Abbott Laboratories (ABT)

$

116.32

+0.06 (0.05%)

Key metrics

Financial statements

Free cash flow per share

4.2330

Market cap

202.5 Billion

Price to sales ratio

4.5671

Debt to equity

0.2890

Current ratio

1.5759

Income quality

1.4663

Average inventory

6.6 Billion

ROE

0.1289

Technology

Technology – consumer electronics

Largecap

With a market cap of 121,78 bil stock is ranked 1

Low risk

ISS score of this stock is ranked 1

Company description

Profile

Abbott Laboratories, along with its subsidiaries, is engaged in the discovery, development, manufacturing, and global sale of health care products, operating across four segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices. The EBITDA is $11,553,000,000.00 a key indicator of the company's operational profitability. Within the Established Pharmaceutical Products segment, the company markets generic pharmaceuticals to address conditions such as pancreatic exocrine insufficiency and dyslipidemia, as well as providing critical anti-infectives like clarithromycin and an influenza vaccine. The operating expenses amount to $16,586,000,000.00 encompassing various operational costs incurred, while the company reported selling, general, and administrative expenses of $12,378,000,000.00 indicating its operational overhead costs. Furthermore, the diluted EPS is $3.72 accounting for potential share dilution. The Diagnostic Products segment enhances health care with laboratory systems focused on immunoassay and clinical chemistry, alongside molecular diagnostics for infectious agents. The Nutritional Products segment delivers essential nutritional solutions for both pediatric and adult populations, while the Medical Devices segment offers innovative treatments for cardiovascular diseases and diabetes management. Abbott Laboratories, founded in 1888 and based in North Chicago, Illinois, has established itself as a leader in the health care sector. The stock is reasonably priced at $136.04 appealing to a broad range of investors. With a large market capitalization of $202,450,199,139.00 the company is a dominant player in the health care industry, contributing significantly to the overall market landscape. The stock has a high average trading volume of 8,877,206.00 indicating strong liquidity. It is a key player in the Medical - Devices industry, driving innovation and growth, and belongs to the Healthcare sector, further affirming its stature within the competitive health care market. Abbott Laboratories’ commitment to advancement and quality in health care solutions continues to position it for sustained success and relevance.

Is Abbott Laboratories (ABT) a good investment?

Investing in Abbott Laboratories (ABT) depends on multiple factors, including revenue growth, profit margins, debt-to-equity ratio, earnings per share, and return on equity. Analysts have rated it as B+, with a Bullish outlook. Always conduct your own research before investing.

What is Abbott Laboratories (ABT)'s stock forecast?

Analysts predict Abbott Laboratories stock to fluctuate between $105.27 (low) and $141.23 (high) in the next 365 days, reflecting market expectations and potential volatility.

What is Abbott Laboratories's market capitalization?

As of 2026-02-27, Abbott Laboratories's market cap is $202,450,199,139, based on 1,740,459,071 outstanding shares.

How does Abbott Laboratories compare to competitors like Eli Lilly & Co.?

Compared to Eli Lilly & Co., Abbott Laboratories has a Lower Market-Cap, indicating a difference in performance.

Does Abbott Laboratories pay dividends?

Abbott Laboratories pays dividends. The current dividend yield is 2.10%, with a payout of $0.63 per share.

How can I buy Abbott Laboratories (ABT) stock?

To buy Abbott Laboratories (ABT) stock: Open a brokerage account (e.g., Robinhood, TD Ameritrade, E-Trade). Search for ABT. Place an order (Market, Limit, etc.).

What is the best time to invest in Abbott Laboratories?

The best time to invest depends on market trends and technical indicators, which show a Bullish trend based on economic conditions and company performance.

Has Abbott Laboratories stock ever split?

Abbott Laboratories's last stock split was 5000:2399 on 2013-01-02.

How did Abbott Laboratories perform in the last earnings report?

Revenue: $44,328,000,000 | EPS: $3.74 | Growth: -51.24%.

Where can I find Abbott Laboratories's investor relations reports?

Visit https://www.abbott.com/investor-relations for detailed financial reports.

Where can I find historical stock prices for Abbott Laboratories?

You can explore historical data from here

What is the all-time high and low for Abbott Laboratories stock?

All-time high: $142.60 (2021-12-27) | All-time low: $89.67 (2023-10-12).

What are the key trends affecting Abbott Laboratories stock?

Key trends include market demand, economic conditions, interest rates, and industry competition, which influence the stock's performance.

News

seekingalpha.com

Abbott's Meltdown Is Worth Buying, Compelling, Profitable Growth Prospects

zacks.com

Abbott (ABT) reached $115.29 at the closing of the latest trading day, reflecting a +2.74% change compared to its last close.

fool.com

Abbott Laboratories' business, if not exciting, is resilient and consistent. The company is a leader in multiple markets and has attractive growth avenues.

prnewswire.com

ABBOTT PARK, Ill., Feb. 20, 2026 /PRNewswire/ -- The board of directors of Abbott (NYSE: ABT) today declared a quarterly common dividend of 63 cents per share.

globenewswire.com

LISTING LINK: https://www.premiersothebysrealty.com/single-family/mfr/a4681242/6610-gulf-of-mexico-drive-longboat-key-fl-34228 DROPBOX: https://tours.coastalhomephotography.net/public/vtour/display/2359971?idx=1#!/nav/gallery PHOTO CREDIT: Coastal Home Photography LONGBOAT KEY, Fla.

