Analog Devices, Inc. (ADI)

$

310.88

-7.82 (-2.52%)

Key metrics

Financial statements

Free cash flow per share

8.7169

Market cap

152.2 Billion

Price to sales ratio

13.8138

Debt to equity

0.2562

Current ratio

2.1899

Income quality

2.1224

Average inventory

1.6 Billion

ROE

0.0657

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

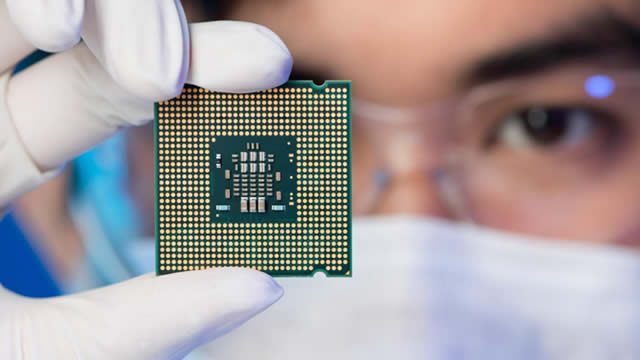

Analog Devices, Inc. designs, manufactures, tests, and markets integrated circuits (ICs), software, and subsystems that leverage analog, mixed-signal, and digital signal processing technologies. The company provides data converter products that translate real-world analog signals into digital data, as well as converting digital data back into analog signals. It also offers power management and reference products for power conversion, driver monitoring, sequencing, and energy management applications across automotive, communications, industrial, and high-end consumer markets. Additionally, Analog Devices manufactures power ICs designed for performance and integration, along with software design simulation tools for accurate power supply designs. The company supplies high-performance amplifiers to condition analog signals, radio frequency and microwave ICs to support cellular infrastructure, and microelectromechanical systems technology solutions, which include accelerometers for gauging acceleration, gyroscopes for rotation sensing, and inertial measurement units that detect multiple degrees of freedom. Furthermore, the company provides broadband switches for radio and instrument systems, as well as isolators. Complementing its product range, Analog Devices also features digital signal processing and system products that facilitate high-speed numeric calculations. The gross profit ratio is 0.55 reflecting the efficiency of the company's production and sales operations. The EBITDA is $5,028,673,000.00 a key indicator of the company's operational profitability, while the EBITDA ratio stands at 0.46 highlighting the company's operational efficiency. The cost of revenue for the company is $4,995,891,000.00 showcasing its production and operational expenses, and the total costs and expenses total $8,017,231,000.00 reflecting its overall spending. In terms of market positioning, the stock is priced at $245.33 positioning it in the higher-end market. It boasts a high average trading volume of 3,783,666.00 indicating strong liquidity, while with a large market capitalization of $152,223,671,271.00 the company is a dominant player within its sector. It is a key player in the Semiconductors industry, contributing significantly to the overall market landscape, which underscores its importance in driving innovation and growth within the Technology sector.

Is Analog Devices, Inc. (ADI) a good investment?

Investing in Analog Devices, Inc. (ADI) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B-, with a Bullish outlook. Always conduct your own research before investing.

What is Analog Devices, Inc. (ADI)'s stock forecast?

Analysts predict Analog Devices, Inc. stock to fluctuate between $158.65 (low) and $319.26 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Analog Devices, Inc.'s market capitalization?

As of 2026-01-30, Analog Devices, Inc.'s market cap is $152,223,671,271, based on 489,654,115 outstanding shares.

How does Analog Devices, Inc. compare to competitors like Nvidia Corp?

Compared to Nvidia Corp, Analog Devices, Inc. has a Lower Market-Cap, indicating a difference in performance.

Does Analog Devices, Inc. pay dividends?

Analog Devices, Inc. pays dividends. The current dividend yield is 1.42%, with a payout of $0.99 per share.

How can I buy Analog Devices, Inc. (ADI) stock?

To buy Analog Devices, Inc. (ADI) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for ADI. Place an order (Market, Limit, etc.).

What is the best time to invest in Analog Devices, Inc.?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Analog Devices, Inc. stock ever split?

Analog Devices, Inc.'s last stock split was 2:1 on 2000-03-16.

How did Analog Devices, Inc. perform in the last earnings report?

Revenue: $11,019,707,000 | EPS: $4.59 | Growth: 39.09%.

Where can I find Analog Devices, Inc.'s investor relations reports?

Visit https://www.analog.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Analog Devices, Inc.?

You can explore historical data from here

What is the all-time high and low for Analog Devices, Inc. stock?

All-time high: $319.26 (2026-01-29) | All-time low: $133.48 (2022-10-13).

What are the key trends affecting Analog Devices, Inc. stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

zacks.com

Analog Devices (ADI) reached $310.92 at the closing of the latest trading day, reflecting a -2.44% change compared to its last close.

zacks.com

Analog Devices' communications segment rebounds in FY25, surging 26% on wireline growth tied to AI data centers and setting the pace for expected momentum in 2026.

zacks.com

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

prnewswire.com

WILMINGTON, Mass., Jan. 23, 2026 /PRNewswire/ -- Analog Devices, Inc. (Nasdaq: ADI) today announced the appointment of Dr. Yoky Matsuoka to its Board of Directors as an independent director and member of the Board's Corporate Development Committee effective January 20, 2026.

zacks.com

AtriCure tops a screen of high-efficiency stocks, joined by REV Group, Oceaneering International and Analog Devices after beating industry averages.

zacks.com

Here, we have picked three AI stocks, MSFT, MU and ADI, which are well-poised to benefit from AI's growing use and ability to solve complex problems.

zacks.com

Analog Devices is riding on surging demand for premium audio, hearables and wearables, gaming, AR and VR.

zacks.com

In the latest trading session, Analog Devices (ADI) closed at $302.1, marking a +1.38% move from the previous day.

zacks.com

Analog Devices' automotive revenue growth is driven by higher content in Level 2+ ADAS and vehicle electronics as cars grow more software-defined.

zacks.com

Does Analog Devices (ADI) have what it takes to be a top stock pick for momentum investors? Let's find out.

See all news