Applied Industrial Technologies, Inc. (AIT)

$

283.54

+0.96 (0.34%)

Key metrics

Financial statements

Free cash flow per share

12.1257

Market cap

10.7 Billion

Price to sales ratio

2.2496

Debt to equity

0.3053

Current ratio

3.6772

Income quality

1.2057

Average inventory

525.3 Million

ROE

0.2174

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

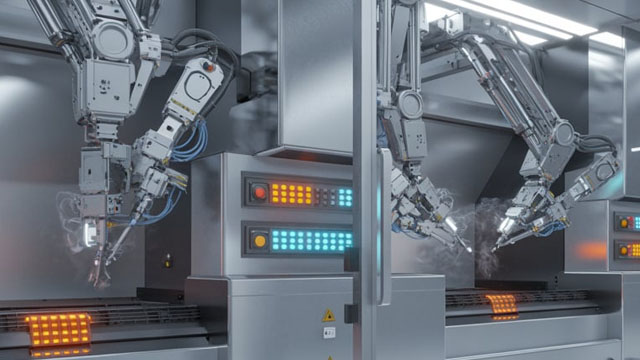

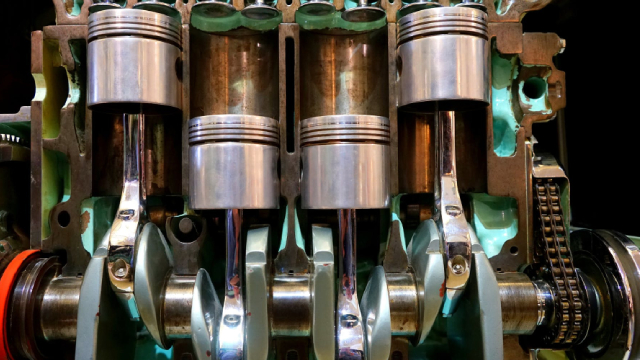

The weighted average number of shares outstanding is 38,289,000.00 highlighting the company's shareholder base. The financial data pertains to the fiscal year 2025 during which the company reported selling, general, and administrative expenses of $884,630,000.00 indicating its operational overhead costs. The income before tax ratio is 0.11 reflecting the pre-tax margin, while the gross profit ratio is 0.30 illustrating the efficiency of the company's production and sales operations. This performance underlines the organization's commitment to maintaining a robust operational framework as it distributes a wide range of industrial products, including bearings, power transmission products, and advanced automation solutions across diverse markets. Through its two segments, Service Center Based Distribution and Fluid Power & Flow Control, Applied Industrial Technologies, Inc. addresses the needs of various industries—ranging from agriculture and food processing to mining and oil and gas—while also providing equipment repair and technical support services. The stock is priced at $260.45 positioning it in the higher-end market. However, the stock has a low average trading volume of 336,741.00 indicating lower market activity. With a mid-range market capitalization of $10,694,536,201.00 the company is a steady performer within the industry. It is a key player in the Industrial - Distribution industry, contributing significantly to the overall market landscape. Furthermore, it belongs to the Industrials sector, driving innovation and growth. This strategic positioning enables the company to maintain a competitive edge while continuing to meet the operational demands of its expansive customer base across North America, Australia, New Zealand, and Singapore. The comprehensive portfolio of products and services, coupled with a well-established service center network, underscores its capability to adapt and provide tailored solutions in an evolving industrial environment.

Is Applied Industrial Technologies, Inc. (AIT) a good investment?

Investing in Applied Industrial Technologies, Inc. (AIT) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as A-, with a Bearish outlook. Always conduct your own research before investing.

What is Applied Industrial Technologies, Inc. (AIT)'s stock forecast?

Analysts predict Applied Industrial Technologies, Inc. stock to fluctuate between $199.96 (low) and $296.70 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Applied Industrial Technologies, Inc.'s market capitalization?

As of 2026-03-02, Applied Industrial Technologies, Inc.'s market cap is $10,694,536,201, based on 37,717,910 outstanding shares.

How does Applied Industrial Technologies, Inc. compare to competitors like GE Aerospace?

Compared to GE Aerospace, Applied Industrial Technologies, Inc. has a Lower Market-Cap, indicating a difference in performance.

Does Applied Industrial Technologies, Inc. pay dividends?

Applied Industrial Technologies, Inc. pays dividends. The current dividend yield is 0.68%, with a payout of $0.51 per share.

How can I buy Applied Industrial Technologies, Inc. (AIT) stock?

To buy Applied Industrial Technologies, Inc. (AIT) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for AIT. Place an order (Market, Limit, etc.).

What is the best time to invest in Applied Industrial Technologies, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bearish trend based on economic conditions and company performance.

Has Applied Industrial Technologies, Inc. stock ever split?

Applied Industrial Technologies, Inc.'s last stock split was 3:2 on 2006-06-16.

How did Applied Industrial Technologies, Inc. perform in the last earnings report?

Revenue: $4,563,424,000 | EPS: $10.26 | Growth: 2.81%.

Where can I find Applied Industrial Technologies, Inc.'s investor relations reports?

Visit https://www.applied.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Applied Industrial Technologies, Inc.?

You can explore historical data from here

What is the all-time high and low for Applied Industrial Technologies, Inc. stock?

All-time high: $296.70 (2026-02-12) | All-time low: $80.93 (2021-09-20).

What are the key trends affecting Applied Industrial Technologies, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

businesswire.com

ITASCA, Ill.--(BUSINESS WIRE)-- #FreightForwarding--AIT Worldwide Logistics' partnership with Greenbriar Equity Group supports continuity and accelerates the next phase of the company's growth plans.

zacks.com

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

zacks.com

AIT tops Q2 earnings estimates as acquisitions and modest organic growth lift profits, even as revenues came in slightly below expectations.

zacks.com

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

seekingalpha.com

Applied Industrial Technologies, Inc. (AIT) Q2 2026 Earnings Call Transcript

zacks.com

Applied Industrial Technologies (AIT) came out with quarterly earnings of $2.51 per share, beating the Zacks Consensus Estimate of $2.48 per share. This compares to earnings of $2.39 per share a year ago.

businesswire.com

CLEVELAND--(BUSINESS WIRE)--Applied Industrial Technologies (NYSE: AIT), a leading value-added distributor and technical solutions provider of industrial motion, fluid power, flow control, automation technologies, and related maintenance supplies, today reported results for its fiscal 2026 second quarter ended December 31, 2025. Net sales for the quarter of $1.2 billion increased 8.4% over the prior year. The change includes a 6.0% increase from acquisitions and a positive 0.2% impact from fore.

businesswire.com

CLEVELAND--(BUSINESS WIRE)--Applied Industrial Technologies (NYSE: AIT) today announced it will release its fiscal 2026 second quarter results on Tuesday, January 27, 2026, before the market opens. The Company's fiscal 2026 second quarter ended December 31, 2025. The Company will host a conference call at 10 a.m. ET that day to discuss the quarter's results and outlook. A live audio webcast and supplemental presentation can be accessed on our Investor Relations site at https://ir.applied.com. T.

zacks.com

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

zacks.com

Here is how Applied Industrial Technologies (AIT) and Helios Technologies (HLIO) have performed compared to their sector so far this year.

See all news