Aris Water Solutions, Inc. (ARIS)

$

23.69

Key metrics

Financial statements

Free cash flow per share

3.1485

Market cap

774.7 Million

Price to sales ratio

1.6292

Debt to equity

1.2409

Current ratio

1.7257

Income quality

3.0982

Average inventory

0

ROE

0.0755

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

Aris Water Solutions, Inc., an environmental infrastructure and solutions company, is dedicated to providing innovative water handling and recycling solutions. The company reported an income before tax of $70,519,000.00 showcasing its pre-tax profitability. Additionally, the operating income ratio stands at 0.25 indicating the company's operational profitability margin. Highlighting its operational efficiency, the EBITDA ratio is 0.43. Furthermore, the income before tax ratio is 0.16 reflecting the pre-tax margin that enhances investor confidence. Investors can identify the company’s stock in the market with the symbol 'ARIS', allowing for easy recognition in the financial landscape. Founded in 2015 and headquartered in Houston, Texas, Aris Water Solutions excels in the produced water handling business, which involves the gathering, transporting, and management of produced water generated from oil and natural gas production. Their water solutions segment focuses on developing and operating recycling facilities designed to treat, store, and recycle this water resource. The stock is affordable at $24.03 making it suitable for budget-conscious investors looking for entry points in the market. Despite its offerings, the stock has a low average trading volume of 1,497,955.00 indicating lower market activity, which may appeal to those seeking less volatility. With a market capitalization of $774,706,211.00 the company is classified as a small-cap player, positioning it within a unique segment of the investment landscape. Aris Water Solutions is a key player in the Regulated Water industry, contributing significantly to the overall market landscape with sustainable practices and operational growth. It also belongs to the Utilities sector, driving innovation and growth while addressing critical environmental challenges through its effective water management solutions.

What is Aris Water Solutions, Inc. (ARIS)'s stock forecast?

Analysts predict Aris Water Solutions, Inc. stock to fluctuate between $14.46 (low) and $33.95 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Aris Water Solutions, Inc.'s market capitalization?

As of 2025-10-14, Aris Water Solutions, Inc.'s market cap is $774,706,211, based on 32,701,824 outstanding shares.

How does Aris Water Solutions, Inc. compare to competitors like Nvidia Corp?

Compared to Nvidia Corp, Aris Water Solutions, Inc. has a Lower Market-Cap, indicating a difference in performance.

Does Aris Water Solutions, Inc. pay dividends?

Aris Water Solutions, Inc. pays dividends. The current dividend yield is 2.18%, with a payout of $0.14 per share.

How can I buy Aris Water Solutions, Inc. (ARIS) stock?

To buy Aris Water Solutions, Inc. (ARIS) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for ARIS. Place an order (Market, Limit, etc.).

What is the best time to invest in Aris Water Solutions, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

How did Aris Water Solutions, Inc. perform in the last earnings report?

Revenue: $435,444,000 | EPS: $0.81 | Growth: 37.29%.

Where can I find Aris Water Solutions, Inc.'s investor relations reports?

Visit https://www.ariswater.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Aris Water Solutions, Inc.?

You can explore historical data from here

What is the all-time high and low for Aris Water Solutions, Inc. stock?

All-time high: $33.95 (2025-03-26) | All-time low: $6.69 (2023-04-26).

What are the key trends affecting Aris Water Solutions, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

prnewswire.com

Ian Telfer Retires as Chair; Board and Management Structure Repositioned for Execution Neil Woodyer Appointed Chair and Chief Executive Officer VANCOUVER, BC, Jan. 22, 2026 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) announces an update to its Board and senior management structure, reflecting the Company's transition into its next phase of growth execution. Aris Mining operates two underground mines in Colombia and has a development pipeline in Guyana and Colombia that supports its longer-term growth outlook to achieve annual gold production of approximately 1.0 million ounces1.

prnewswire.com

2026 production expected to rise to 300,000–350,000 ounces, driven by Segovia ramp-up and Marmato expansion VANCOUVER, BC, Jan. 21, 2026 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) reports gold production of 256,503 ounces (oz) for the full year ended December 31, 2025, representing a 22% increase over 2024 production of 210,995 oz, driven by the expanded Segovia mill and above-guidance performance at Marmato. Fourth quarter production of 69,852 oz capped off a year of strong operational execution.

prnewswire.com

VANCOUVER, BC, Jan. 8, 2026 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) has updated the Segovia mineral reserve and resource estimates with an effective date of November 28, 2025. Measured and indicated mineral resources increased by 7% to 3.6 million ounces of gold (Moz), up from 3.4 Moz in the 2024 estimate, while inferred resources increased by 12% to 2.9 Moz, reflecting continued exploration success and resource growth at Segovia.

prnewswire.com

VANCOUVER, BC , Dec. 12, 2025 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) announces the completion of its previously announced acquisition of the remaining 49% interest in the Soto Norte joint venture in Colombia from MDC Industry Holding Company LLC (Mubadala). Aris Mining now owns 100% of the Soto Norte Project, and the associated precious metals stream previously granted to Mubadala has been terminated.

