Arlington Asset Investment Corp. 6.75% SR NT 25 (AIC)

$

24.33

+0.01 (0.04%)

Key metrics

Financial statements

Free cash flow per share

-0.3154

Market cap

631.4 Million

Price to sales ratio

81.0811

Debt to equity

0.4069

Current ratio

0

Income quality

5.0562

Average inventory

0

ROE

-0.0141

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

Arlington Asset Investment Corp. (NYSE: AAIC) currently invests primarily in mortgage related and residential real estate and has elected to be taxed as a REIT. The Company is headquartered in the Washington, D.C. metropolitan area. For more information, please visit www.arlingtonasset.com.

News

businesswire.com

6 months ago

MONTPELLIER, France--(BUSINESS WIRE)--Analysis of a major subgroup of patients undergoing a first Total Knee Replacement (TKR), representing over 70% of the trial population (108 out of 151), revealed the following benefits when comparing patients treated with F14/mdc-CWM (n=51) to those in the control group (n=57)1: 70% reduction in the number of opioid users at 3 months post-surgery, 28% reduction in the total quantity of opioids consumed during the first 3 months post-surgery, Lower daily kn.

businesswire.com

a year ago

JACKSONVILLE, Fla.--(BUSINESS WIRE)--Jacksonville Transportation Authority and Balfour Beatty's Vision 2 Reality Team Break Ground on Autonomous Innovation Center.

