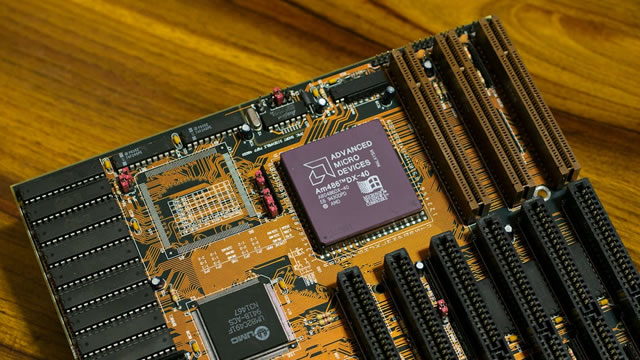

Advanced Micro Devices, Inc. (AMD)

$

246.27

+9.54 (3.87%)

Key metrics

Financial statements

Free cash flow per share

3.3506

Market cap

400.9 Billion

Price to sales ratio

12.5187

Debt to equity

0.0637

Current ratio

2.3077

Income quality

2.0466

Average inventory

7 Billion

ROE

0.0561

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

The operating income ratio is 0.07 indicating the company's operational profitability margin, while the gross profit stands at $12,725,000,000.00 highlighting the company's profitability from core operations. The total costs and expenses for the company are $23,885,000,000.00 reflecting its overall spending and financial management. Additionally, the company incurred an interest expense of $92,000,000.00 reflecting its debt servicing obligations, as well as an income tax expense of $381,000,000.00 indicating its tax obligations. These factors collectively paint a picture of AMD's financial health and operational efficiency within the competitive semiconductor market. On the market front, the stock is reasonably priced at $157.39 appealing to a broad range of investors. It has a high average trading volume of 39,566,231.00 indicating strong liquidity and active interest from market participants. With a large market capitalization of $400,937,410,800.00 the company is a dominant player in the semiconductor industry, contributing significantly to the overall market landscape. AMD is recognized as a key player in the Semiconductors industry, driving innovation and growth, and it belongs to the Technology sector, which is pivotal for advancements in technology and computing solutions.

Is Advanced Micro Devices, Inc. (AMD) a good investment?

Investing in Advanced Micro Devices, Inc. (AMD) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B-, with a Bullish outlook. Always conduct your own research before investing.

What is Advanced Micro Devices, Inc. (AMD)'s stock forecast?

Analysts predict Advanced Micro Devices, Inc. stock to fluctuate between $76.48 (low) and $267.08 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Advanced Micro Devices, Inc.'s market capitalization?

As of 2026-02-03, Advanced Micro Devices, Inc.'s market cap is $400,937,410,800, based on 1,628,040,000 outstanding shares.

How does Advanced Micro Devices, Inc. compare to competitors like Nvidia Corp?

Compared to Nvidia Corp, Advanced Micro Devices, Inc. has a Lower Market-Cap, indicating a difference in performance.

Does Advanced Micro Devices, Inc. pay dividends?

Advanced Micro Devices, Inc. pays dividends. The current dividend yield is 0.03%, with a payout of $0.01 per share.

How can I buy Advanced Micro Devices, Inc. (AMD) stock?

To buy Advanced Micro Devices, Inc. (AMD) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for AMD. Place an order (Market, Limit, etc.).

What is the best time to invest in Advanced Micro Devices, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Advanced Micro Devices, Inc. stock ever split?

Advanced Micro Devices, Inc.'s last stock split was 2:1 on 2000-08-22.

How did Advanced Micro Devices, Inc. perform in the last earnings report?

Revenue: $25,785,000,000 | EPS: $1.01 | Growth: 90.57%.

Where can I find Advanced Micro Devices, Inc.'s investor relations reports?

Visit https://www.amd.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Advanced Micro Devices, Inc.?

You can explore historical data from here

What is the all-time high and low for Advanced Micro Devices, Inc. stock?

All-time high: $267.08 (2025-10-29) | All-time low: $54.57 (2022-10-13).

What are the key trends affecting Advanced Micro Devices, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

investopedia.com

Stock futures are higher this morning as investors assess earnings reports and tech shares rally; gold and silver prices are surging after falling sharply in recent days; Palantir shares are soaring after the AI software maker's results topped Wall Street estimates; two of Elon Musk's companies, SpaceX and xAI, have merged at a reported valuation of $1.25 trillion; and chip giant Advanced Micro Devices is scheduled to release quarterly results after the closing bell. Here's what you need to know today.

youtube.com

AMD Inc. (AMD) earnings are set to report following Tuesday's close. Rick Ducat compares the semiconductor name to its peers to show its outperformance in the past 52-weeks.

fool.com

In today's video, I discuss recent updates affecting Advanced Micro Devices (AMD +3.95%) and other AI stocks. To learn more, check out the short video, consider subscribing, and click the special offer link below.

fool.com

Advanced Micro Devices doesn't have to beat Nvidia for its shareholders to win. AMD's stock could surge to $290 per share.

fool.com

Nvidia's new architecture will extend its lead in the computing space further. Nvidia's stock is cheaper than AMD or Broadcom by one valuation measure.

zacks.com

Improved Manufacturing data joined another strong tranche of Q4 earnings reports today.

zacks.com

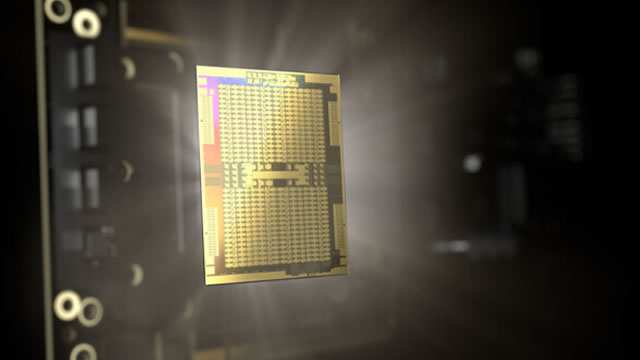

AMD's stock has had an explosive start to 2026, spiking over +15% as it gains share in the AI chip market.

marketwatch.com

AMD could do a better job than Intel at capitalizing on the AI-fueled boom in traditional server chips.

proactiveinvestors.com

Advanced Micro Devices (NASDAQ:AMD) will report its fourth quarter earnings on Tuesday, with Wedbush analysts expecting a solid performance from the company, driven by its CPU and services businesses. Heading into the report, Wedbush has maintained an 'Outperform' rating on AMD with a 12-month price target of $290.

zacks.com

Advanced Micro Devices' Data Center strength, fueled by EPYC and Instinct momentum, is expected to drive solid Q4 results amid fierce competition from NVIDIA and Broadcom.

See all news