Avino Silver & Gold Mines Ltd. (ASM)

$

10.15

+1.19 (11.72%)

Key metrics

Financial statements

Free cash flow per share

0.0634

Market cap

1.6 Billion

Price to sales ratio

18.4977

Debt to equity

0.0256

Current ratio

2.7543

Income quality

1.5506

Average inventory

11.3 Million

ROE

0.1456

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

Avino Silver & Gold Mines Ltd., along with its subsidiaries, is actively involved in the acquisition, exploration, and development of mineral properties across Canada, with a strong focus on finding silver, gold, and copper deposits. The company's extensive portfolio includes ownership in 42 mineral claims and four leased mineral claims, highlighted by the Avino mine area property, which consists of four exploration concessions covering 154.4 hectares and 24 exploitation concessions spanning 1,284.7 hectares. Additionally, it holds one leased exploitation concession covering 98.83 hectares. Other notable properties include the Gomez Palacio property with nine exploration concessions totaling 2,549 hectares, the Santiago Papasquiaro property comprising four exploration concessions covering 2,552.6 hectares and one exploitation concession of 602.9 hectares, and the Unification La Platosa properties, containing three leased concessions situated in Durango, Mexico. The company also has 100% interests in the Minto and Olympic-Kelvin properties located in British Columbia, as well as 14 quartz leases in the Eagle property within the Mayo Mining Division of Yukon, Canada. Financially, the net income ratio is 0.12 reflecting the company's profitability margin, while the gross profit stands at $23,201,000.00 highlighting the profitability from its core operations. Additionally, the company incurred an interest expense of $387,000.00 demonstrating its debt servicing obligations. The gross profit ratio is 0.35 indicating the efficiency of the company's production and sales operations, and the operating income ratio is 0.22 which further illustrates the company’s operational profitability margin. In the stock market, the company is perceived as an appealing option, with the stock being affordable at $4.65 catering to budget-conscious investors. The stock also boasts a high average trading volume of 6,339,995.00 reflecting strong liquidity, which is essential for investors looking to enter or exit positions comfortably. With a market capitalization of $1,592,007,200.00 the company is classified as a small-cap player, positioning it uniquely within the investment landscape. Avino Silver & Gold Mines Ltd. is a key player in the Other Precious Metals industry, contributing significantly to the overall market landscape, and it belongs to the Basic Materials sector, where it drives both innovation and growth in the mining sector.

Is Avino Silver & Gold Mines Ltd. (ASM) a good investment?

Investing in Avino Silver & Gold Mines Ltd. (ASM) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B, with a Bullish outlook. Always conduct your own research before investing.

What is Avino Silver & Gold Mines Ltd. (ASM)'s stock forecast?

Analysts predict Avino Silver & Gold Mines Ltd. stock to fluctuate between $1.15 (low) and $11.99 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Avino Silver & Gold Mines Ltd.'s market capitalization?

As of 2026-02-06, Avino Silver & Gold Mines Ltd.'s market cap is $1,592,007,200, based on 156,848,000 outstanding shares.

How does Avino Silver & Gold Mines Ltd. compare to competitors like Southern Copper Corporation?

Compared to Southern Copper Corporation, Avino Silver & Gold Mines Ltd. has a Lower Market-Cap, indicating a difference in performance.

How can I buy Avino Silver & Gold Mines Ltd. (ASM) stock?

To buy Avino Silver & Gold Mines Ltd. (ASM) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for ASM. Place an order (Market, Limit, etc.).

What is the best time to invest in Avino Silver & Gold Mines Ltd.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Avino Silver & Gold Mines Ltd. stock ever split?

Avino Silver & Gold Mines Ltd.'s last stock split was 1:5 on 1995-09-26.

How did Avino Silver & Gold Mines Ltd. perform in the last earnings report?

Revenue: $66,178,000 | EPS: $0.06 | Growth: 1,233.33%.

Where can I find Avino Silver & Gold Mines Ltd.'s investor relations reports?

Visit https://www.avino.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Avino Silver & Gold Mines Ltd.?

You can explore historical data from here

What is the all-time high and low for Avino Silver & Gold Mines Ltd. stock?

All-time high: $11.99 (2026-01-29) | All-time low: $0.40 (2023-11-01).

What are the key trends affecting Avino Silver & Gold Mines Ltd. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

zacks.com

In the closing of the recent trading day, Avino Silver (ASM) stood at $10.38, denoting a -2.54% move from the preceding trading day.

zacks.com

Avino Silver (ASM) closed the most recent trading day at $11.02, moving 1.96% from the previous trading session.

zacks.com

Here is how Avino Silver (ASM) and Nexa Resources S.A. (NEXA) have performed compared to their sector so far this year.

zacks.com

Avino Silver posts 9% year-over-year rise in Q4 silver-equivalent output, lifted by La Preciosa, even as full-year production slips 2% but meets guidance.

accessnewswire.com

VANCOUVER, BC / ACCESS Newswire / January 26, 2026 / Avino Silver & Gold Mines Ltd. (TSX:ASM)(NYSE American:ASM)(FSE:GV6)( "Avino" or "the Company") reports results of six drill holes from La Preciosa, completing the Company's 2025 program.

zacks.com

Avino Silver (ASM) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term.

accessnewswire.com

VANCOUVER, BC / ACCESS Newswire / January 22, 2026 / Avino Silver & Gold Mines Ltd. (TSX:ASM)(NYSE American:ASM)(GV6:FSE) a long-standing silver producer in Mexico, reports full year 2025 production results of 1,157,828 silver ounces ("oz"), 7,621 gold oz and 5,667,996 pounds of copper ("lbs"), for a total of 2.6 million silver equivalent 1 ("AgEq 1 ") oz.

prnewswire.com

DENVER, Jan. 20, 2026 /PRNewswire/ - Energy Fuels Inc. (NYSE: UUUU) (TSX: EFR), a leading U.S. producer of uranium, rare earth elements (REE), and other critical materials, today announced it has entered into a Scheme Implementation Deed (SID) to acquire 100% of the issued share capital of Australian Strategic Materials Limited (ASX: ASM) (ASM), a leading producer of REE metals and alloys. The transaction values ASM at US$299m1 and will be completed by way of a scheme of arrangement under Australian law.

wsj.com

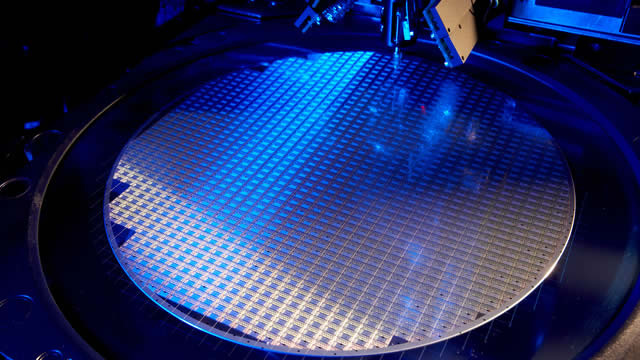

Orders climbed to roughly €800 million in the fourth quarter on strong demand from producers of integrated circuits that power smartphones and other devices.

reuters.com

Computer chip equipment maker ASM International on Monday reported preliminary bookings above market estimates for the fourth quarter of 2025, backed by a rebound in orders from China.

See all news