https://www.defenseworld.net

a year ago

Principal Financial Group Inc. decreased its holdings in Science Applications International Co. (NYSE:SAIC – Free Report) by 1.9% during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 194,349 shares of the information technology services provider’s stock after selling 3,687 shares during the quarter. Principal Financial Group Inc. owned 0.37% of Science Applications International worth $24,161,000 at the end of the most recent reporting period. Several other large investors also recently added to or reduced their stakes in the business. Treasurer of the State of North Carolina boosted its stake in shares of Science Applications International by 0.5% during the 3rd quarter. Treasurer of the State of North Carolina now owns 24,376 shares of the information technology services provider’s stock worth $2,573,000 after acquiring an additional 123 shares during the last quarter. Parkside Financial Bank & Trust lifted its position in Science Applications International by 17.5% during the third quarter. Parkside Financial Bank & Trust now owns 1,082 shares of the information technology services provider’s stock valued at $114,000 after purchasing an additional 161 shares in the last quarter. Linden Thomas Advisory Services LLC grew its holdings in Science Applications International by 1.9% during the fourth quarter. Linden Thomas Advisory Services LLC now owns 8,857 shares of the information technology services provider’s stock valued at $1,101,000 after purchasing an additional 163 shares during the period. Panagora Asset Management Inc. increased its position in Science Applications International by 4.5% in the third quarter. Panagora Asset Management Inc. now owns 3,969 shares of the information technology services provider’s stock worth $419,000 after buying an additional 171 shares in the last quarter. Finally, Contravisory Investment Management Inc. bought a new position in shares of Science Applications International in the fourth quarter worth about $25,000. 76.00% of the stock is currently owned by institutional investors. Wall Street Analysts Forecast Growth Several equities research analysts recently issued reports on SAIC shares. StockNews.com raised shares of Science Applications International from a “hold” rating to a “buy” rating in a report on Wednesday, April 17th. JPMorgan Chase & Co. decreased their price objective on shares of Science Applications International from $142.00 to $140.00 and set a “neutral” rating on the stock in a research report on Tuesday, March 19th. Truist Financial reaffirmed a “hold” rating and issued a $130.00 target price on shares of Science Applications International in a report on Friday, April 12th. Wells Fargo & Company raised their price target on Science Applications International from $141.00 to $143.00 and gave the company an “equal weight” rating in a report on Tuesday, March 19th. Finally, The Goldman Sachs Group cut their target price on Science Applications International from $113.00 to $110.00 and set a “sell” rating for the company in a research report on Thursday, February 29th. One investment analyst has rated the stock with a sell rating, four have issued a hold rating and one has given a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of “Hold” and an average target price of $127.60. Get Our Latest Research Report on SAIC Science Applications International Stock Up 0.1 % SAIC opened at $136.75 on Monday. The company has a market capitalization of $7.01 billion, a PE ratio of 15.45 and a beta of 0.70. The firm has a 50-day simple moving average of $130.69 and a two-hundred day simple moving average of $128.07. The company has a quick ratio of 0.97, a current ratio of 0.98 and a debt-to-equity ratio of 1.13. Science Applications International Co. has a 52 week low of $95.43 and a 52 week high of $145.17. Science Applications International (NYSE:SAIC – Get Free Report) last announced its quarterly earnings results on Monday, March 18th. The information technology services provider reported $1.43 EPS for the quarter, missing analysts’ consensus estimates of $1.44 by ($0.01). Science Applications International had a net margin of 6.41% and a return on equity of 23.73%. The firm had revenue of $1.74 billion for the quarter, compared to the consensus estimate of $1.64 billion. During the same period in the previous year, the company posted $2.04 earnings per share. Science Applications International’s quarterly revenue was down 11.7% on a year-over-year basis. Analysts forecast that Science Applications International Co. will post 8.11 earnings per share for the current fiscal year. Science Applications International Announces Dividend The firm also recently declared a quarterly dividend, which was paid on Friday, April 26th. Investors of record on Friday, April 12th were given a $0.37 dividend. This represents a $1.48 annualized dividend and a yield of 1.08%. The ex-dividend date of this dividend was Thursday, April 11th. Science Applications International’s dividend payout ratio is presently 16.72%. Insider Activity at Science Applications International In other Science Applications International news, EVP Vincent P. Difronzo acquired 795 shares of the company’s stock in a transaction on Friday, April 12th. The stock was acquired at an average cost of $126.04 per share, with a total value of $100,201.80. Following the purchase, the executive vice president now directly owns 8,772 shares of the company’s stock, valued at approximately $1,105,622.88. The purchase was disclosed in a legal filing with the SEC, which is available at the SEC website. In related news, CEO Toni Townes-Whitley purchased 3,000 shares of the firm’s stock in a transaction that occurred on Friday, April 12th. The shares were bought at an average price of $125.96 per share, for a total transaction of $377,880.00. Following the acquisition, the chief executive officer now owns 46,795 shares of the company’s stock, valued at approximately $5,894,298.20. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, EVP Vincent P. Difronzo acquired 795 shares of the company’s stock in a transaction on Friday, April 12th. The shares were purchased at an average cost of $126.04 per share, with a total value of $100,201.80. Following the completion of the purchase, the executive vice president now directly owns 8,772 shares of the company’s stock, valued at $1,105,622.88. The disclosure for this purchase can be found here. 0.67% of the stock is owned by insiders. About Science Applications International (Free Report) Science Applications International Corporation provides technical, engineering, and enterprise information technology (IT) services primarily in the United States. The company's offerings include IT modernization; digital engineering; artificial intelligence; Weapon systems support design, build, modify, integrate, and sustain weapon systems; and end-to-end services, such as design, development, integration, deployment, management and operations, sustainment, and security of its customers' IT infrastructure, as well as training and simulation and ground vehicles support which integrates, modify, upgrades, and sustains ground vehicles for nation's armed forces.

