Alnylam Pharmaceuticals, Inc. (ALNY)

$

397.83

-2.34 (-0.59%)

Key metrics

Financial statements

Free cash flow per share

1.6841

Market cap

52.9 Billion

Price to sales ratio

16.4694

Debt to equity

11.8571

Current ratio

2.5412

Income quality

6.1027

Average inventory

73.5 Million

ROE

0.2613

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

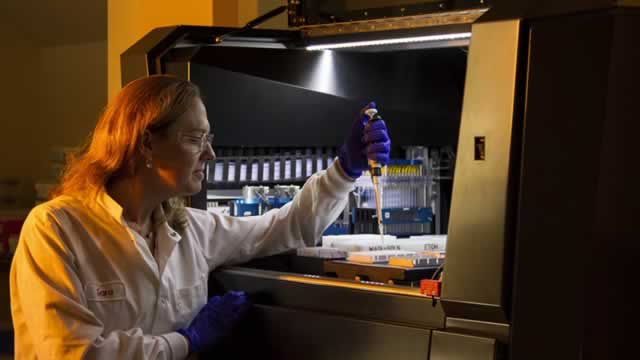

Alnylam Pharmaceuticals, Inc. focuses on the discovery, development, and commercialization of innovative therapeutics based on ribonucleic acid interference. The company reported selling, general, and administrative expenses of $975,526,000.00 indicating its operational overhead costs. Additionally, the company incurred an interest expense of $141,858,000.00 reflecting its debt servicing obligations. A net loss of -$278,157,000.00 was reported, indicating challenges in its operations. With its stock identified by the symbol 'ALNY' in the market, the weighted average number of diluted shares outstanding is 127,651,000.00 reflecting potential dilution effects. Alnylam's pipeline of investigational RNAi therapeutics addresses a range of conditions, including genetic disorders, cardio-metabolic diseases, hepatic infectious diseases, and central nervous system (CNS)/ocular diseases. Marketed products such as ONPATTRO (patisiran), GIVLAARI, and OXLUMO highlight its commitment to addressing unmet medical needs. Furthermore, the company is advancing multiple candidates in its pipeline, including givosiran and cemdisiran, enhancing its portfolio with potential therapies for various diseases. Strategic collaborations with prominent partners like Regeneron Pharmaceuticals, Inc. and Sanofi Genzyme bolster its development capabilities. The stock is priced at $453.56 positioning it in the higher-end market. It has an average trading volume of 1,261,685.00 indicating moderate liquidity. With a mid-range market capitalization of $52,558,840,215.00 the company is a steady performer in the competitive landscape. It is a key player in the biopharmaceutical industry, contributing significantly to the overall market landscape. Additionally, it belongs to the Healthcare sector, driving innovation and growth within the field. Alnylam continues to enhance its position through collaborations and partnerships, unlocking new avenues for discovering and delivering RNAi therapeutics. The company's focus on cutting-edge science and strategic alliances marks it as a noteworthy entity in advancing healthcare solutions and addressing complex diseases. As it navigates its challenges, Alnylam remains committed to its vision of transforming the treatment landscape through pioneering biopharmaceutical innovations.

Is Alnylam Pharmaceuticals, Inc. (ALNY) a good investment?

Investing in Alnylam Pharmaceuticals, Inc. (ALNY) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B-, with a Bullish outlook. Always conduct your own research before investing.

What is Alnylam Pharmaceuticals, Inc. (ALNY)'s stock forecast?

Analysts predict Alnylam Pharmaceuticals, Inc. stock to fluctuate between $205.87 (low) and $495.55 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Alnylam Pharmaceuticals, Inc.'s market capitalization?

As of 2026-01-06, Alnylam Pharmaceuticals, Inc.'s market cap is $52,558,840,215, based on 132,113,818 outstanding shares.

How does Alnylam Pharmaceuticals, Inc. compare to competitors like Eli Lilly & Co.?

Compared to Eli Lilly & Co., Alnylam Pharmaceuticals, Inc. has a Lower Market-Cap, indicating a difference in performance.

How can I buy Alnylam Pharmaceuticals, Inc. (ALNY) stock?

To buy Alnylam Pharmaceuticals, Inc. (ALNY) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for ALNY. Place an order (Market, Limit, etc.).

What is the best time to invest in Alnylam Pharmaceuticals, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

How did Alnylam Pharmaceuticals, Inc. perform in the last earnings report?

Revenue: $2,248,243,000 | EPS: -$2.18 | Growth: -38.07%.

Where can I find Alnylam Pharmaceuticals, Inc.'s investor relations reports?

Visit https://www.alnylam.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Alnylam Pharmaceuticals, Inc.?

You can explore historical data from here

What is the all-time high and low for Alnylam Pharmaceuticals, Inc. stock?

All-time high: $495.55 (2025-10-20) | All-time low: $117.58 (2022-05-12).

What are the key trends affecting Alnylam Pharmaceuticals, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

youtube.com

CNBC's “Closing Bell Overtime” team discusses why the biotech recovery may continue into 2026 with Salveen Richter, lead U.S. biotech analyst at Goldman Sachs Research.

defenseworld.net

Assenagon Asset Management S.A. increased its holdings in shares of Alnylam Pharmaceuticals, Inc. (NASDAQ: ALNY) by 354.5% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 80,381 shares of the biopharmaceutical company's stock after acquiring an additional 62,695 shares during the period.

benzinga.com

Alnylam (NASDAQ: ALNY) has corrected by roughly 13% over the past couple of weeks. To understand why this pullback is unfolding now, it is important to examine the stock's structure through the lens of the Adhishthana principles and assess where it stands within its broader cycle.

fool.com

Alnylam has been a big winner for investors since its IPO in 2004. The drugmaker's future looks promising.

seekingalpha.com

Google's parent company received a relatively benign antitrust ruling that would not force Alphabet to sell its Chrome browser or Android operating system. Chipotle Mexican Grill reported mixed quarterly results as a result of tough year-over-year comparisons and an uncertain macroeconomic environment. We initiated a position in Oracle, which is highly levered to the ongoing artificial intelligence infrastructure build-out.

benzinga.com

Alnylam Pharmaceuticals, Inc. (NASDAQ: ALNY) stock is trading higher on Friday, with no news to justify the movement.

investors.com

The S&P 500's TJX is among the five stocks to watch showing resilience in a tough market

reuters.com

The UK's drug cost-effectiveness watchdog has recommended Alnylam Pharmaceuticals' heart disease drug, ensuring access for patients through the government health system in England and Wales, the company said on Friday.

seekingalpha.com

Alnylam Pharmaceuticals, Inc. ( ALNY ) Jefferies London Healthcare Conference 2025 November 19, 2025 6:30 AM EST Company Participants Yvonne Greenstreet - CEO & Director Tolga Tanguler - Executive VP & Chief Commercial Officer Conference Call Participants Maurice Raycroft - Jefferies LLC, Research Division Presentation Maurice Raycroft Jefferies LLC, Research Division Hi, everyone. My name is Maurice Raycroft, and I'm one of the Biotech Analysts at Jefferies.

zacks.com

Here is how Alnylam Pharmaceuticals (ALNY) and Collegium Pharmaceutical (COLL) have performed compared to their sector so far this year.

See all news