AeroVironment, Inc. (AVAV)

$

248.93

+1.46 (0.59%)

Key metrics

Financial statements

Free cash flow per share

-0.4876

Market cap

12.4 Billion

Price to sales ratio

15.7774

Debt to equity

0.0725

Current ratio

3.5230

Income quality

-0.0302

Average inventory

146 Million

ROE

0.0506

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

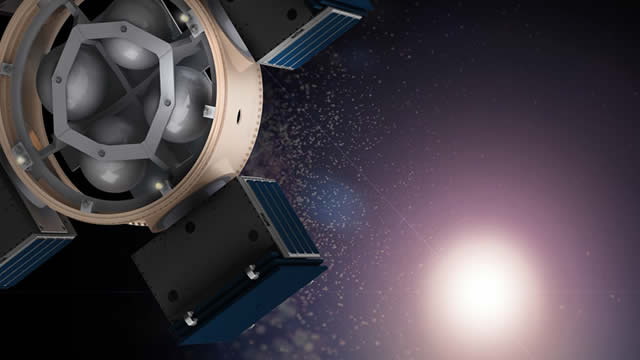

AeroVironment, Inc. designs, develops, produces, delivers, and supports a comprehensive portfolio of robotic systems and associated services for government agencies and businesses both in the United States and globally. The company operates through four segments: Unmanned Aircraft Systems (UAS), Tactical Missile System (TMS), Medium Unmanned Aircraft Systems (MUAS), and High Altitude Pseudo-Satellite Systems (HAPS). AeroVironment supplies UAS, TMS, unmanned ground vehicles, and related services primarily to organizations within the U.S. Department of Defense and to international allied governments. It also engages in the design, engineering, tooling, and manufacturing of unmanned aerial systems, including airborne platforms, payloads and their integration, ground control systems, and ground support equipment among other key items and services related to unmanned aircraft systems. In the fiscal year 2025 the company incurred an interest expense of -$2,188,000.00 reflecting its debt servicing obligations. The total costs and expenses for the company are $0.00 indicating its overall spending. Furthermore, the weighted average number of shares outstanding is 28,019,000.00 highlighting the company's shareholder base. The EBITDA ratio is 0.06 demonstrating the company's operational efficiency, while it continues to innovate within the sector. The stock is reasonably priced at $265.00 appealing to a broad range of investors. Despite a low average trading volume of 1,444,617.00 which indicates lower market activity, AeroVironment remains a steady performer with a mid-range market capitalization of $12,429,622,546.00. It is a key player in the Aerospace & Defense industry, contributing significantly to the overall market landscape. Moreover, it belongs to the Industrials sector, driving innovation and growth, which fosters a strong competitive position in the market. This combination of reasonable stock pricing, solid performance, and an influential market presence positions AeroVironment favorably for current and potential stakeholders.

Is AeroVironment, Inc. (AVAV) a good investment?

Investing in AeroVironment, Inc. (AVAV) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as C+, with a Bullish outlook. Always conduct your own research before investing.

What is AeroVironment, Inc. (AVAV)'s stock forecast?

Analysts predict AeroVironment, Inc. stock to fluctuate between $102.25 (low) and $295.90 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is AeroVironment, Inc.'s market capitalization?

As of 2025-08-28, AeroVironment, Inc.'s market cap is $12,429,622,546, based on 49,932,200 outstanding shares.

How does AeroVironment, Inc. compare to competitors like GE Aerospace?

Compared to GE Aerospace, AeroVironment, Inc. has a Lower Market-Cap, indicating a difference in performance.

How can I buy AeroVironment, Inc. (AVAV) stock?

To buy AeroVironment, Inc. (AVAV) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for AVAV. Place an order (Market, Limit, etc.).

What is the best time to invest in AeroVironment, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

How did AeroVironment, Inc. perform in the last earnings report?

Revenue: $692,722,000 | EPS: $1.56 | Growth: -28.77%.

Where can I find AeroVironment, Inc.'s investor relations reports?

Visit https://www.avinc.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for AeroVironment, Inc.?

You can explore historical data from here

What is the all-time high and low for AeroVironment, Inc. stock?

All-time high: $295.90 (2025-06-30) | All-time low: $52.03 (2022-01-28).

What are the key trends affecting AeroVironment, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

marketbeat.com

The nature of warfare and the defense sector is changing. The modern battlefield is no longer defined solely by large, expensive tanks and fighter jets, but increasingly by swarms of small, intelligent, and autonomous systems.

zacks.com

In the closing of the recent trading day, AeroVironment (AVAV) stood at $245.9, denoting a +1.97% move from the preceding trading day.

prnewswire.com

Next-generation platform offers ultra-low latency, high scalability, and real-world deployment flexibility for connected vehicles ASHBURN, Va. , Aug. 26, 2025 /PRNewswire/ -- INTEGRITY Security Services™ (ISS), the global leader in end-to-end embedded cybersecurity solutions, announced today a technology partnership with AeroVironment, Inc. ("AV") (NASDAQ: AVAV), a leading provider of all-domain defense technologies and Artificial Intelligence-enabled transportation management systems.

businesswire.com

ARLINGTON, Va.--(BUSINESS WIRE)--AeroVironment, Inc. (“AV”) (NASDAQ: AVAV) will report its financial results for the first quarter of fiscal year 2026, which ended August 2, 2025, after the market closes on September 9, 2025. Management will host a conference call and live audio webcast at 4:30 p.m. Eastern Time that same day to discuss the results. The call will be led by Wahid Nawabi, AeroVironment's chairman, president, and chief executive officer; Kevin P. McDonnell, executive vice presiden.

businesswire.com

ARLINGTON, Va.--(BUSINESS WIRE)--AV has delivered its P550 sUAS to the U.S. Army as part of the Long Range Reconnaissance (LRR) program to support Transformation in Contact brigades.

benzinga.com

Needham analyst Austin Bohlig initiated coverage on AeroVironment, Inc AVAV with a Buy rating and a price target of $300.

globenewswire.com

ANDOVER, Mass., Aug. 19, 2025 (GLOBE NEWSWIRE) -- Mercury Systems, Inc. (NASDAQ: MRCY, www.mrcy.com), a technology company that delivers mission-critical processing to the edge, today announced a new production agreement with AeroVironment, Inc. (“AV”) (NASDAQ: AVAV) to support the U.S. Space Force's Satellite Communication Augmentation Resource (SCAR) program.

zacks.com

In the closing of the recent trading day, AeroVironment (AVAV) stood at $259.61, denoting a -1.33% move from the preceding trading day.

zacks.com

In the most recent trading session, AeroVironment (AVAV) closed at $260.07, indicating a -2.83% shift from the previous trading day.

zacks.com

AeroVironment (AVAV) reached $262.48 at the closing of the latest trading day, reflecting a -3.56% change compared to its last close.

See all news