seekingalpha.com

5 years ago

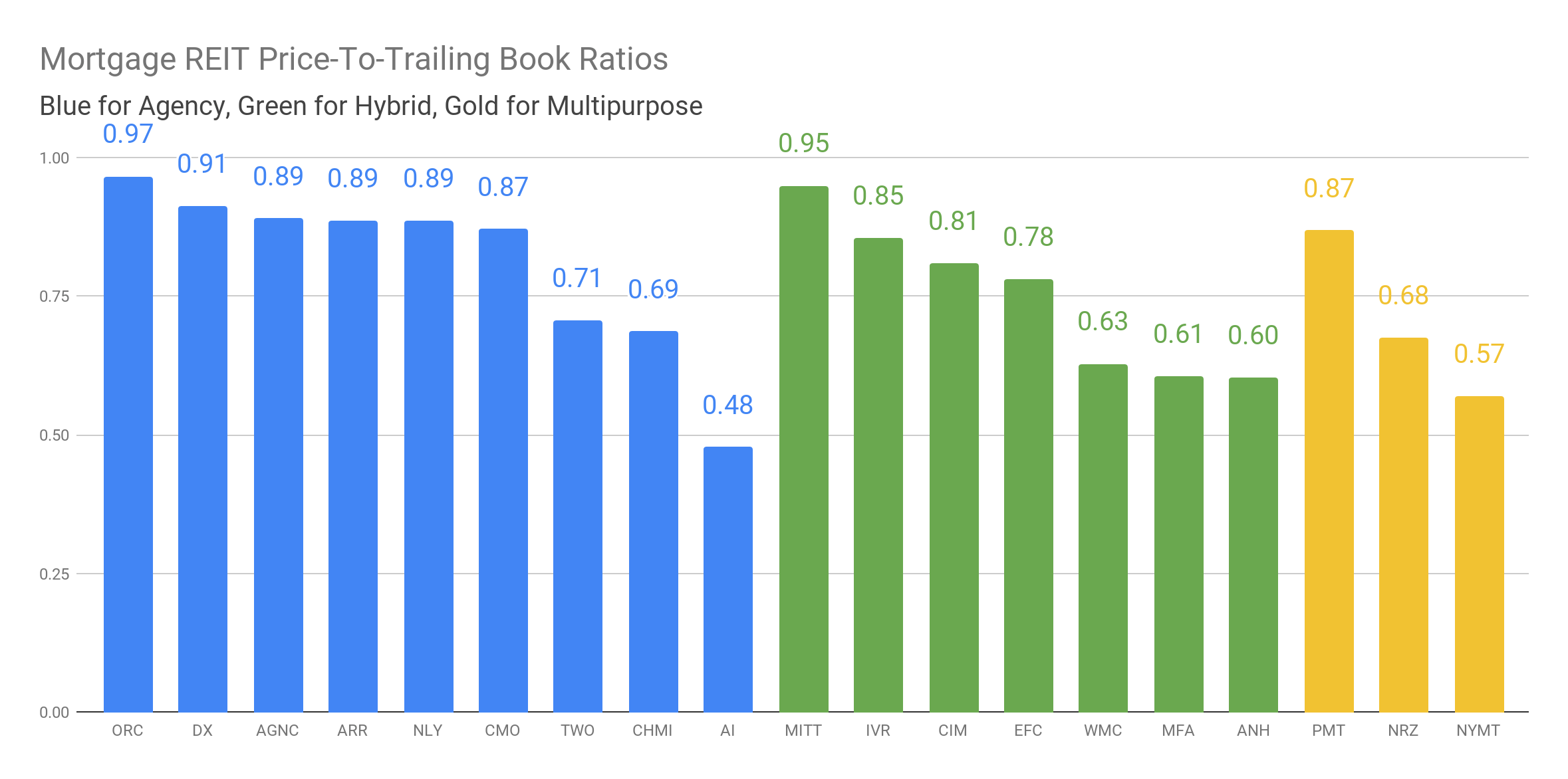

Discounts to book value (or NAV) are the start of your mortgage REIT analysis, but not the end. In this series we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