prnewswire.com

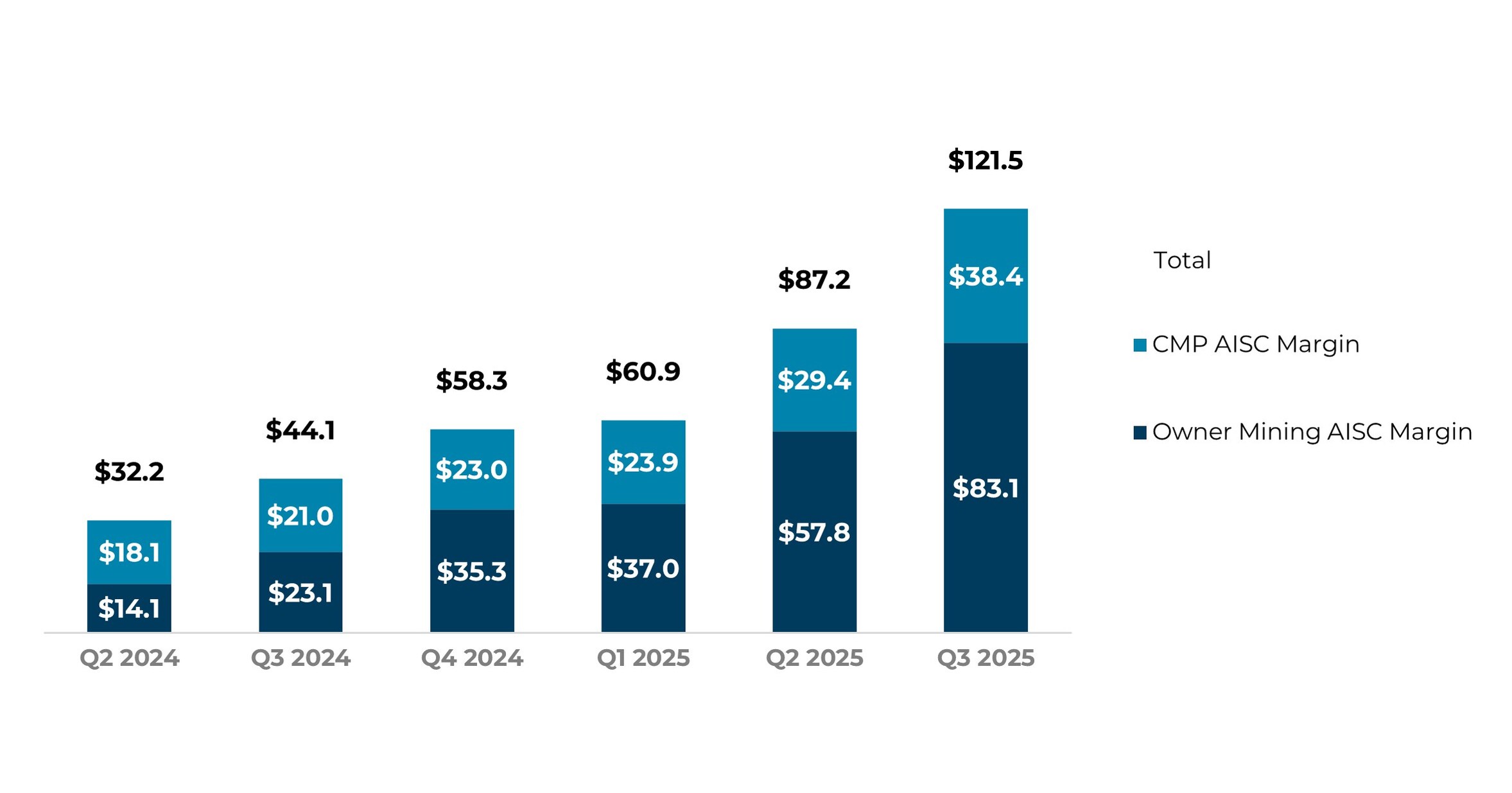

Segovia Ramp-Up Driving Profitable Growth: Record Revenue, Cash Flow, and Adjusted Earnings VANCOUVER, BC , Oct. 29, 2025 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) announces its financial and operating results for the three and nine months ended September 30, 2025 (Q3 2025 and 9M 2025). All amounts are in U.S. dollars unless otherwise indicated.

prnewswire.com

PEA confirms long-life, low-cost open pit gold operation in Guyana with 25.2% IRR and $1.8 billion after-tax NPV5% at $3,000/oz gold VANCOUVER, BC , Oct. 28, 2025 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) announces positive results from the recently completed preliminary economic assessment (PEA) of its 100%-owned Toroparu Gold Project (Toroparu or the Project) in Guyana. The PEA confirms Toroparu as a large-scale, long-life open pit gold project with robust economics — 21.3-year mine life, 235 koz of average annual gold production, and $1.8 billion after-tax NPV5% at $3,000/oz gold.

prnewswire.com

VANCOUVER, BC , Oct. 23, 2025 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) will publish its Q3 2025 financial results after market close on Wednesday, October 29, 2025 and host a conference call on Thursday, October 30, 2025, at 6:00 am PT / 9:00 am ET / 2:00 pm BST / 3:00 pm CEST to discuss the results. Participants may gain expedited access to the conference call by registering at Diamond Pass Registration.

prnewswire.com

HOUSTON , Oct. 15, 2025 /PRNewswire/ -- Western Midstream Partners, LP ("WES") (NYSE: WES) today announced that it has completed its acquisition of Aris Water Solutions, Inc. ("Aris"). "I am pleased to announce the completion of WES's acquisition of Aris Water Solutions, solidifying our position as one of the largest three-stream midstream, flow-assurance providers in the Delaware Basin," said Oscar K.

prnewswire.com

VANCOUVER, BC , Sept. 24, 2025 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) reports that all 23 workers who were underground at the time of the La Reliquia Mine shaft collapse have been safely brought to surface.

prnewswire.com

VANCOUVER, BC , Sept. 23, 2025 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) confirms an incident that occurred on September 22 at the La Reliquia Mine, a formalized third-party operation located within Aris Mining's Segovia title, but outside of Aris Mining's infrastructure.

See all news