lacked interest in acquiring the remaining stake in Innolectric from the controlling majority owner. Subsequently, Bel was advised that on November 26, 2025, insolvency proceedings were initiated pursuant to an application submitted within the German legal system with respect to Innolectric.

zacks.com

Investors interested in Electronics - Miscellaneous Products stocks are likely familiar with Kimball Electronics (KE) and Bel Fuse (BELFB). But which of these two stocks offers value investors a better bang for their buck right now?

seekingalpha.com

Bel Fuse Inc. (BELFB) is upgraded to Buy after Q3 2025 results confirmed a strong inflection point, driven by robust revenue and margin growth. BELFB's Power Solutions segment led with 94% YoY growth, margins near 40%, and management guides for record FY2025 revenue and EBITDA. Valuation remains attractive at ~15.6x forward EV/EBITDA, with a target price range of $160-$185, supported by margin strength and low leverage.

globenewswire.com

WEST ORANGE, N.J., Oct. 31, 2025 (GLOBE NEWSWIRE) -- BEL FUSE INC. (NASDAQ:BELFA) and (NASDAQ:BELFB) today announced that its Board of Directors has declared regular quarterly cash dividends of $0.06 per share on the Company's Class A common shares and $0.07 per share on the Company's Class B common shares.

globenewswire.com

WEST ORANGE, N.J., Oct. 31, 2025 (GLOBE NEWSWIRE) -- Bel Fuse Inc. (Nasdaq: BELFA and BELFB), a leading global manufacturer of products that power, protect and connect electronic circuits, today announced its investor conference schedule for November 2025:

zacks.com

The headline numbers for Bel Fuse (BELFB) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

zacks.com

Bel Fuse (BELFB) came out with quarterly earnings of $2.09 per share, beating the Zacks Consensus Estimate of $1.68 per share. This compares to earnings of $0.92 per share a year ago.

See all news