seekingalpha.com

5 years ago

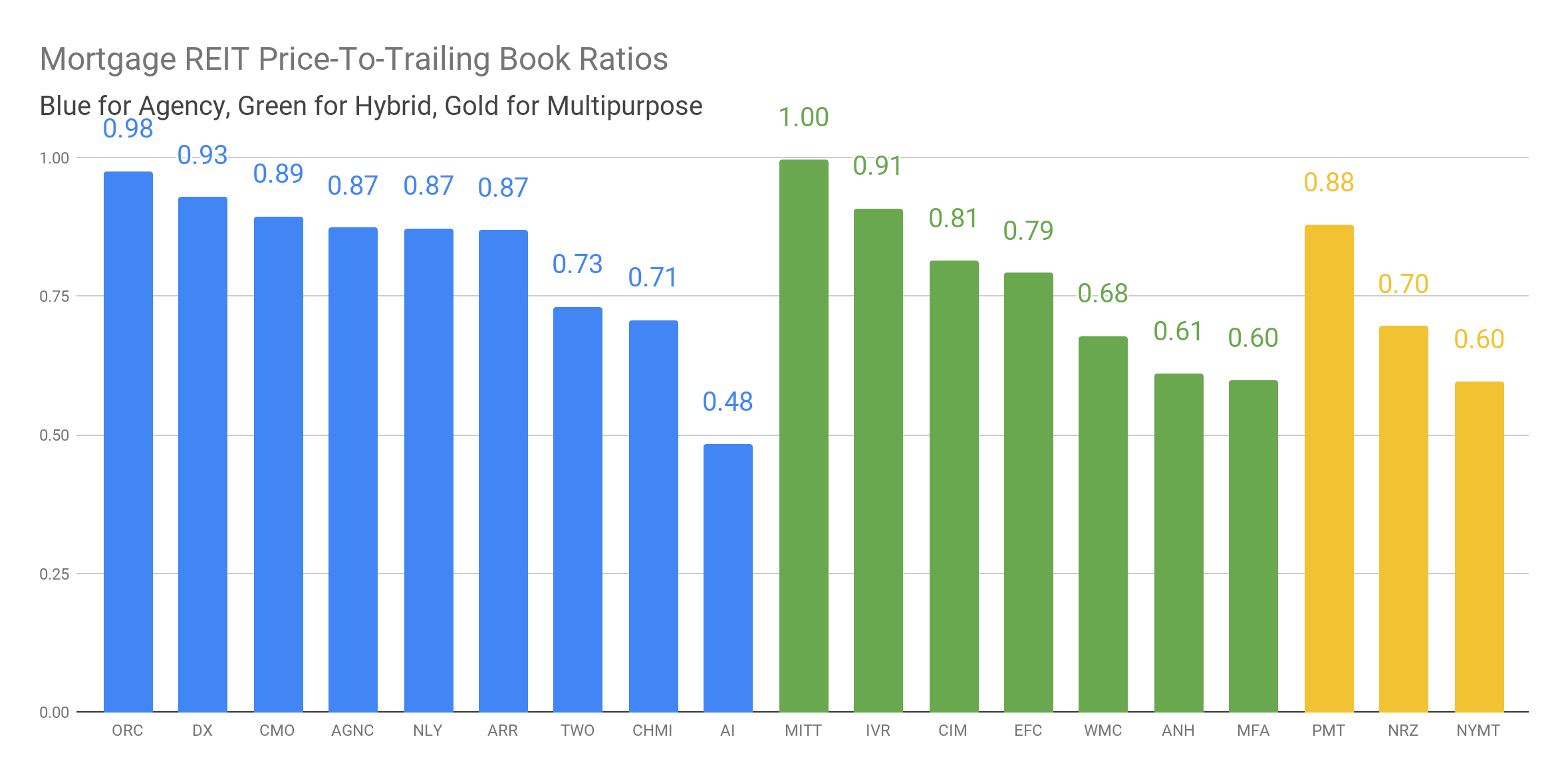

Discounts to book value are the start of your analysis, but not the end. In this series we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

seekingalpha.com

5 years ago

Price-to-book ratios dropped materially, creating new opportunities. Buying with a discount to book value doesn’t guarantee success, yet it does improve the odds dramatically.