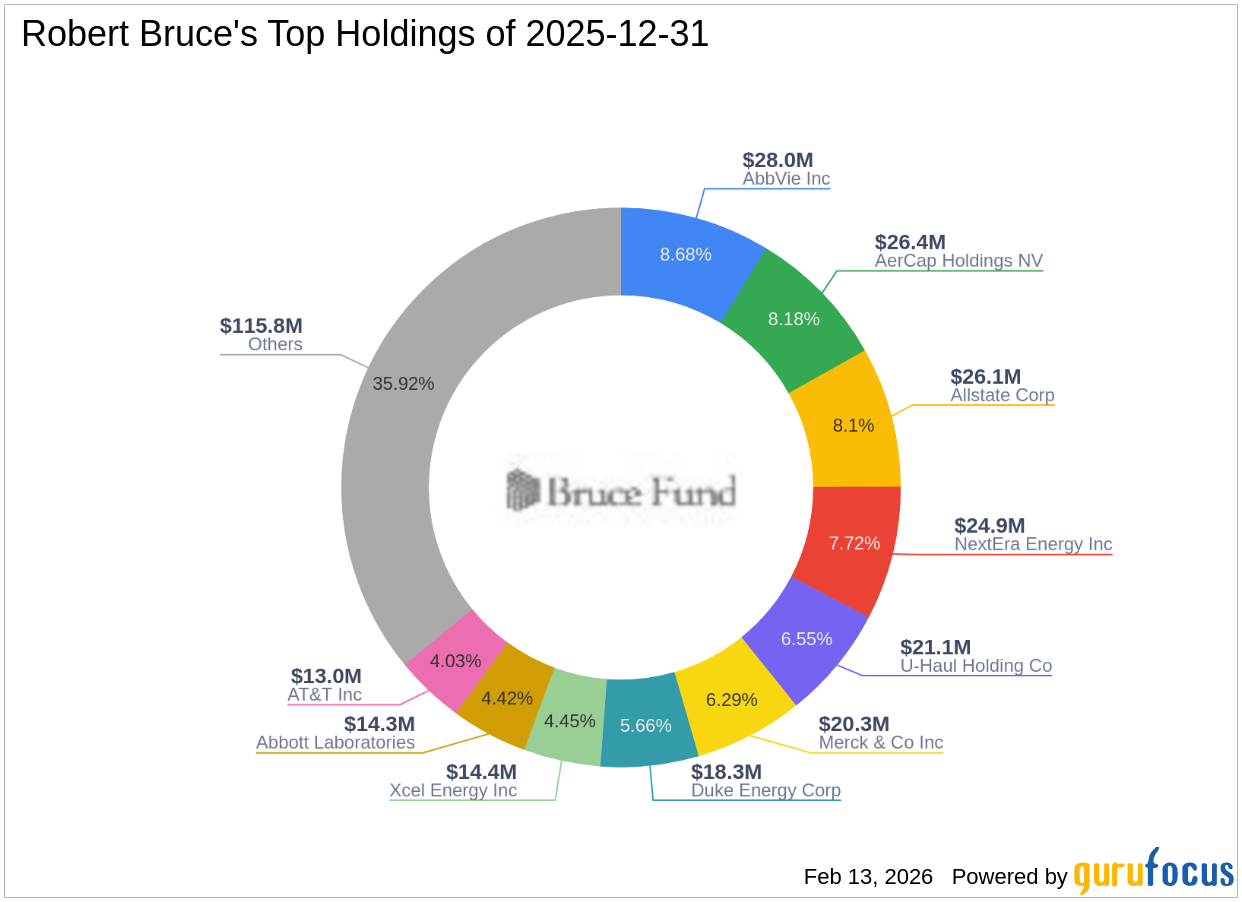

gurufocus.com

Exploring the Strategic Moves of a Seasoned Value Investor Robert Bruce (Trades, Portfolio) recently submitted the 13F filing for the fourth quarter of 2025, p

fool.com

This company has delivered earnings and dividend growth over time. Abbott's innovation and a new acquisition could spur more growth in the years to come.

reuters.com

Abbott has recalled certain glucose monitoring sensors after reports linked the devices to seven deaths and 860 serious injuries, the U.S. health regulator said on Wednesday.

247wallst.com

Founded in 1869, Goldman Sachs is the world's second-largest investment bank by revenue and ranks 55th on the Fortune 500 list of the largest U.S.

seekingalpha.com

In reality, Abbott Laboratories is actually a Dividend Aristocrat – a vaunted status reserved for companies that have increased dividends for at least 25 consecutive years. ABT grew its revenue from $20.8 billion in FY 2016 to $44.3 billion in FY 2025. That's a compound annual growth rate of 8.8%. Abbott Laboratories has a great financial position. The long-term debt/equity ratio is 0.3, while the interest coverage ratio is 17.

See all news