seekingalpha.com

5 years ago

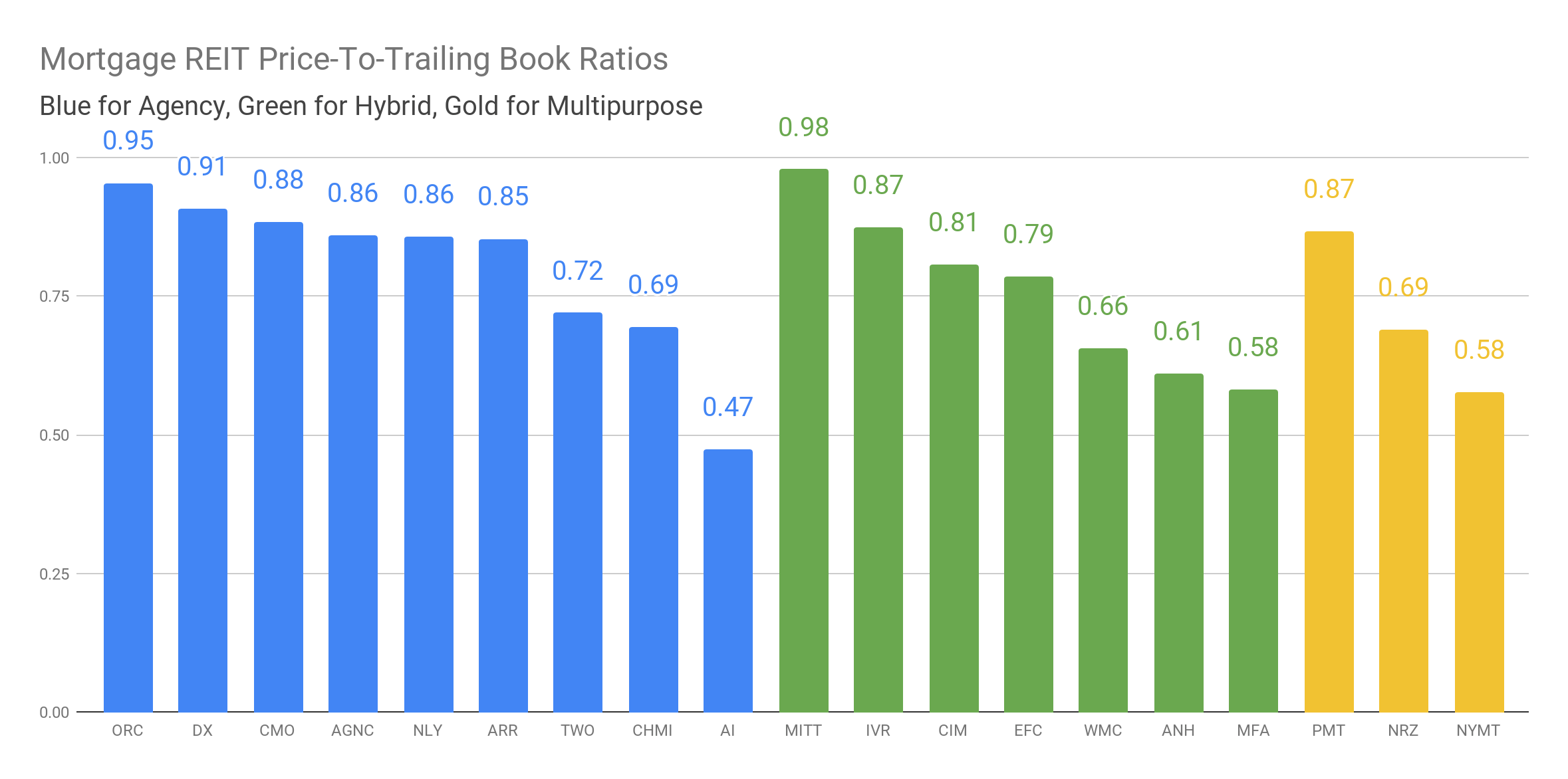

Discounts to book value are the start of your analysis, but not the end. In this series, we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

seekingalpha.com

5 years ago

Analysis starts with discount to book, but it doesn't end there. Using current estimates for book value is far superior to using trailing book values, but the trailing values will still give investors a rough idea.

seekingalpha.com

5 years ago

One topic that seems to come up regularly is investors wondering about using a buy-and-hold strategy for years on common shares.

seekingalpha.com

5 years ago

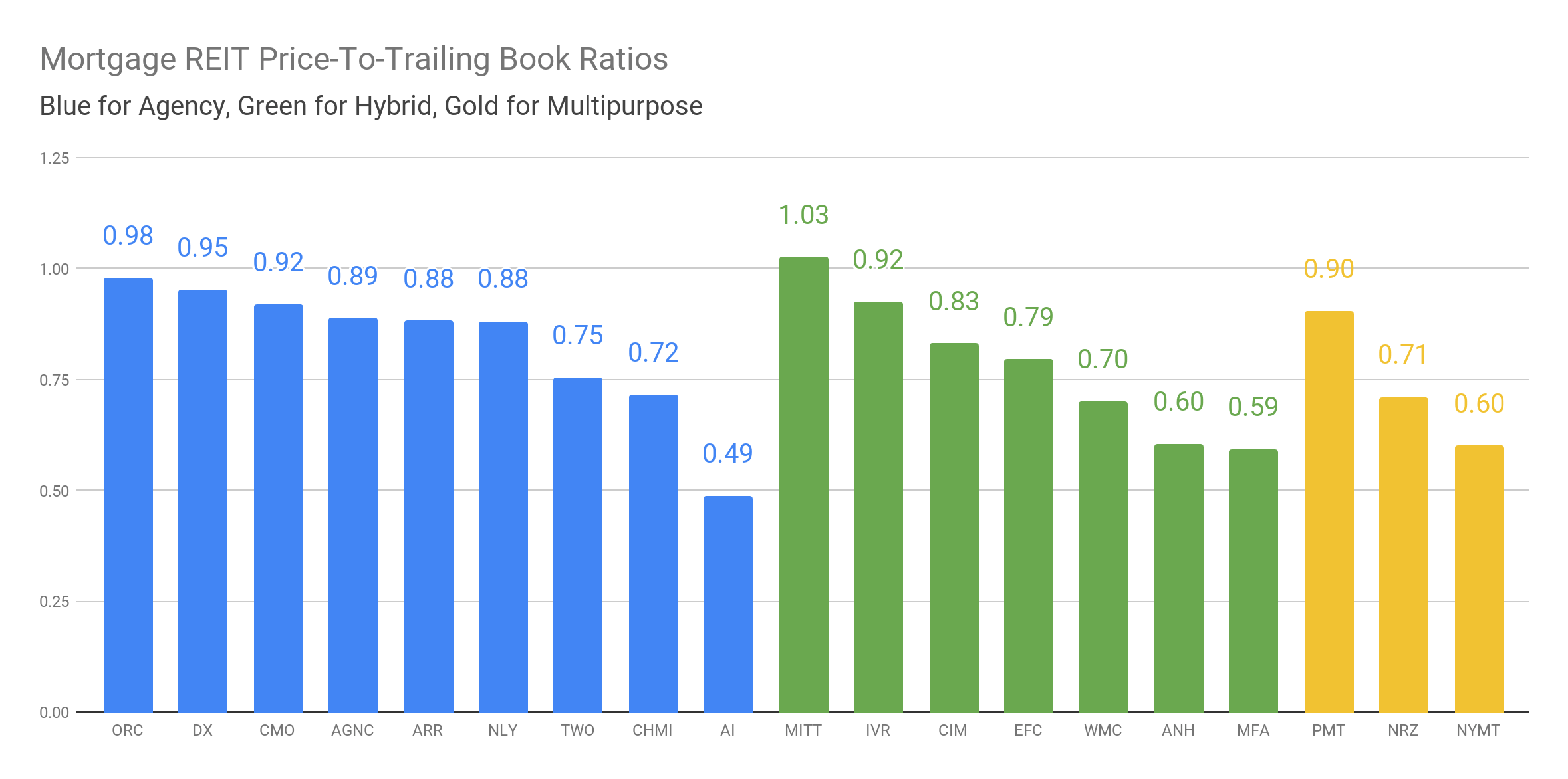

Mortgage REIT earnings season wrapped up this week. As with their Equity REIT peers, earnings reports were generally better-than-expected.

See all news